October 2025: Q3 San Francisco Apartment Insider

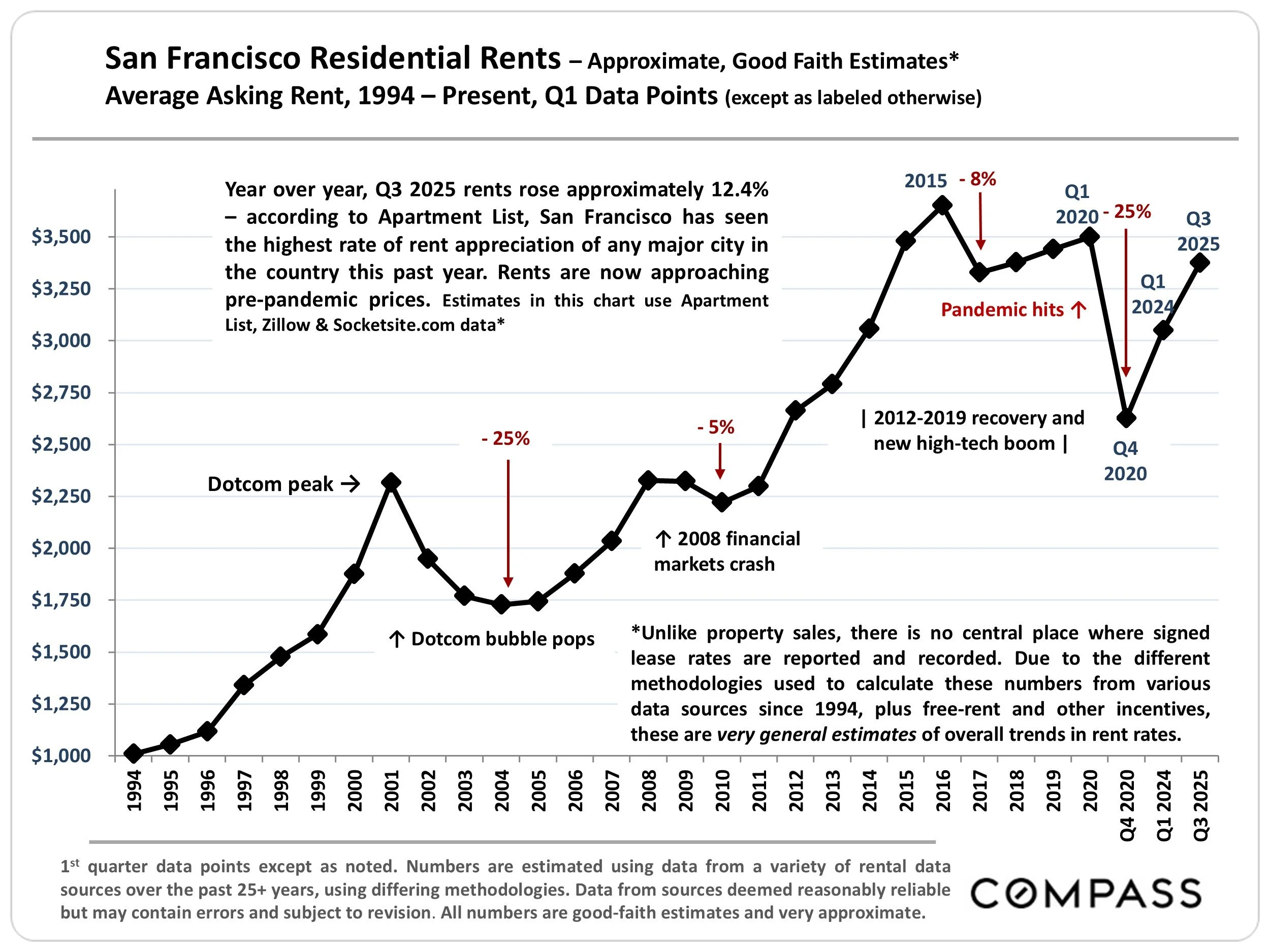

We have great news on rent recovery in San Francisco. A typical one-bedroom apartment in the city now rents for more than it did before the pandemic, and two-bedrooms are more expensive than they’ve ever been. In September, the median rent of a one-bedroom was $3,520 (surpassing the pre-pandemic median of $3,500 for the first time). The median rent for a two-bedroom climbed to $5,000 for the first time ever! The data (from Zumper) tracks back to 2016 levels. Year over year numbers are staggering: rent growth for a two-bedroom apartment is up 17.1% and one-bedroom rent prices are up 10.7%, the third-highest increase nationally.

