July 2025: Q2 San Francisco Apartment Insider

Good morning.

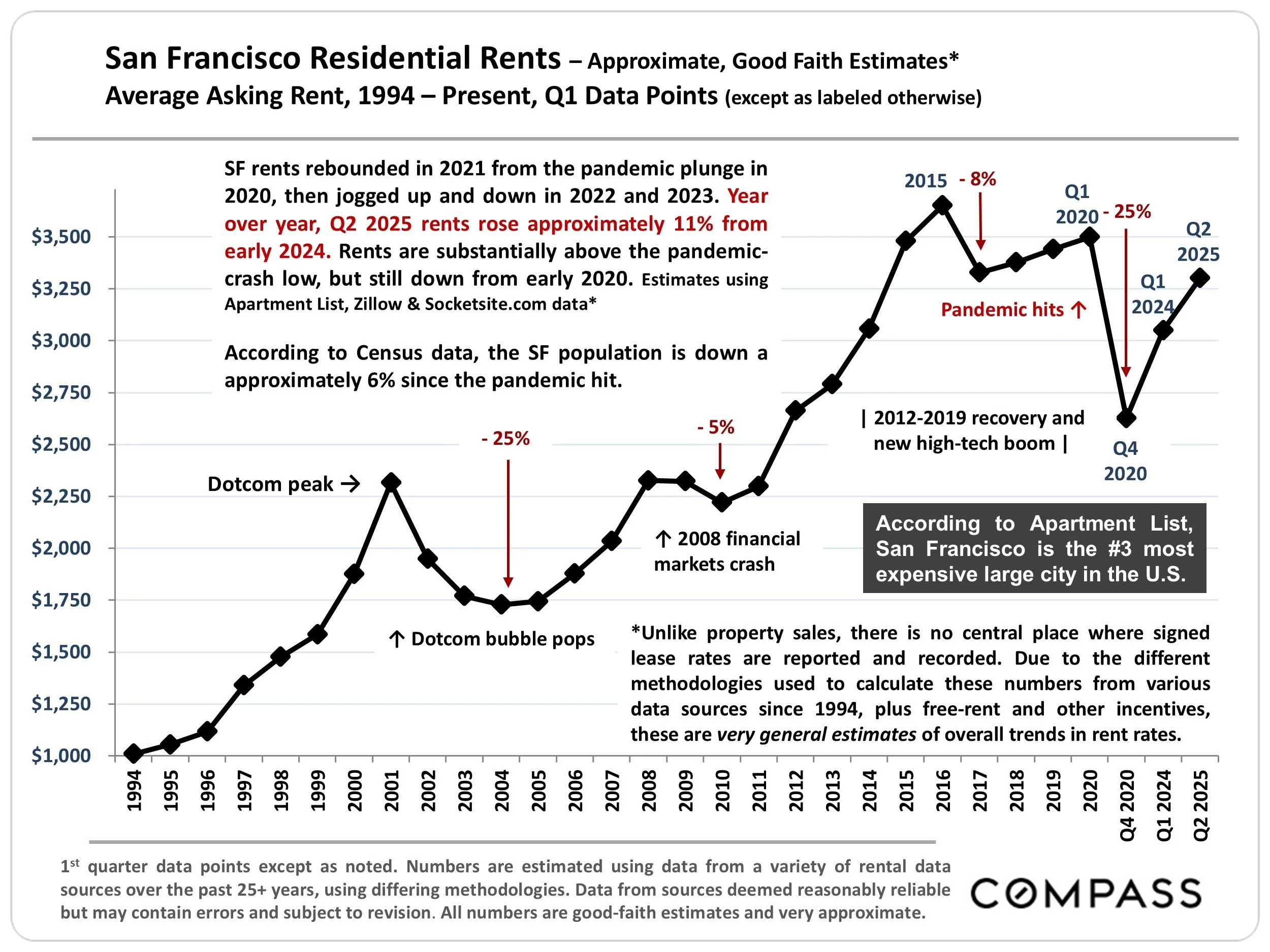

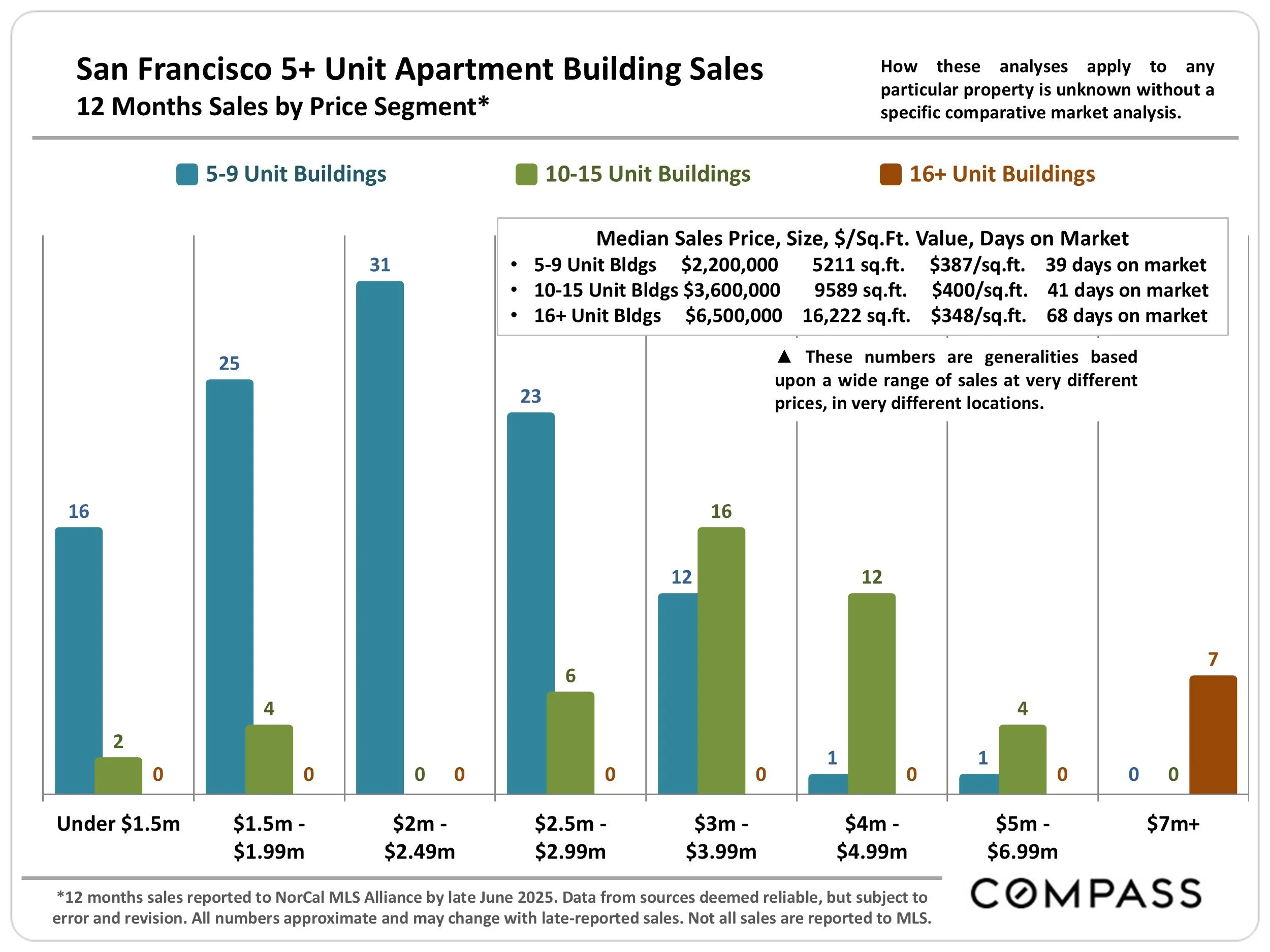

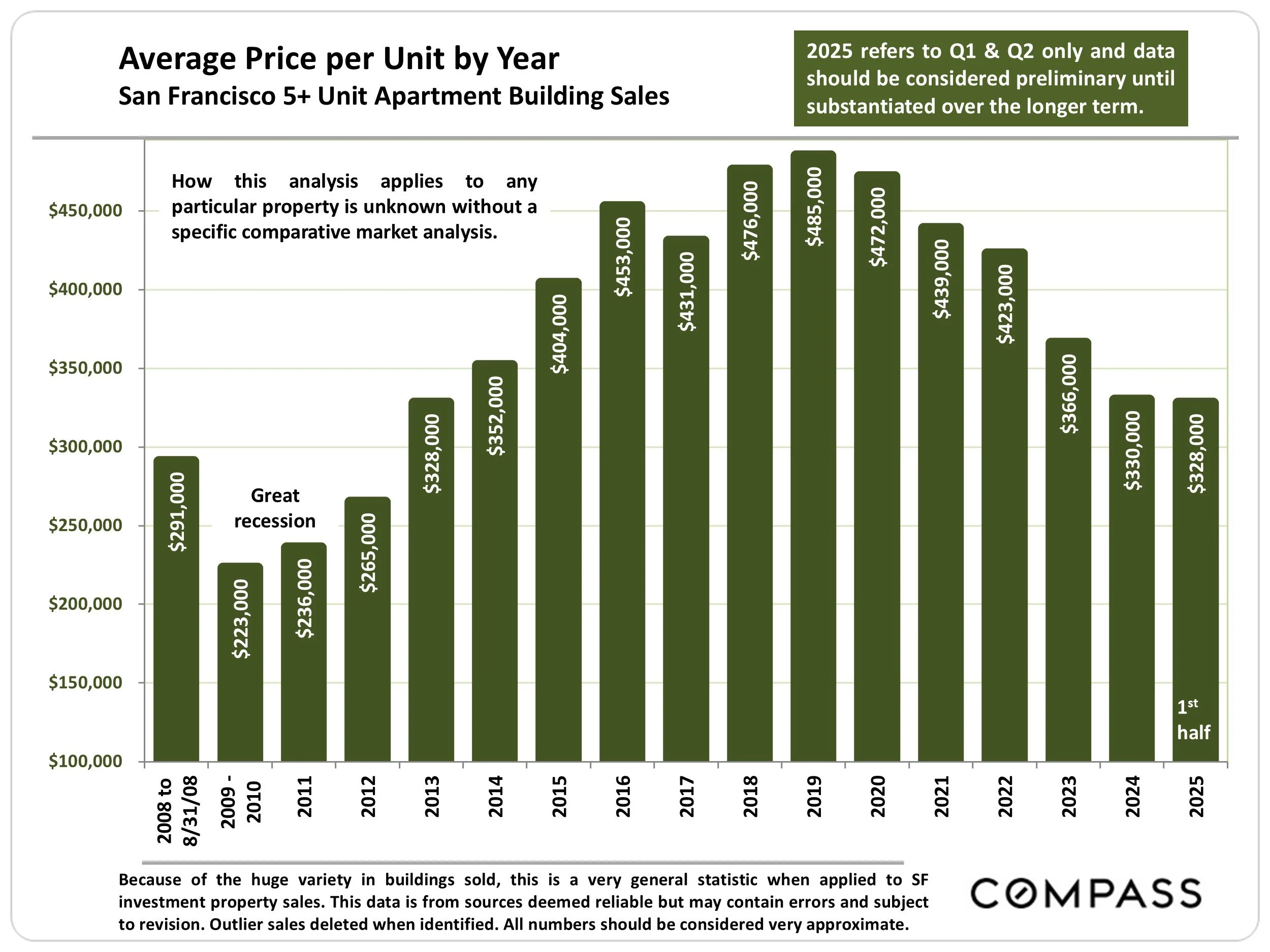

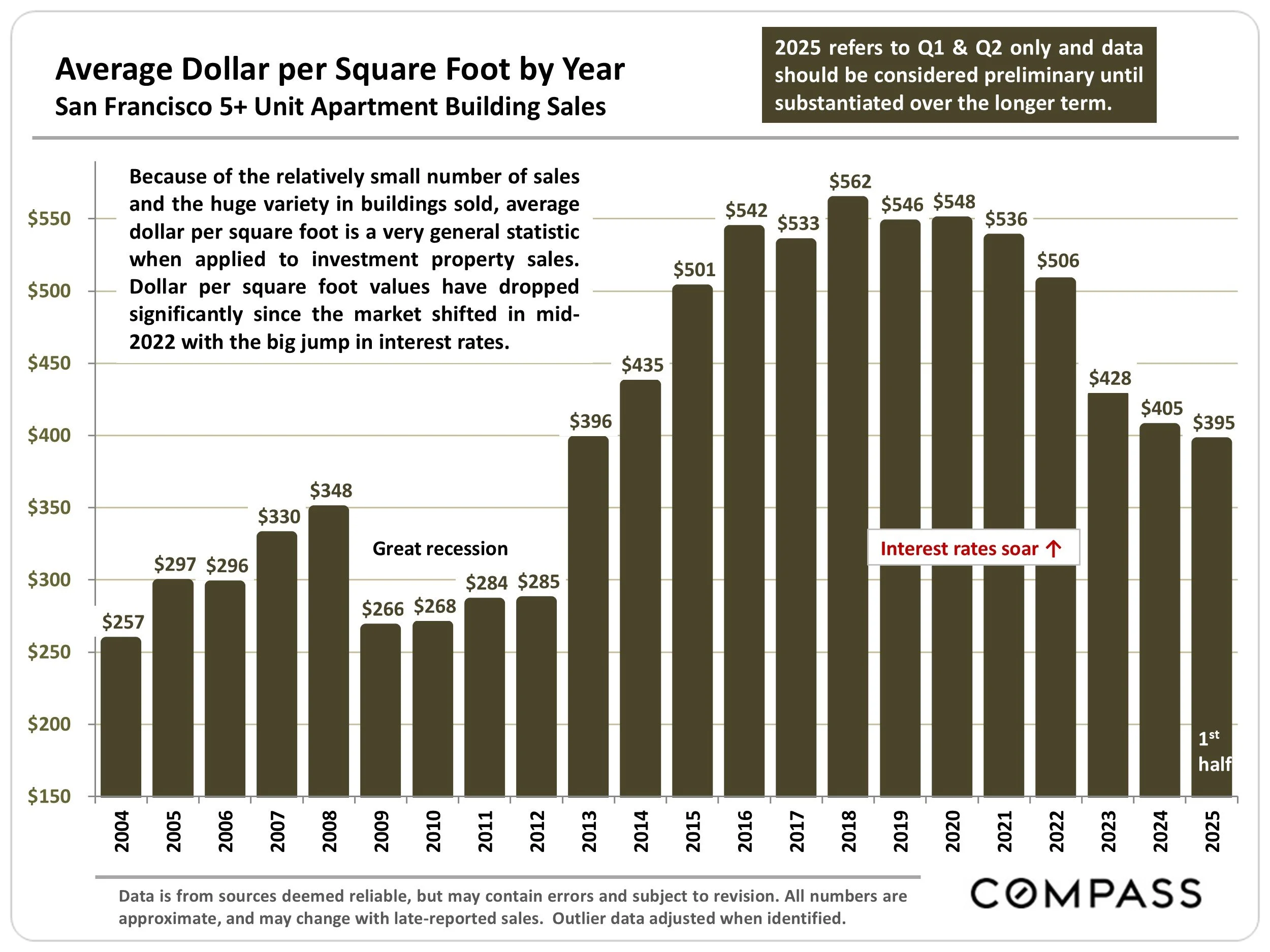

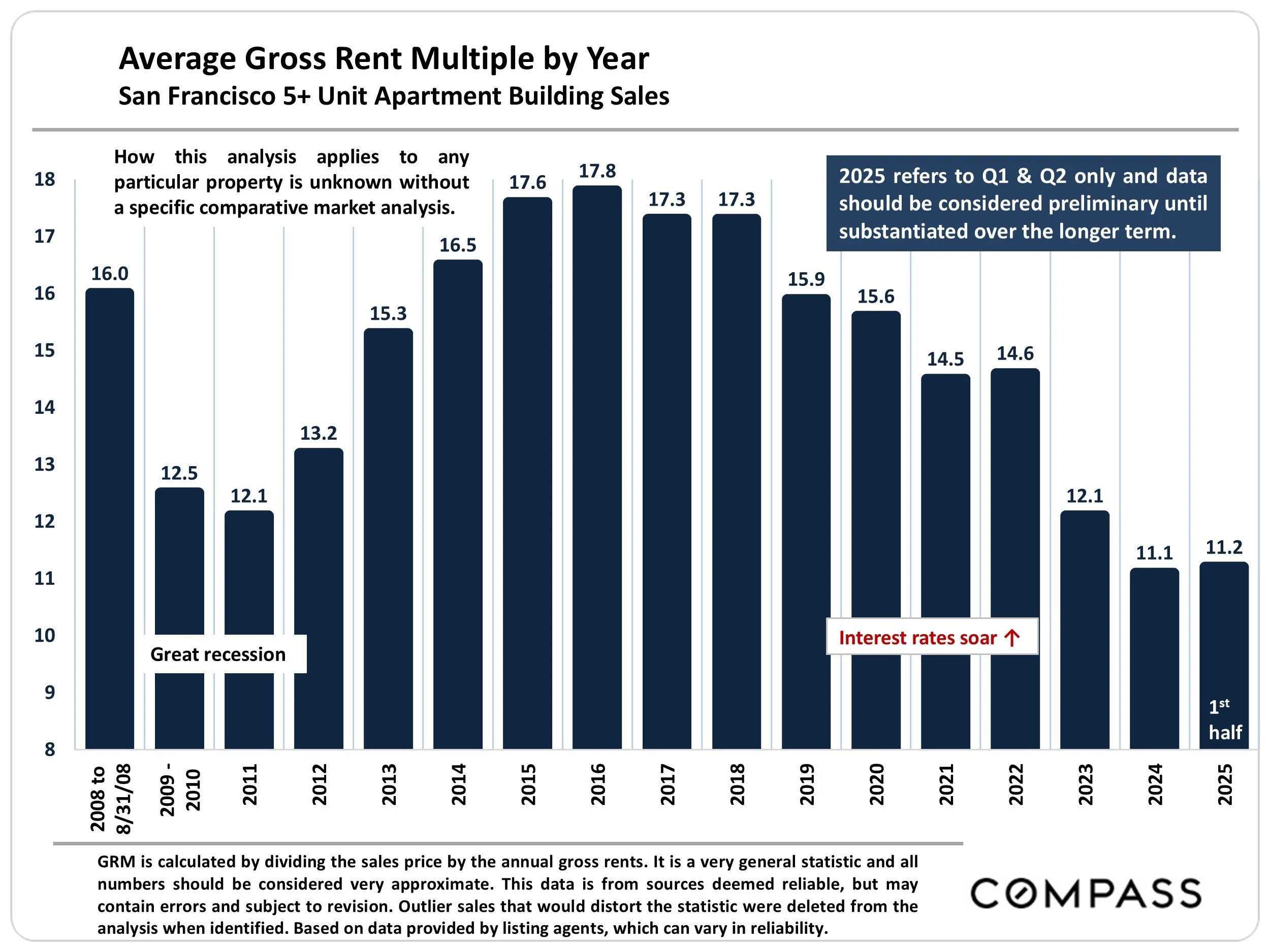

