December 2025: San Francisco Real Estate Insider

Good Morning and Happy Holidays!

As we wind down 2025 and the real estate market slows, I want to look at two big issues that will impact the City as well as the market in 2026. The mayor has a lot on his plate and two of the most pressing issues are the budget (as in deficit) and his Family Zoning Plan.

First, as it relates to real estate and the city, the mayor has a budget deficit to deal with. The fallout from the pandemic spike in values (and the work from home protocol that decimated office property values) is still a large albatross hanging over the local budget. The number of property value appeals has gone from a trickle to a flood. During the 2019/2020 fiscal year, the Assessment Appeals Board processed 1,417 (appeal) applications. In the 2024/2025 fiscal year, the number surged to 9,281.

The result is growing financial peril for both taxpayers (you and I) and a city staring down significant budget shortfalls. If the city doesn’t complete an extraordinary mountain of work within a state-mandated timeline (two years to complete an assessment), it risks paying out more than $1B in property tax refunds. But even if the agency does process all its appeals within the time limit, the amount the city expects to refund is sizable: the controller’s office projected that San Francisco will need to refund between about $105M and $189M annually for six fiscal years, totaling around $817M. Of course, the controller says the department (dedicated to handling appeals) is only 60 people and is “short-staffed.” I could put forth a simple solution that would save the county time and money: bring in a robust AI tool to compile all the data needed for a staff worker to make a review on each appeal. Sadly, I do not think this would not appeal to those entities that like to bloat the payroll with more full time employees.

Second, looking at the mayors Family Zoning Plan, it passed the Land Use and Transportation Committee last month after several “11th hour” amendments and was approved by the Board of Supervisors this week with a resounding 7–4 vote. The plan will allow taller and denser housing in parts of the city that long resisted new development. Several (OK, most all) supervisors requested carve-out’s for their districts and a few were approved; but most were denied. Requested (and denied or tabled) amendments included a limit on luxury development in lower-income neighborhoods, a ban on demolition of existing residential units, lower heights in commercial corridors, eliminate form-based zoning and limit development in coastal zones. Some of the approved amendments include an exemption for approx. 500 landmarked properties, amendments to reduce allowable heights for the Marina Safeway, Ghirardelli Square and a senior-living facility on Geary Blvd., protection on rent-controlled buildings with three or more units and incentives for developers to build units with two or more bedrooms. The next logical step will be for opponents (of the Plan) will be to attempt to water it down through ballot measure(s) in 2026.