What is driving the rebound in rent rates? At the top of the list are jobs. Office demand jumped 107% compared to same time last year. AI companies and employers in their ecosystem are fueling the rebound. Companies like OpenAI and Anthropic are leasing millions of square feet of space. As an example of the large swaths of space getting consumed, OpenAI has leased buildings spanning nearly 1M square feet for its headquarters in Mission Bay not floors, but buildings. Some well-respected voices are saying AI-driven demand is projected to slash the city’s 34.6% office vacancy rate in half within five years. The bottom line; San Francisco does not have enough AI talent to fill the open jobs so those coming to the city for these jobs will need your apartments.

On the flip side of this, evictions are at a 10 year high. San Francisco tenants faced more than 3,470 residential eviction cases over the yearlong period ending in June, the highest figure recorded for any 12-month span in at least the past 10 years. Drivers are increasing economic pressure from rising rents and a slow job market. For reference, prior to the pandemic, eviction filings in San Francisco averaged roughly 3,000 each year.

In local news, Veritas is back in the headlines. The company defaulted on $652M in debt secured by 66 buildings in San Francisco (approx. 1,566 units). The notice of default (NOD) provides Veritas with a short period of time to get into “good standing” with its lender (RBC Real Estate Capital Corp). Since the NOD was filed on Sept. 18th, the 90 days period to hold off on a sale would end on Dec. 17. Expect the borrower to work this out with the lender.