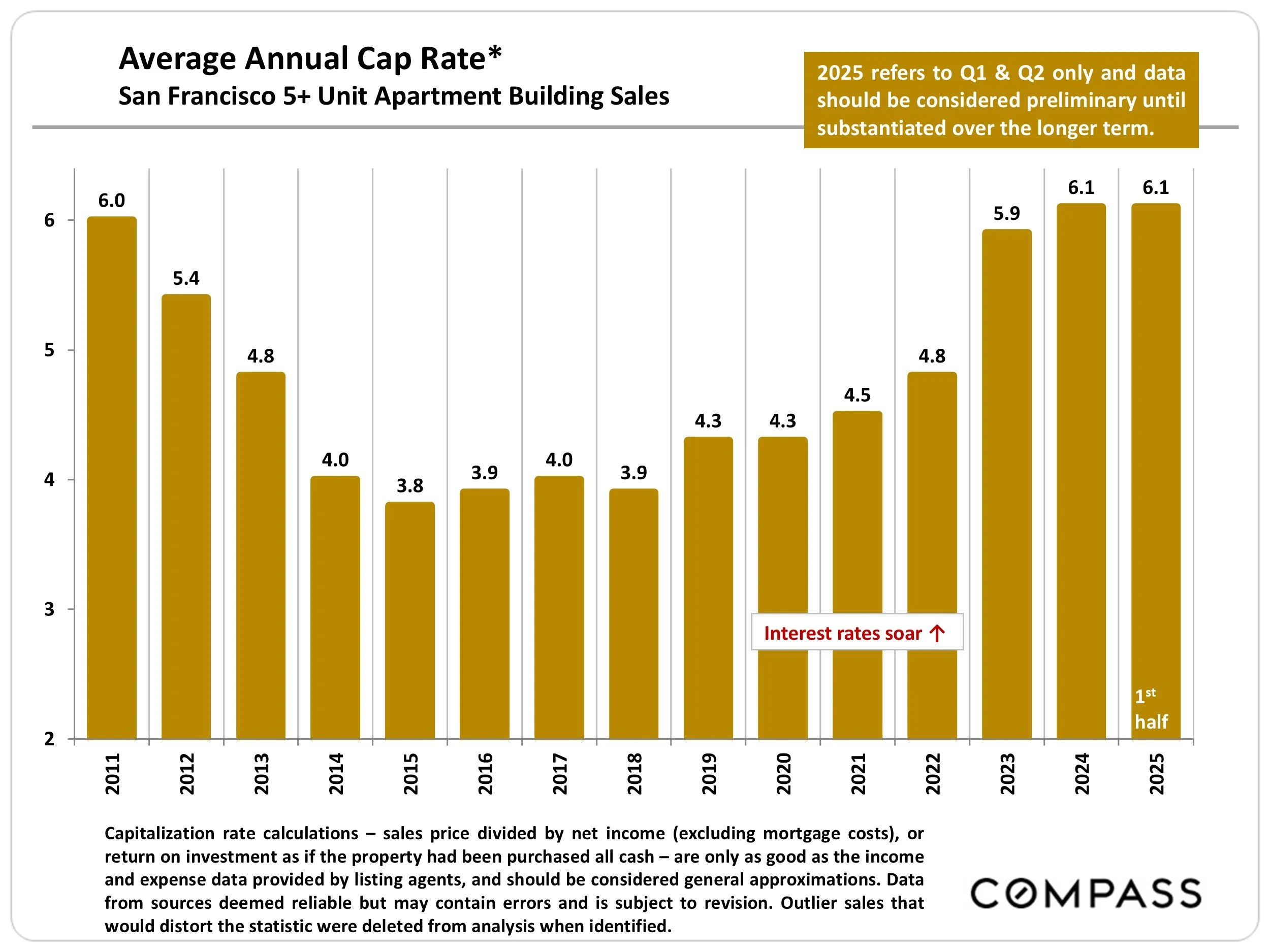

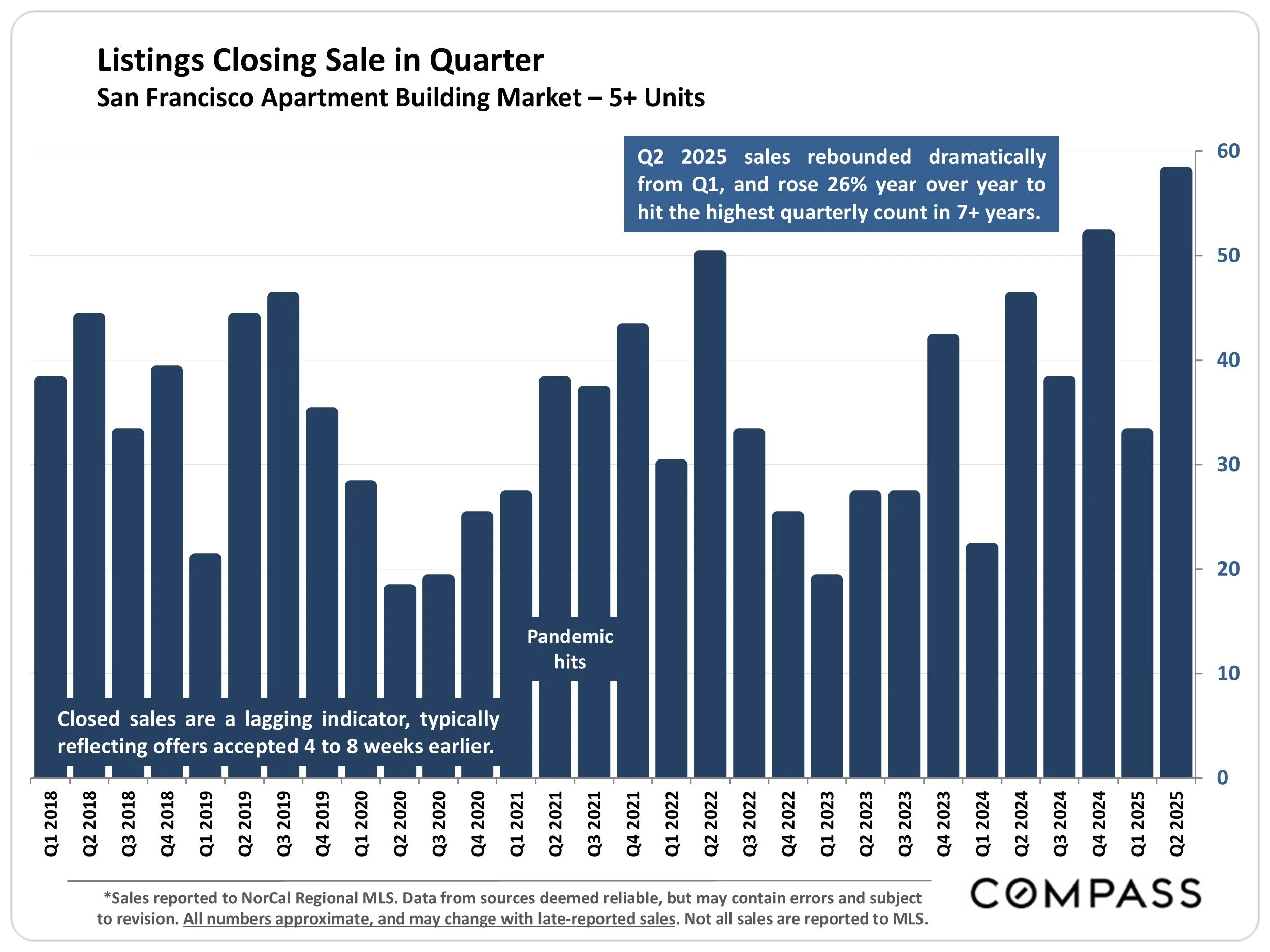

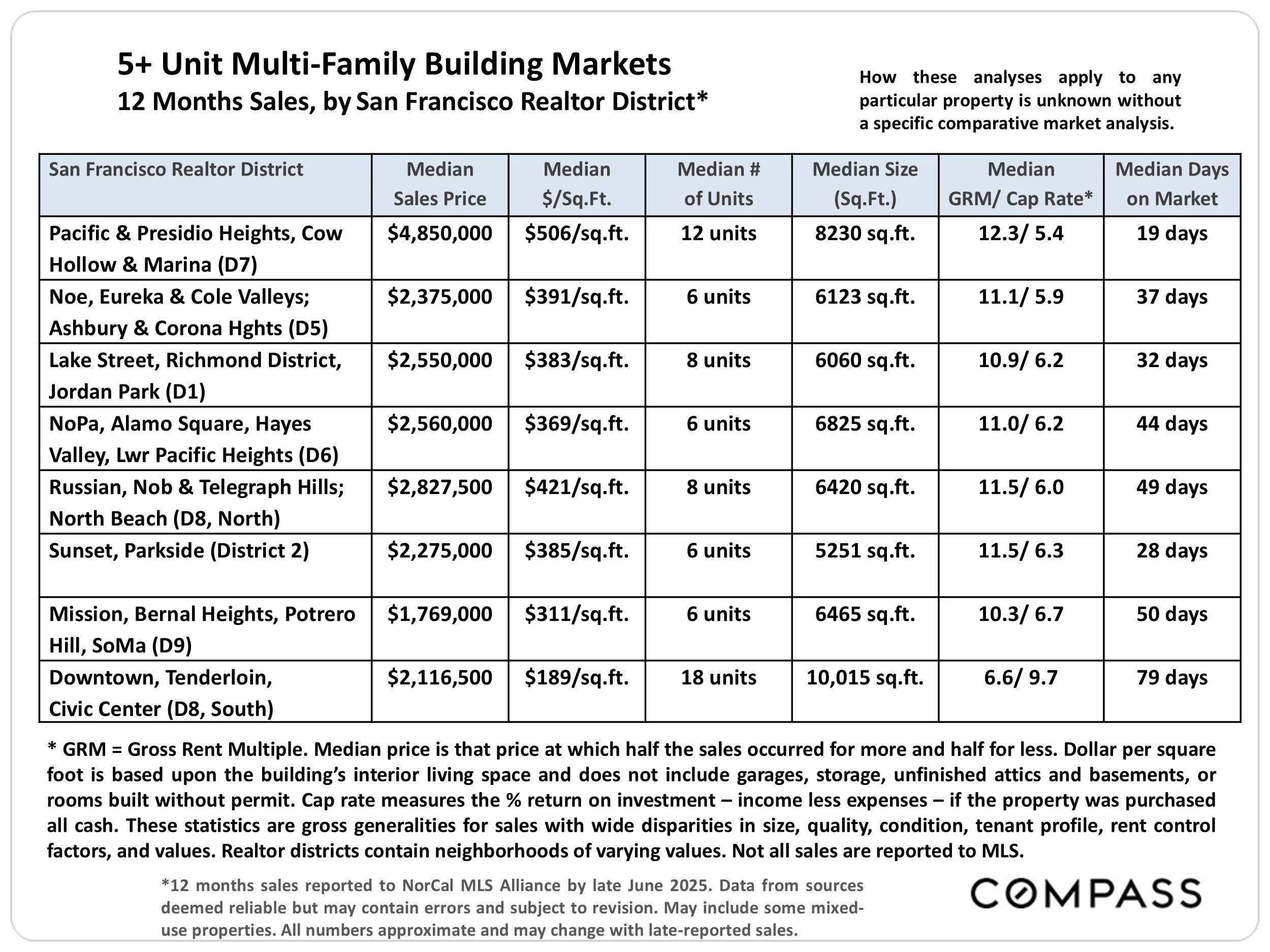

As we enter the second half of the year we are seeing an interesting trend in San Francisco, rental rates continue