November 2025: San Francisco Real Estate Insider

Good morning.

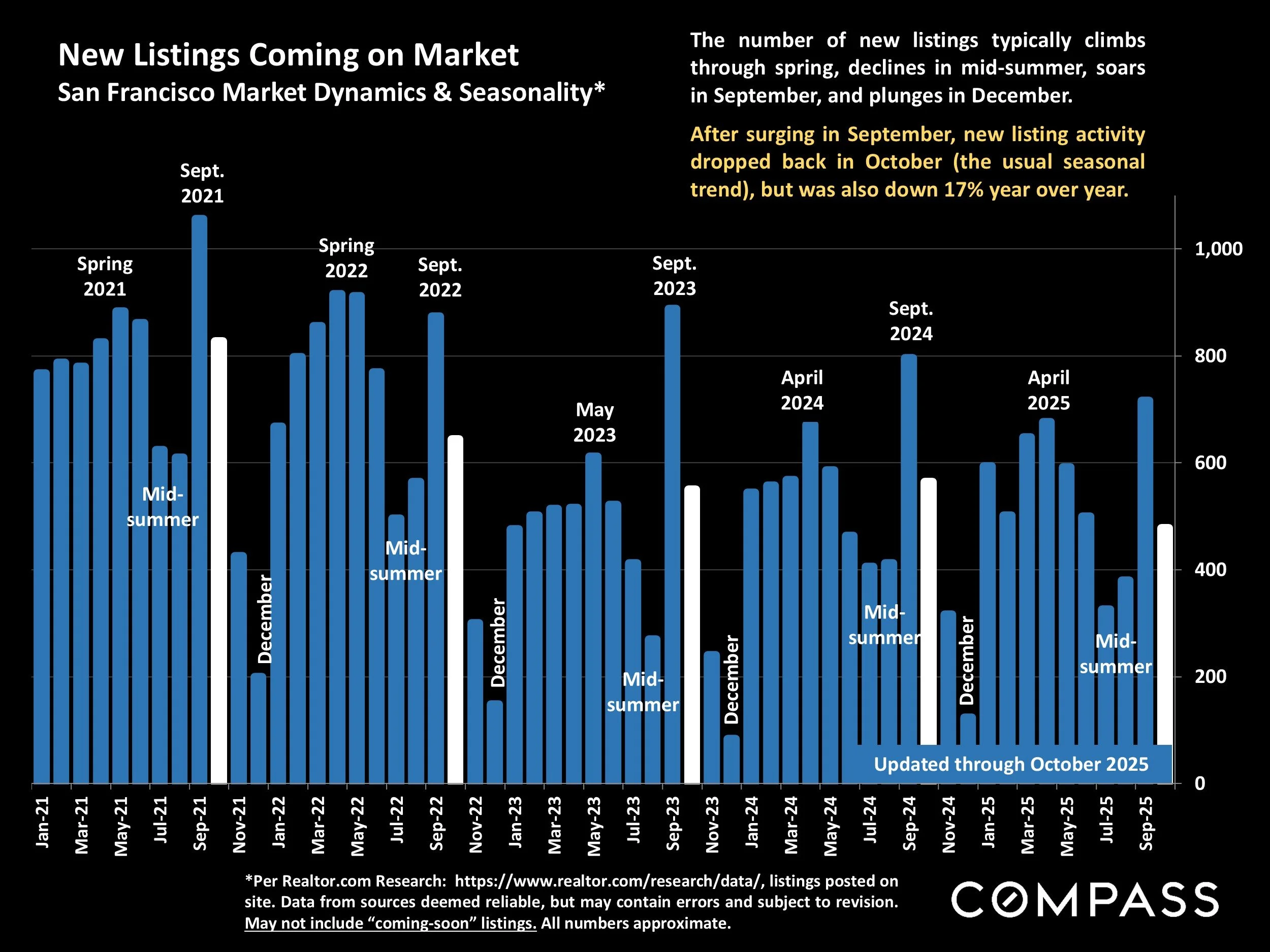

The local market is still very active although we see (new) inventory starting to taper off for the year. Most new inventory comes to MLS (open market) on Thursday and Friday and over the past two to three weeks we’ve seen new listings in the forty (properties) range. Since the start of the fall market in early September, we would see close to 100 new listings per week.

he net effect on the local market will be that active buyers will start to circulate back to available listings (vs. waiting for new inventory). In certain price points we see a lot of buyers with a FOMO mentality; they see properties that they like every week; but “think” that if they write an offer and get into contract, something better will come to market in the following week(s). I also see buyers drop out of the market altogether until Q1.