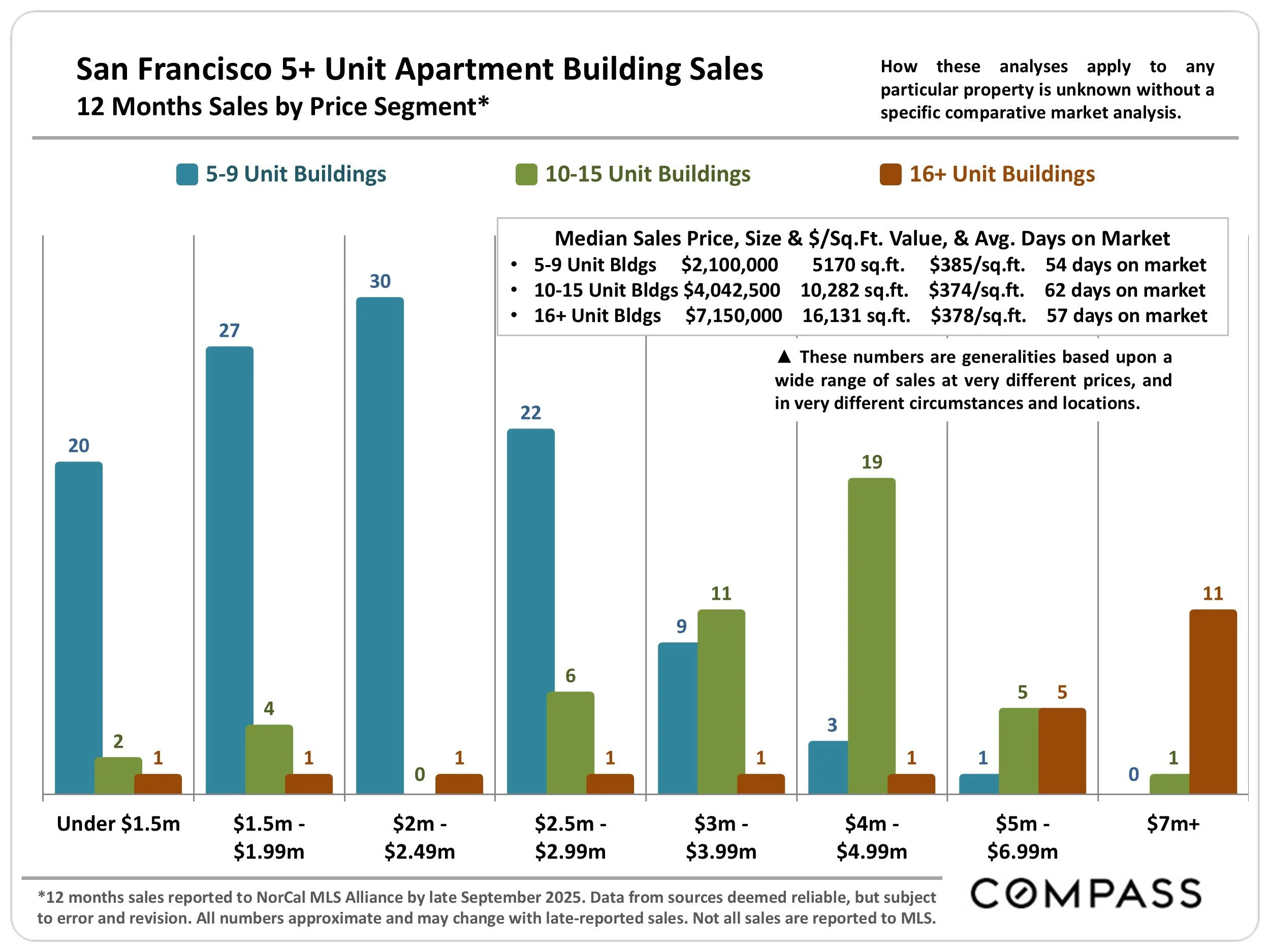

