July 2025: San Francisco Real Estate Insider

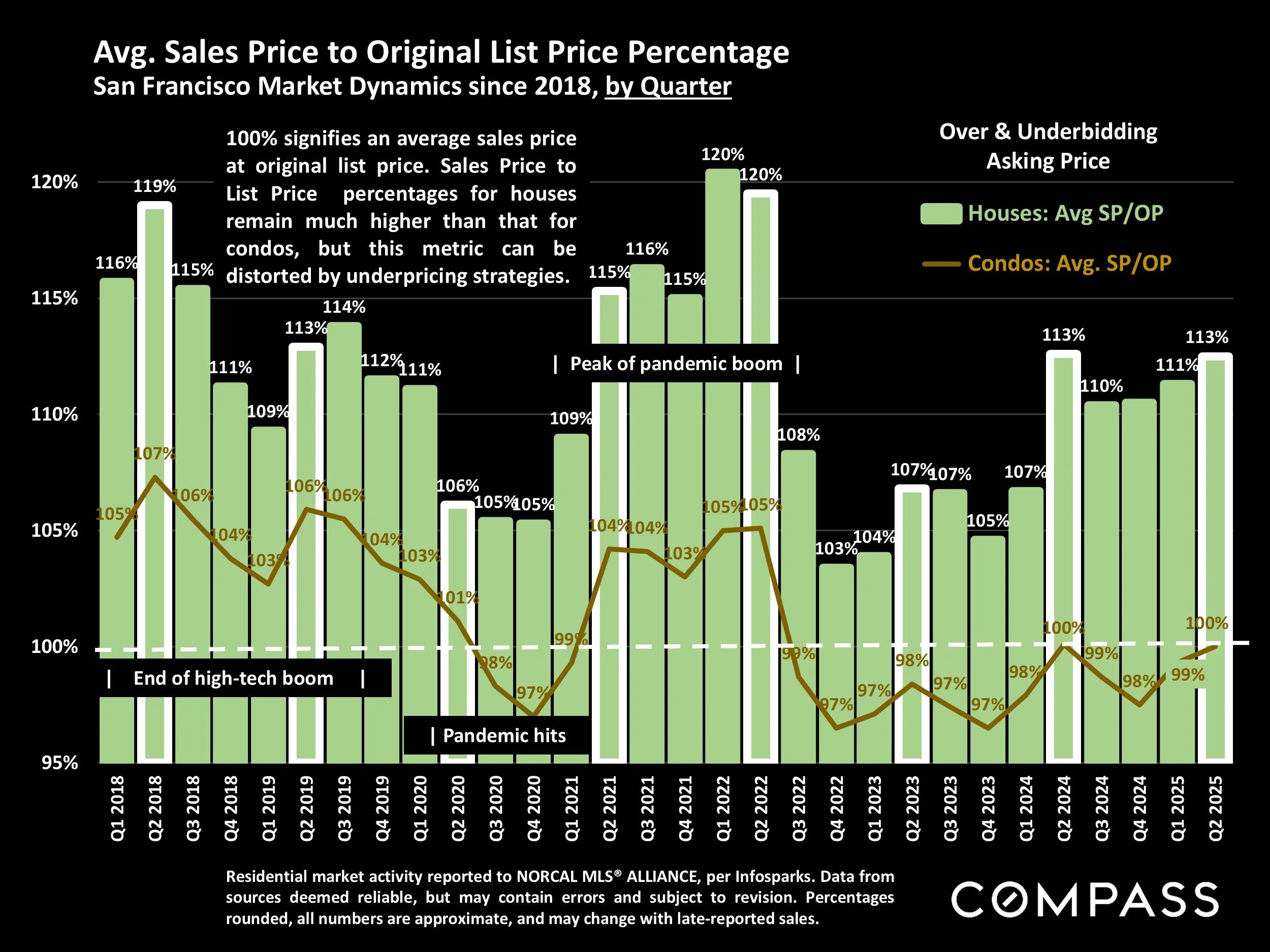

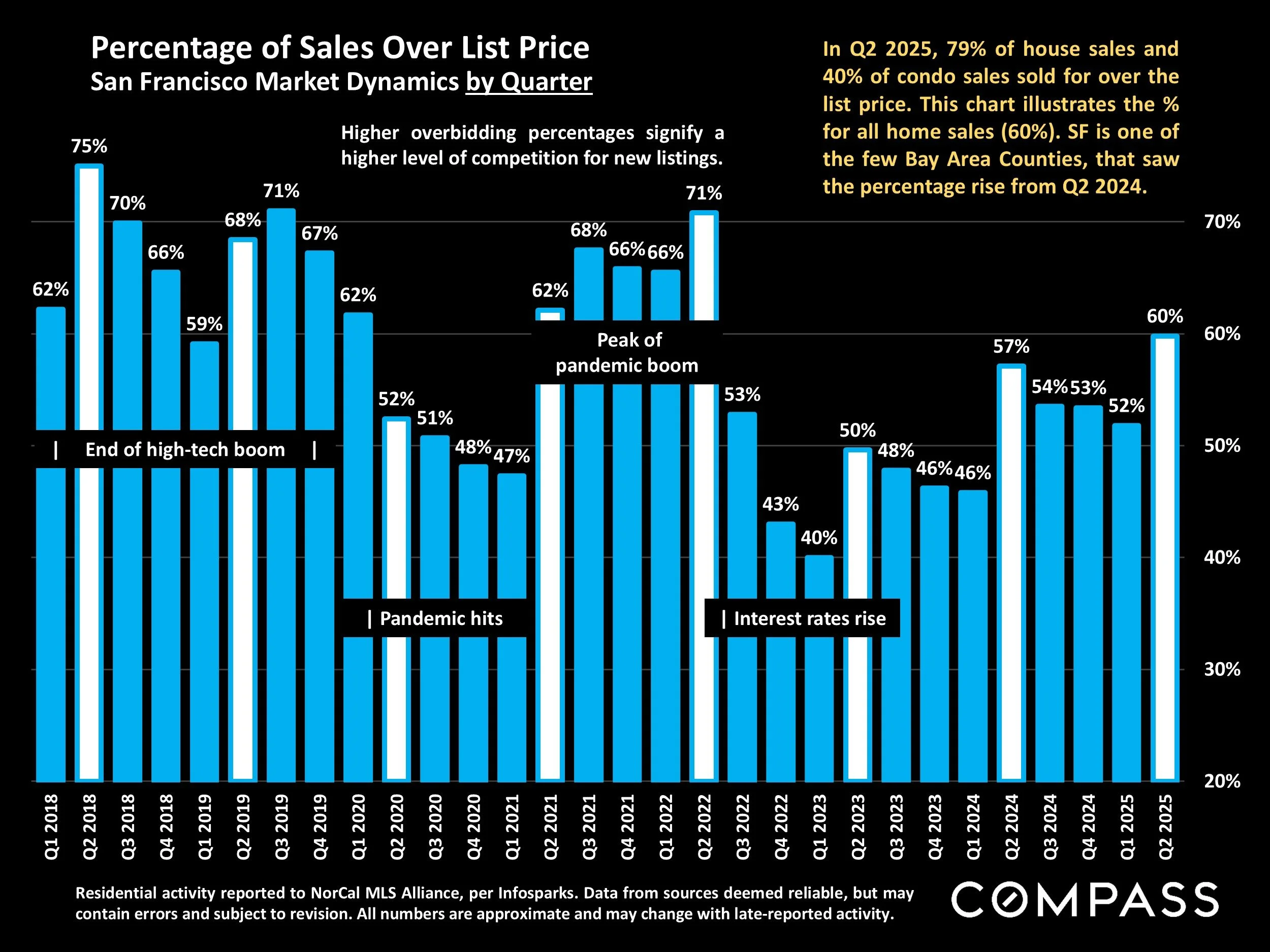

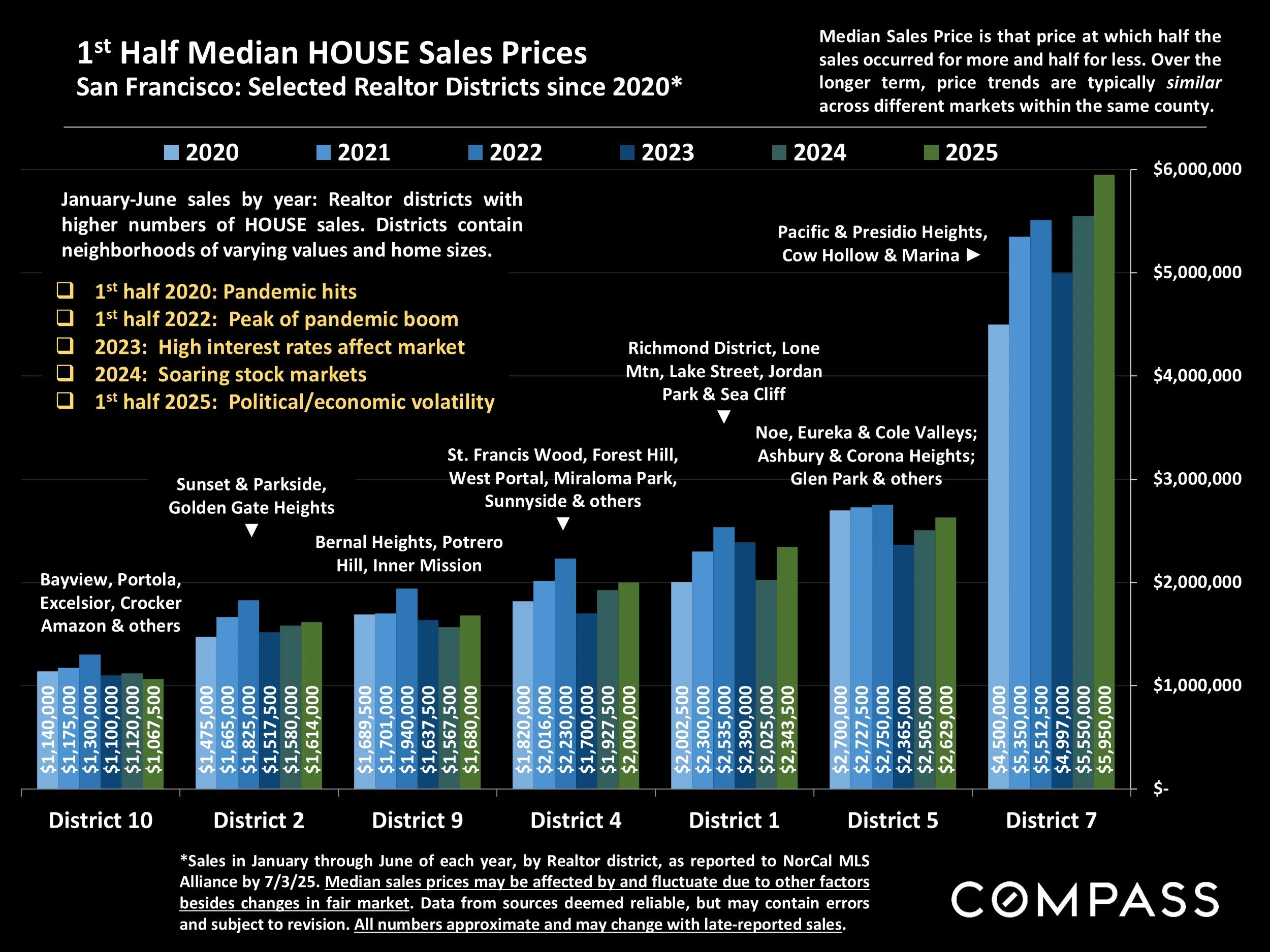

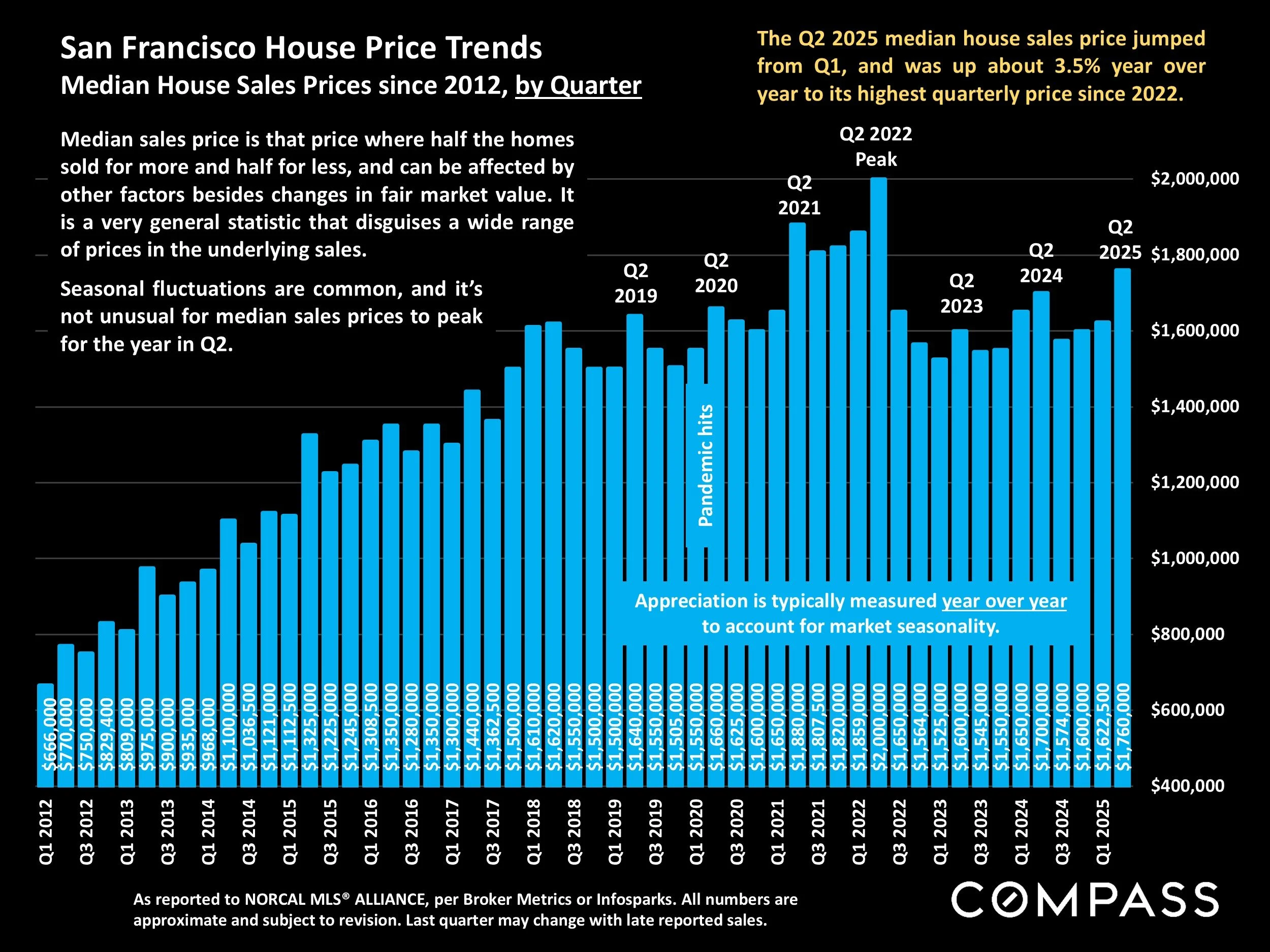