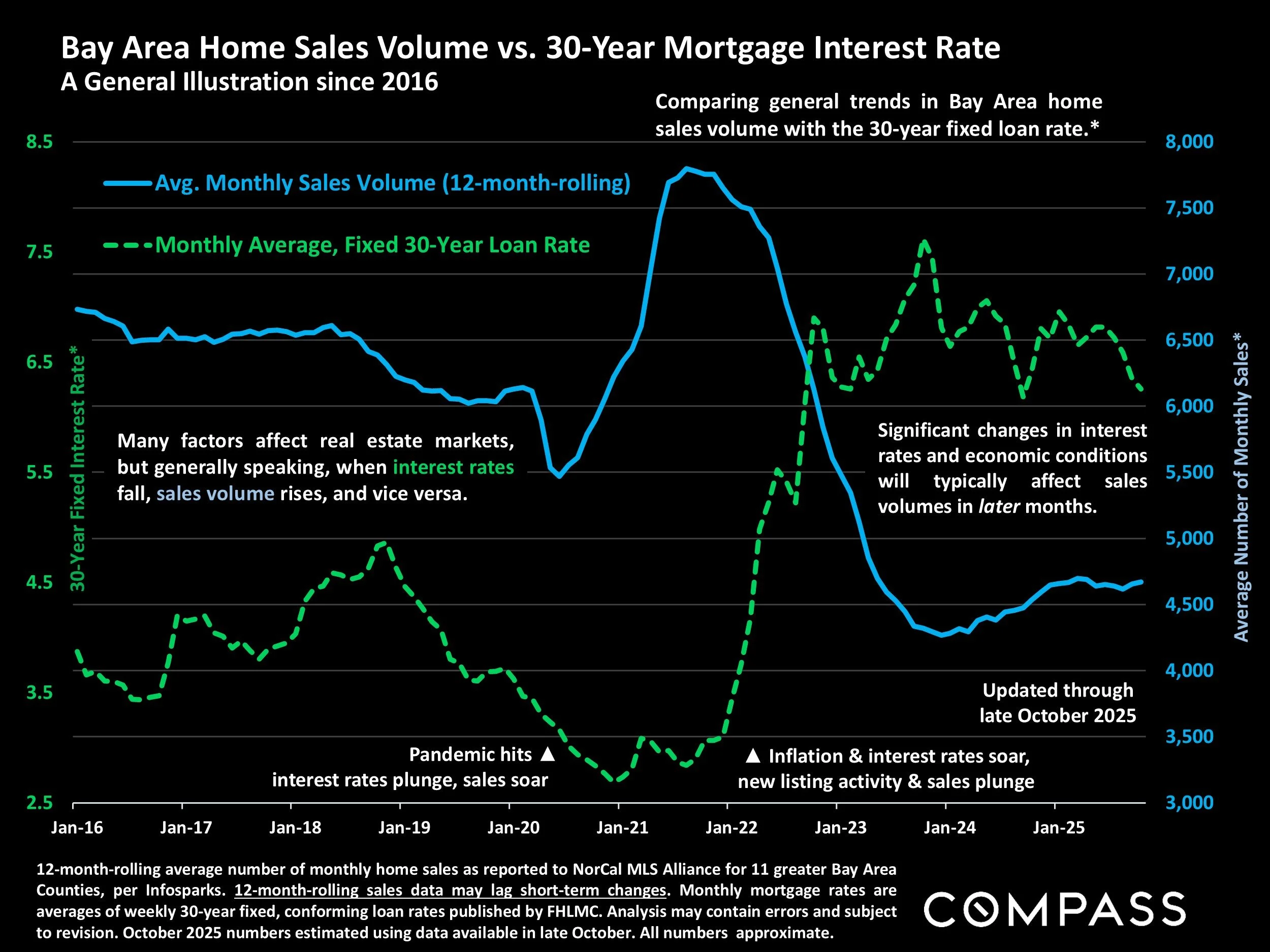

Looking at interest rates, I see buyers lock in mid-fives to low-sixes on the 30 year fixed rate mortgage. Looking at the impact of rates on sales volume, there is no denying the massive impact of cheap(er) money.

The big question is what will the Fed Chair Jerome Powell do in December? A rate cut is not a certainty.

Speaking of debt; it’s a way of life and comes in many forms; led by the Federal Government down to you and I. The government spends almost $1T per year servicing the U.S. debt: more than is spends on social security, defense or Medicare.

The gross National debt (as of Oct. 3, 2025) is $37.85T, an increase from one year ago of $2.17T

Gross national debt per household is $286,294 (as of Q2 2025).

Total US household debt is $18.39T with the average monthly payment at $1,237, up from $1,199 in 2024.