to improve (up 11% year-over-year), yet the sale prices of apartment properties is lagging. Amid a period of extreme political/economic volatility, ‘Q2 2025 had the highest quarterly number of San Francisco 5+ unit apartment building sales in over seven years! Standard indicators of value, however, remain far below the peaks of 7-9 years ago. The downward numbers are in the price per foot and price per unit while the cap rates and GRM numbers are flat. Is this the inflection point? The second half of the year will tell.

Looking at the downtown office market, total vacancy is now at 35.1%, down from 35.8% last quarter, the largest decline since the start of 2015. Availability is at 37.7%, an 80-basis point decrease from last quarter. AI companies continue to lead in terms of new leases.

In positive legislative news, SB 436 – co-authored by persona non grata, Matt Haney (of San Francisco), was an attempt to modify a three day notice to pay or quit. The bill would have extended the 3-day period to 14 days (excluding weekends and judicial holidays). Thankfully this measure is dead (for now) as it failed to get enough votes to get out of the Assembly Judiciary Committee.

Keep in mind landlords will enjoy a 6.3% allowable rent increase (in the counties of San Francisco, Alameda, Marin, and San Mateo), effective on or after August 1, 2025, for units subject to statewide rent control (AB 1482). This takes into account the inflationary rate for the prior year (1.3% PLUS 5%).

On to the numbers for the quarter.