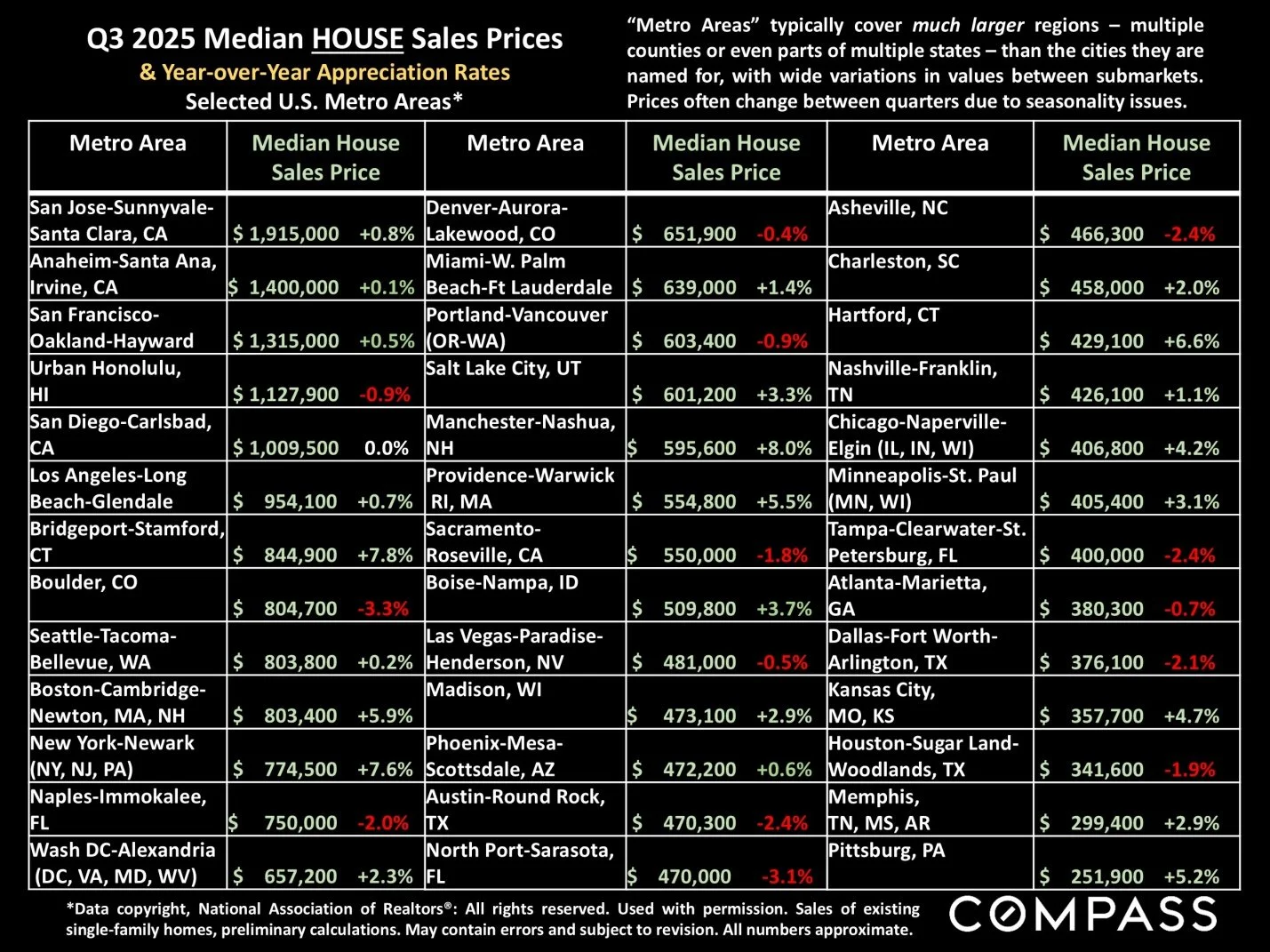

Looking at Bay Area real estate and how the compares against other major metros, data from the latest NAR ‘Q3 2025 "metro-area" analysis of median prices and year-over-year appreciation was released. As has been widely reported, significant appreciation is most commonly seen in the Northeast and Midwest - which have seen relatively little new home construction in recent years. Declines are most commonly seen in the South/Southeast, especially Florida and Texas, which have seen the greatest amount of new home construction in recent years (skewing the supply and demand dynamic). By the way, the WSJ had a recent article "Builders' Cheap Mortgages Are a Bad Deal for Home Buyers," alleging that "People who borrow from a builder are more likely to overpay for their property and be underwater [on their mortgage] after they move in."

Note that metro areas, which are defined by the federal government, typically contain multiple counties and sometimes parts of multiple states. For example, the San Francisco metro area contains five counties of widely different values (and its house sales are dominated by the two counties with the lowest median house sales prices). These are very broad calculations.