Mortgage debt is $12.94T, with average monthly payments increasing by 6.6%.

Auto loan debt is $1.66T, with average monthly payments increasing by 4.5%.

Credit card debt is $1.209T, with average monthly payments increasing by 1.4%

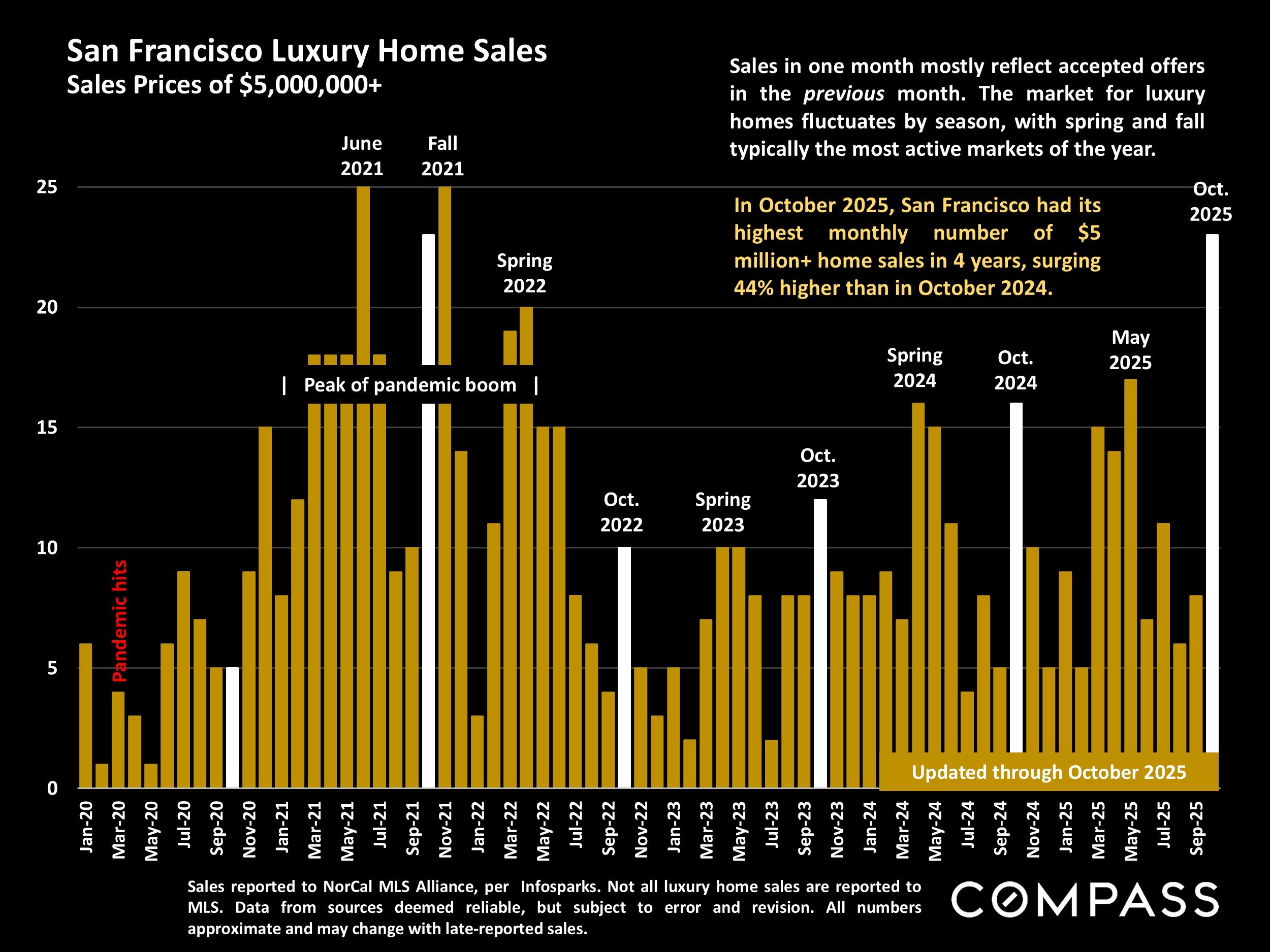

Looking at values in the city, the top end of the market is seeing pace – pace not seen in some time. In fact, the sales are at a four year high (pandemic bubble) and the year-over-year numbers (for October) jumped by 44%.

There is no doubt that there is a lot of new money in the local market.

That is it for now. Have a great weekend. If you are thinking of a move, let’s put a plan in place to make the most of your asset. Likewise, if you have friends or colleagues looking to get into the market, feel free to pass my name along.

Call or email, anytime.