January 2026: ‘Q4 Sea Cliff - Lake Street Insider

Good morning and Happy New Year.

As we enter the second week of January I feel very optimistic about the next twelve months. Politically, we seem to be heading on the right path in terms of quality of life issues and a reduction in crime. From a local economic perspective, while AI has been carrying the city, many of the city’s core business sectors (finance, tech, bio/life-science, creative/media, hospitality, etc.) are not yet in full “hire mode” but should hopefully show signs of resurgence this year. Keep in mind; while the majority of California experienced declines in value in 2025, San Francisco realized a 12.6% increase (from 2024).

Looking at the city and what is to come in 2026, the mayor has one of his top agenda items off his plate (for the time being) – that would be the Family Zoning Plan. It was approved by the Board of Supervisors in December with a resounding 7–4 vote. The plan will allow taller and denser housing in parts of the city that have long resisted new development (hello west side). Several (OK, most all) supervisors requested carve-out’s for their districts and a few were approved, but most were denied. The next step for opponents (of the Plan) will be to attempt to overturn it or water it down via lawsuits and then eventually through ballot measure(s) in 2026. In fact, this week the first round of lawsuits (to overturn the Plan) were filed by San Francisco Neighborhoods United and Small Business Forward, two small organizations that feel the Plan lacks enough tenant and business protections as written.

The mayor can now focus on the largest pressing issue; the budget (as in big deficit). One of the largest concerns (on the forecast) is property tax revenue. The fallout from the pandemic spike in pricing and the work-from-home protocol that decimated office property values caused property appeals to turn from a trickle to a flood. During the 2019/2020 fiscal year, the Assessment Appeals Board processed 1,417 applications. In the 2024/2025 fiscal year, the number surged to 9,281. If the city doesn’t complete the assessments by the state-mandated timeline (two years), it risks paying out more than $1B in property tax refunds. But even if the agency does process all its appeals within the time limit, the amount the city expects to refund is sizable. The controller’s office has projected that San Francisco will need to refund between about $105M and $189M annually for six fiscal years, totaling around $817M. Of course, the controller says the department (dedicated to handling appeals) is only 60 people and is “short-staffed,” Maybe a robust AI tool can save the day? Not in SF (unless it’s an FTE).

Staying on the budget, although in 2025 we had an increased tax revenue of $277M, the mayor is still looking at a two-year budget deficit of $936M, and it is expected to grow to nearly $1.2B by 2029. To add salt to the wound, organized labor (reneging on a negotiated agreement with business community a year ago) is trying to get an initiative on the June 2026 ballot that would increase the City’s “Overpaid Executive Tax.” The tax is estimated to generate $200M annually, yet the measure does not explicitly say where the money will go. To counter the (potential) initiative, the business chamber has two (potential) initiatives. The first measure would reduce business-tax revenue by $300M through various means, including canceling scheduled business-tax increases, cutting taxes for medium-sized businesses, raising the small-business tax exemption from $5M to $10M, and reducing the annual business-registration fee for companies with $50M or less in gross receipts. The second measure would also accelerate a scheduled increase in the Overpaid Executive Tax, but to a lesser degree than the union’s measure. It would also negate the impact of the union measure by providing tax cuts to some small businesses. The mayor will need to intervene in this fight – he has been very good about not publicly taking a side on a large issue, but I expect him to use his 70%+ approval rating to try and shut these initiatives down and get labor to honor their earlier negotiated commitments with the business community and elected leaders. If they don’t, expect organized labor to be the big loser as the mayor looks to cut $400M from 2026 spending.

What is happening in the northwest corner of the city that may impact you?

First, in signs of life at the old Alexandria Theatre at Geary and 18th, blueprints plans to build 83 units of housing were formally submitted to the San Francisco Planning Department (without a construction timeline). The plans include 51 2BR/1BA units; 18 3BR/2BA units and 14 1BR/1BA units. The plans also include commercial and retail space on the ground and second floors.