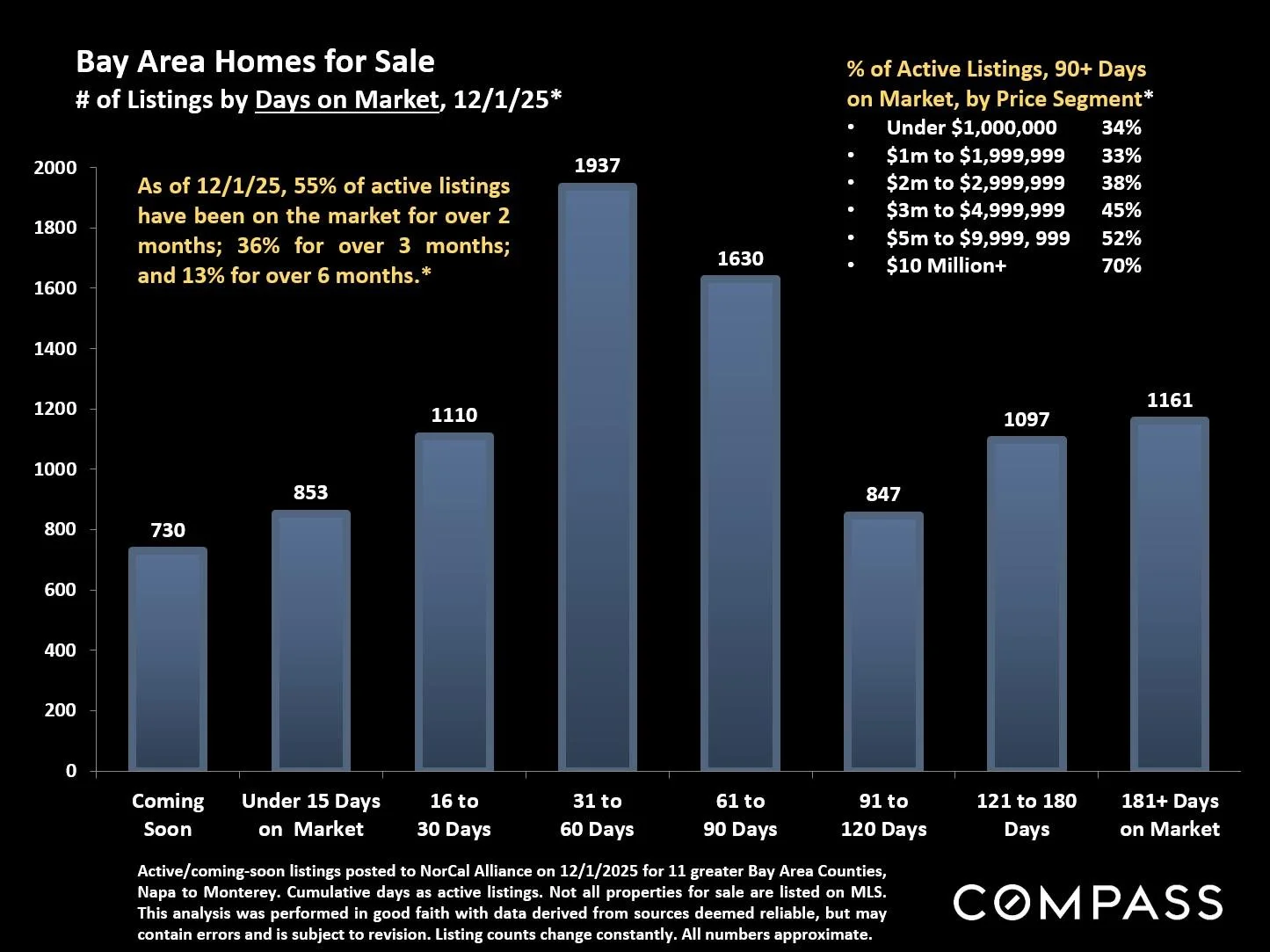

On a final note, keep in mind that December is the greatest opportunity of the year for buyers to aggressively negotiate really good deals. Currently, 55% of active listings (~4,700) in the Bay Area have been on the market for over 60 days; 36% (~3,100) have been on the market over 90 days. The only thing wrong with most of these properties is that they were overpriced to begin with and have now been left behind by buyers, stigmatized because they didn't sell. Most of these sellers and listing agents are still eager - or even desperate - to sell these listings. Don’t be shy!

That is it for now. Have a great weekend. If you are thinking of a move, let’s put a plan in place to make the most of your asset. Likewise, if you have friends or colleagues looking to get into the market, feel free to pass my name along.

Call or email, anytime.