July 2025: ‘Q2 Sea Cliff - Lake Street Insider

Good morning:

Depending on your preferred news outlet; San Francisco either continues to make progress with Quality of Life (QOL) issues, or it is descending into a zombie apocalypse fueled by opioids. Personally I see progress, especially in the northwest corner of the city when I compare to two years ago in terms of homelessness, street filth and garage, car break-in’s, etc. I’m generally impatient, but also realize that change happens in (super) slow motion in San Francisco, especially when the keys are held by elected officials. But, as far as desirability (to own and live) in the northwest corner, it’s never been higher.

The market is pretty quiet on the north side of town as we settle into the second half of the year. Depending on your desired micro-area, you may have literally no homes available (i.e. Sea Cliff or Lake Street Corridor), or numerous homes (13+ in Pacific Heights). As most people juggle vacations, kid summer activities, and work over the next two months, I do not expect to see a lot of new inventory come online in our neighborhood. The buyers are here, just no inventory. Most people that want to sell (after the spring market) are “generally” told to wait until fall (when everyone else sells), but why wait for competition (amongst sellers)? At a minimum, I’d suggest offering your home on the private market as available. There is no downside to that.

The big news in the Corridor is the sale of the recently closed St. Anne’s at 300 Lake Street. The six acre site reviewed offers in mid-May with an asking price of $58,500,000. The premium site is obviously destined for residential development. The sale coincides with the new west side housing plan that attempts to re-zone the area to accommodate 36,000 new housing units. It’s no secret that the Planning Department (and the mayor) wants this site to accommodate housing and their biggest concern is that the new owner will not maximize the allowable density. This (max density) will obviously butt against preferences of the local property owners that prefer less density. Regardless, expect the new owner to take advantage of the recent rollback of CEQA as well as a host of other Assembly and Senate bills that expedite the entitlement process. Keep in mind, neighborhood infill housing projects up to 85 feet in height are now exempt from CEQA’s public/environmental review and litigation. Other recent legislation that can / will be utilized: AB 1287 (density bonus), SB 330 (removes obstacles to limit a project pursuing allowable zoning), and AB 2234 (focuses on streamlining the post-entitlement phase of development by establishing prompt timelines for permit processing). This is a huge deal for the surrounding neighbors. I expect the developer to promptly submit their concept for the site and move this forward with negotiations on density. Regardless of the final approved project specifics, this site will create years of dust, noise, diesel emissions, traffic, disruption, dirt and general inconvenience for all.

The latest news at the Alexandria Theater is that in June the developer (TimeSpace Group) submitted refined design plans calling for 83 housing units (14 one-bed, 51 two-bed, 18 three-bed), ground-floor retail, community/co-working space, bicycle parking and private terraces. If you recall, the last proposal for this site included a zoning variance to build 75 housing units up to 85 feet high.

Just across the Presidio to the Cow Hollow side, the late Senator Feinstein & Dick Blum’s home at 2460 Vallejo Street recently sold off market. The 9,600 foot home sold for $19m. I’ve always looked at the last two blocks of Vallejo Street as some of the most prime addresses on the north side.

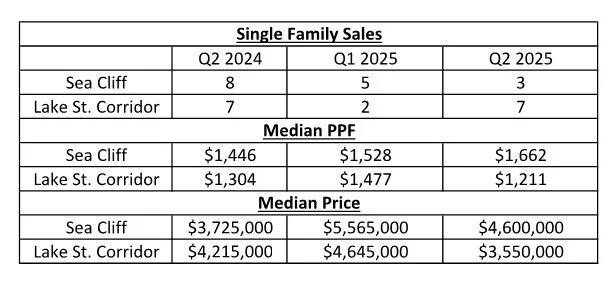

On to the numbers for the quarter. As referenced, the neighborhood was pretty quiet last quarter. Sea Cliff was really quiet and well below historical second quarter numbers in terms of sales. Every listed home (sans two withdrawn properties and one put on hold) sold quickly. The median days on the market for the sold homes was a paltry nine days. And, they all sold at approximately 107% of the asking price.

In the Lake Street Corridor, inventory crept up from the beginning of the year, but the sales were fairly flat when looking at historical quarter data. As in Sea Cliff, the sold properties in the area sold with a median of 13 days on the market and closing at 107% of list price.

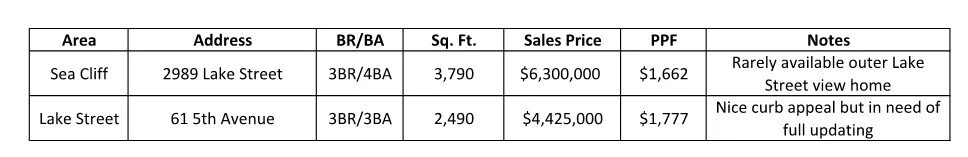

The top sales of the quarter.

That is it for now. If you or friends are in the market for the Lake Street Corridor, I have a vacant duplex on 7th Avenue off of Lake Street coming up. What is so great about this property? It has three levels of living over a full garage and a deep back yard. It could be a build-to-suit or developer dream as the existing third level can be expanded without enlarging the envelope (driving you into Planning Department hell / neighborhood notification). The property will always be a duplex, but can be configured to live as a ~4000 foot single family with an in-law unit.

That is it for now. If you are ready to move up, trade down or simply out; please reach out. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.