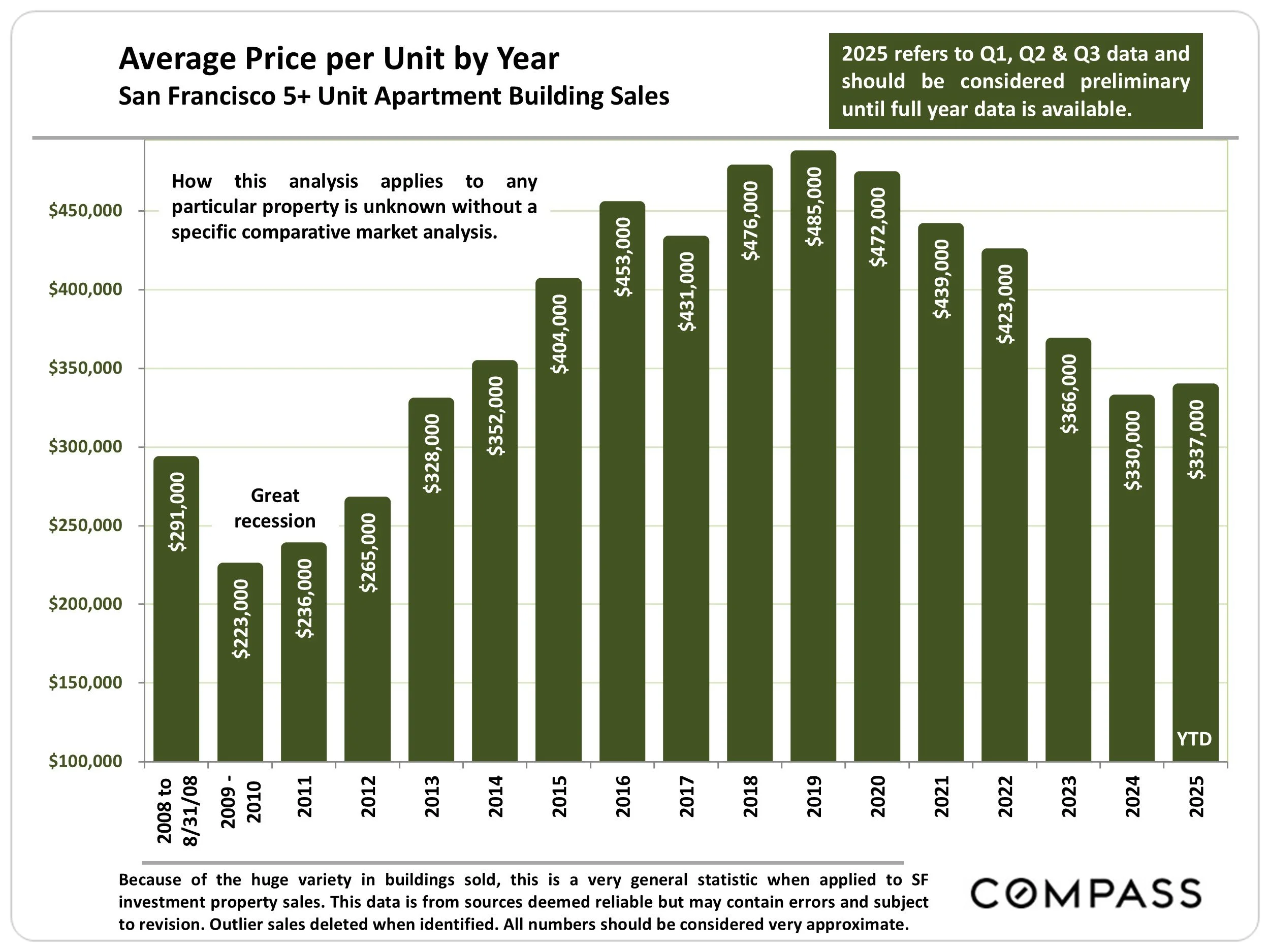

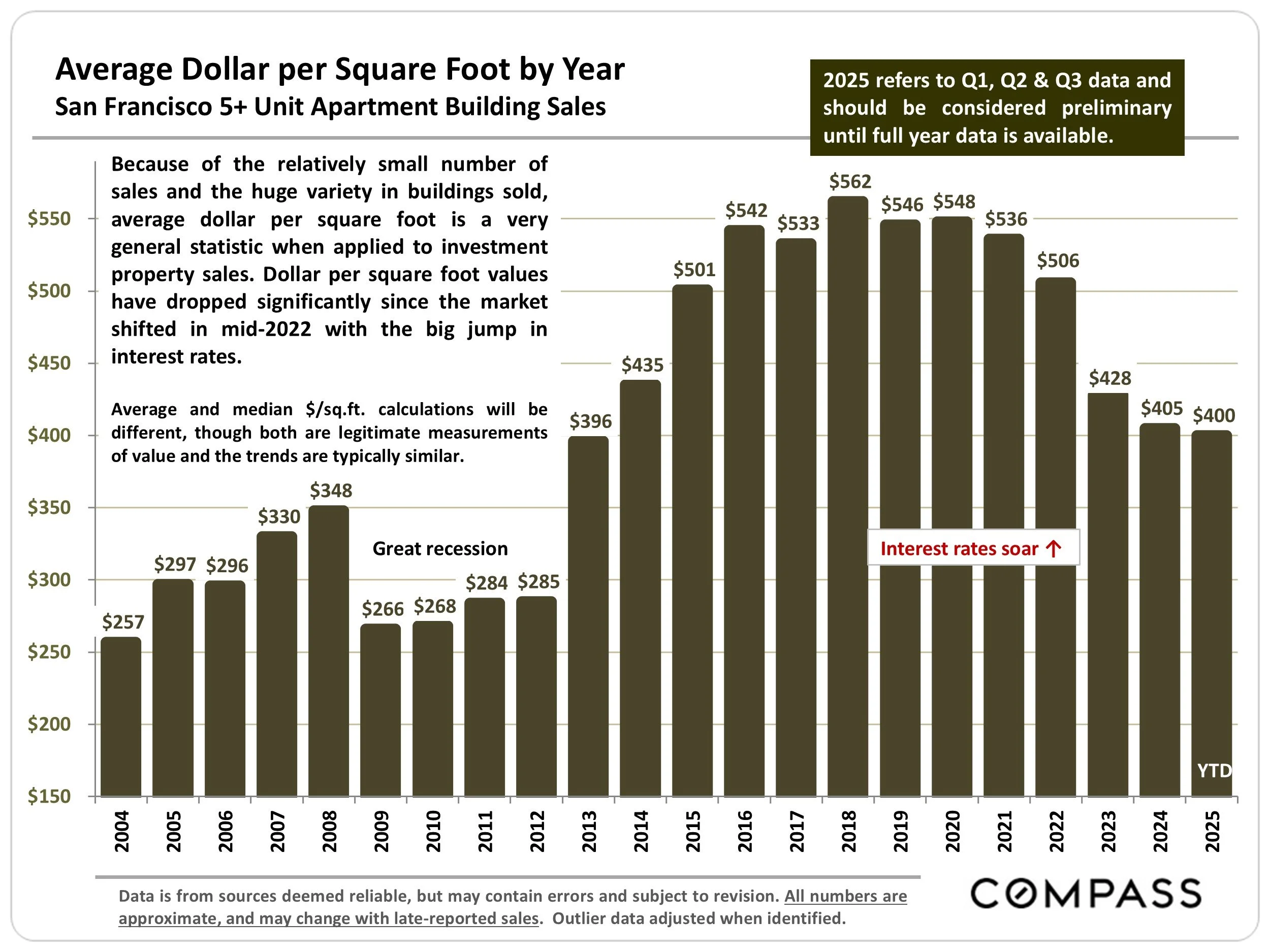