Close to home, looking at a traffic impact, the Presidio has its first new ground-up development in more than two decades. A 196-unit, six-building apartment complex is planned on 4.6 acres of the old Letterman Hospital site. The proposed development calls for the construction of six low-scale buildings at the intersection of Lincoln Boulevard and Girard Road on land currently occupied by a parking lot and two non-historic structures.

Over at 300 Lake Street, St. Anne’s new owner has not yet closed escrow on the site. It seems a bit odd that sitting supervisors across the city were requesting carve-out’s from the mayor on his Family Zoning Plan (for their districts), yet I did not hear a peep in D1 about a carve out for St. Anne’s. It would have been nice to see the supervisor step up for the adjacent residents (of St. Anne’s) but it didn’t happen.

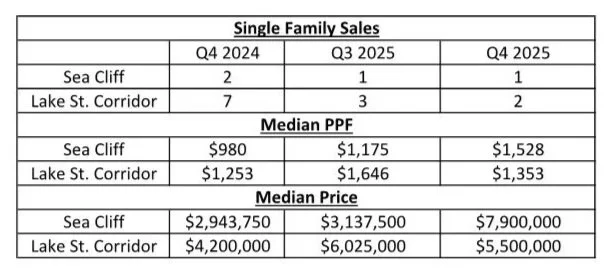

As far as the real estate market in our corner of the city, transaction flow was scarce as sellers were on the sidelines. Compared to 2024 activity, sales in Sea Cliff were down by almost 50% (19 in ’24 and just 10 in ’25). In the Lake Street Corridor, sales were down 40% (25 in ’24 and just 15 in ’25). The demand is clearly evident – listed homes spent a mere 11 days on the market before the seller accepted an offer. The median sales price was 114% of asking…which means the seller received multiple offers (in most cases).

Looking at Sea Cliff activity in Q4, available homes were non-existent. The neighborhood realized one sale and a home on El Camino Del Mar briefly was marketed offline. In the Lake Street Corridor, there were two sales. Although not technically a single family, there was a sale of a duplex on 15th Avenue that was reconfigured to live as a SFR.

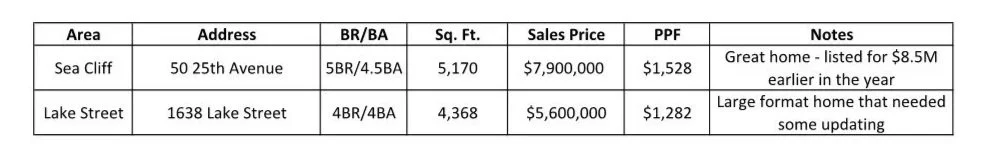

Looking at the top sales of the quarter, we didn’t have a lot to choose from. As a reference point, in my last quarterly update I noted the uptick in demand and that 1638 Lake Street would not have closed anywhere near $5M in 2024. How quickly things can change.

What I expect to see in the first half of this year for our corner of the city; I expect to see a continuation of the second half of 2025, which is a strong demand (especially in the luxury category) fueled by AI capital. I also think available inventory of single family homes will stay low, similar to 2025 numbers. Some folks are still enjoying their sub-3% mortgage while others are more enamored with the resurgence of San Francisco than in prior years. Considering there are only ~1,000 single family homes in the Corridor and Sea Cliff, buyers will need to dig deep to acquire available properties.

I have two great properties coming up shortly in Sea Cliff. The first, for rent, is a Lewis Butler designed luxury 4BR/4BA view home with an elevator. Perfect for an executive relocation or a “soft landing” while you remodel your own home.

The second, for sale, is a 4BR/3BA Tudor revival home architected by Edward Grosvenor Bolles. This home has only seen two owners since it was constructed in 1915, has great curb appeal and a flat yard accessed from a deck off the kitchen.

If either of these homes would be a possible fit for someone you know (or yourself), please reach out directly for specifics.

That is it for now. If you would like to chat about an off-market sale or simply have me in for a look to give you a valuation, reach out. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.