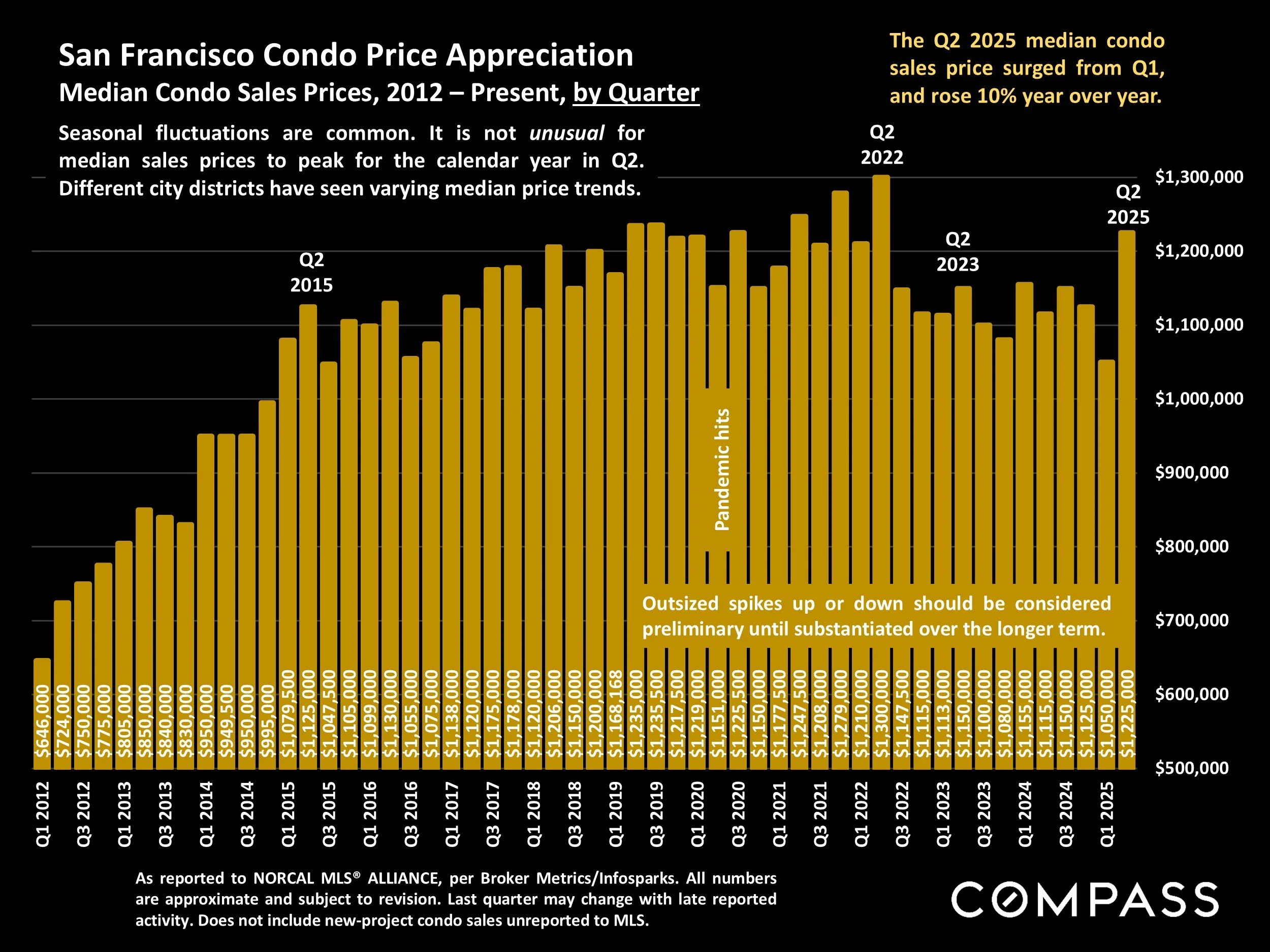

Across most of the Bay Area, the severe economic volatility which prevailed in ‘Q2 – and the absence of a meaningful decline in mortgage interest rates – generally caused a significant year-over-year weakening in the spring selling season, usually the most dynamic selling season of the year. However, this did not occur in San Francisco. Indicators of supply and demand either strengthened or remained essentially unchanged from ‘Q2 2024. The median sales prices for both houses and condos hit their highest quarterly points since the peak of the pandemic boom and apartment rents were the highest since 2020. Though one has to assume the market would have been even stronger if the macroeconomic conditions had been more favorable, the San Francisco market remained quite robust.

