June 2025: San Francisco Real Estate Insider

As we roll into June the local real estate market can be summed up as “fairly inconsistent” (as it was last month). All product categories, as well as price categories, are not necessarily following any rhythm. You could have two homes on the same block and one may get multiple offers while the other is completely overlooked. Proper home preparation, marketing, and a plan for exposure is more important than ever for sellers and their agent(s).

The sense on the street as we enter summer is that we will see no change to the lack of market consistency. Properly prepared and marketed properties will sell; others may not have the best outcome. As we get closer to September, I’ll give an update on the expected inventory levels (fall is the season with the most new inventory).

A lot of the inconsistency in the market is obviously related to buyer hesitancy. They may not be feeling super optimistic with their job, their finances, or the cost of money (interest rates). One positive sign, over the past 30 days, the U.S. stock market has experienced a notable rally, with major indices posting significant gains:

The NASDAQ led the surge with an 8.25% gain

S&P 500 increased by approx. 5.0%

The Dow was up by approx. 3.4%

Let’s hope the upward trajectory continues as we move through summer.

Looking at the overall Northern California market, it is currently defined by rising inventory and moderating pricing. In San Francisco, we are experiencing a very different absorption dynamic than the rest of the Bay Area. We see an increasing absorption rate (based on year on year numbers), as other counties move in the opposite direction. Yet we still trend below San Mateo & Santa Clara Counties, which are both on a declining absorption trend.

In the last few months I made references to the resurgence in the ultra-luxury market ($10M+). Looking at the updated market snapshot, I have another update which includes; homes for sale, homes in contract and homes sold in the past 12 months:

San Mateo & Santa Clara Counties continue to be strongest markets for sales

San Francisco, Monterey and Marin are following

The Wine Country has an extremely high number of active listings (40) when compared to its 12-month rate of sales (three sales, plus three currently in contract). I also see this spike in inventory related to the call back by employers to RTO. Many of these listings were purchased in the past five years by buyers seeking more space and remote work flexibility. I should note there are some great values in this market.

In Alameda, Contra Costa and Santa Cruz, the ultra-luxury market would probably be defined at $4M+, and there is very little activity in the $10m+ segment.

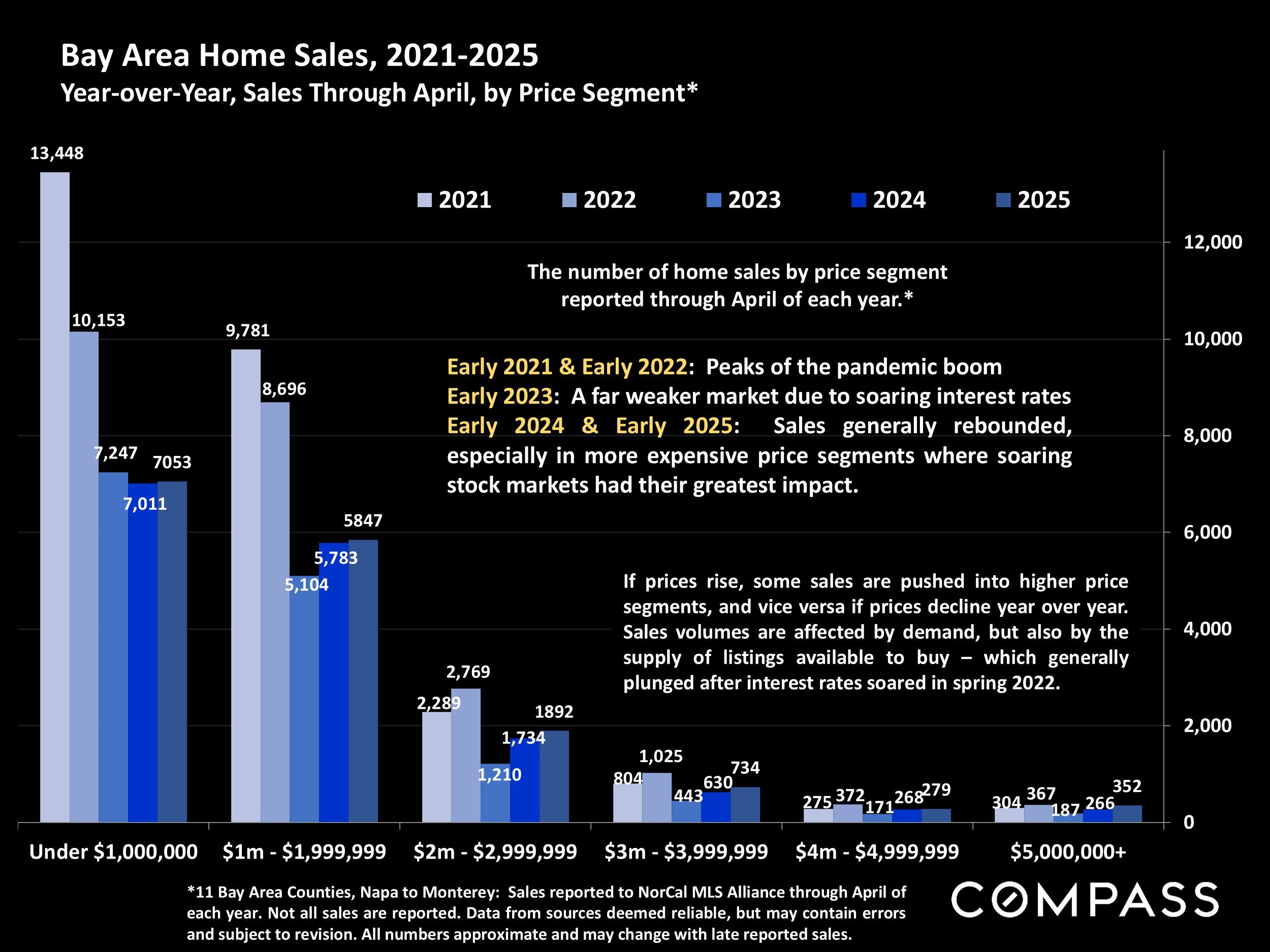

Regarding sales by price segment in the first four months of 2021 through 2025, the biggest year-over-year increase in sales, 2024 to 2025, was in the $5M+ segment, which jumped 32%.

That is it for now. Have a great weekend. If you are thinking of a move, let’s put a plan in place to make the most of your asset. Likewise, if you have friends or colleagues looking to get into the market, feel free to pass my name along.

Call or email, anytime.