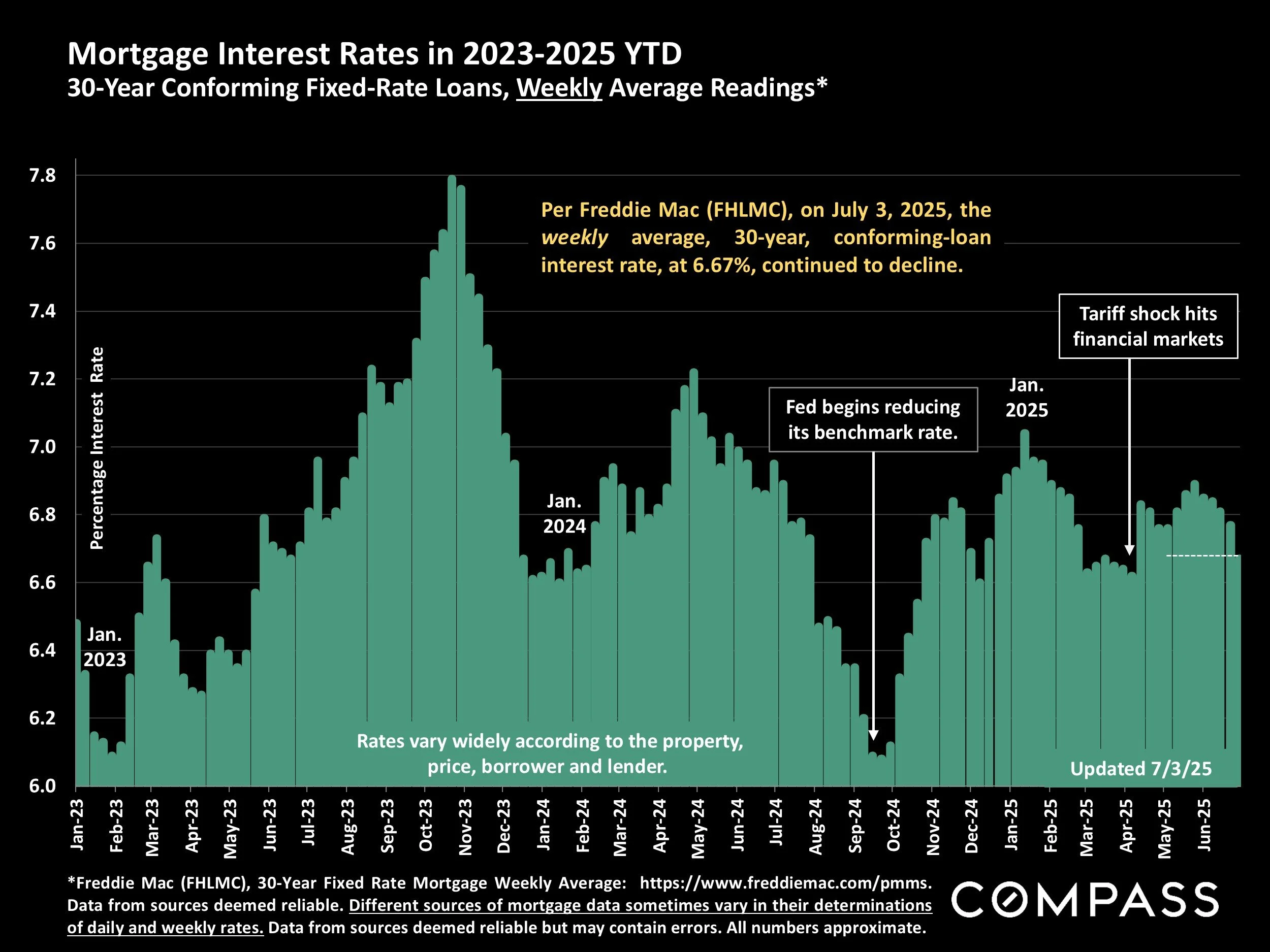

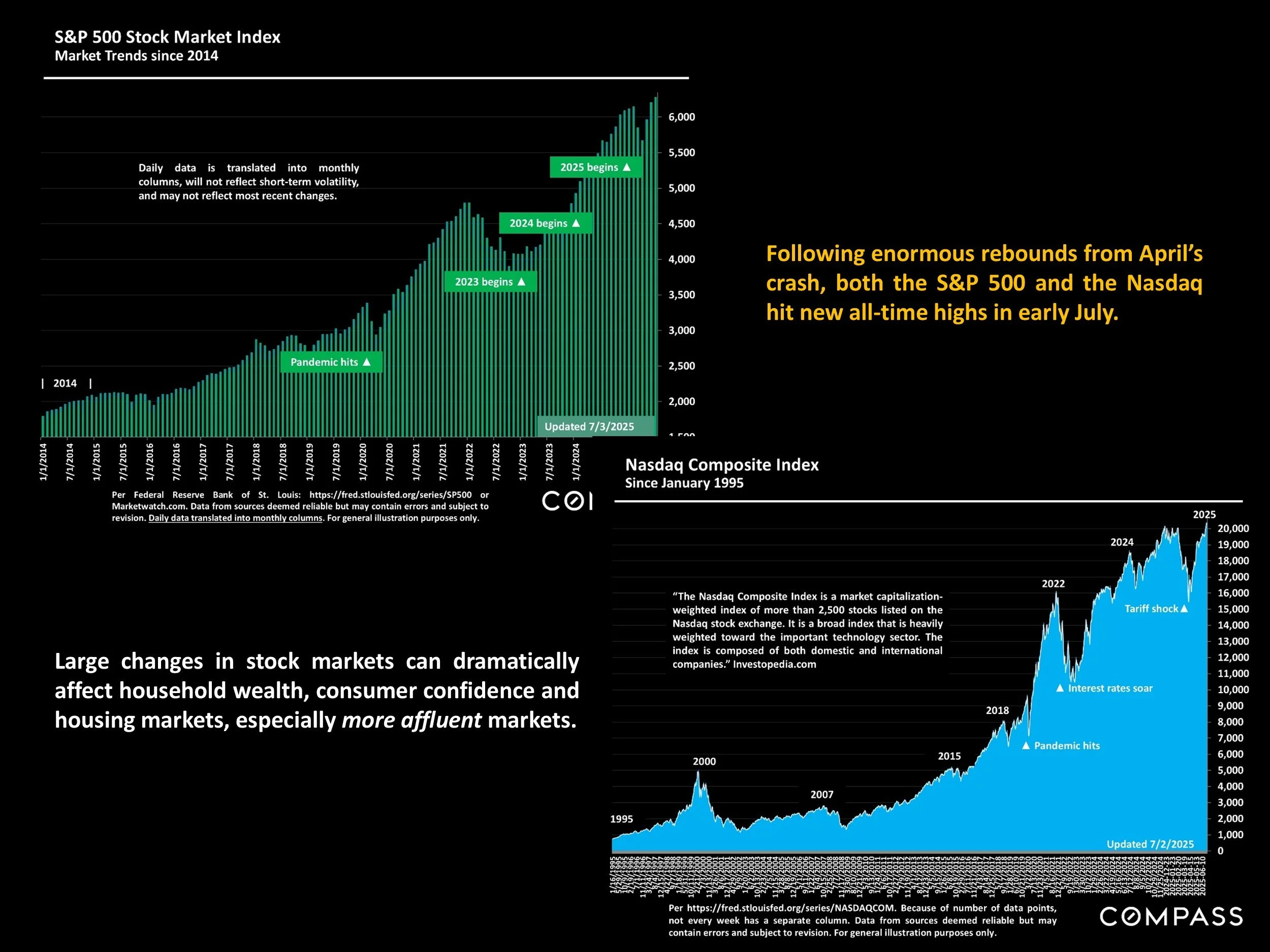

Furthermore, as of early July, measures of economic uncertainty were dropping, stock markets had staged an astounding recovery to hit new highs, consumer confidence had begun to rebound, and interest rates were gradually declining. Improvements in these conditions, should they continue, may support an even more heated market in the second half of the year.

As always, correct pricing, preparation and marketing are imperatives for sellers desiring the best results. And opportunities exist for buyers who keep a close eye on both new and older listings, monitor time-on-market, and price reductions on unsold homes that meet their requirements (or perhaps need a little bit of work) and are prepared to move quickly and aggressively.

Some data points of interest

That is it for now. Have a great weekend. If you are thinking of a move, let’s put a plan in place to make the most of your asset. Likewise, if you have friends or colleagues looking to get into the market, feel free to pass my name along.

Call or email, anytime.