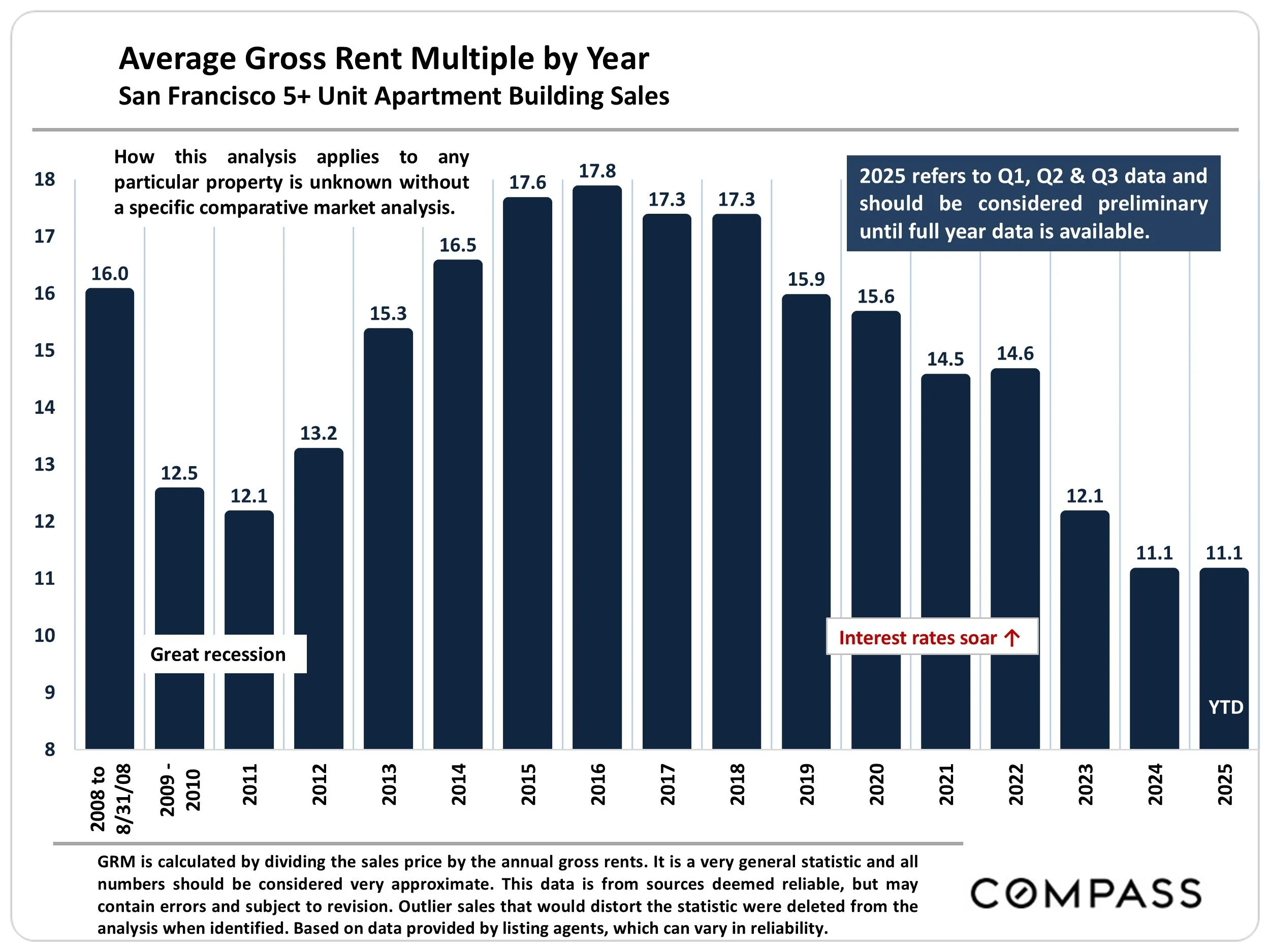

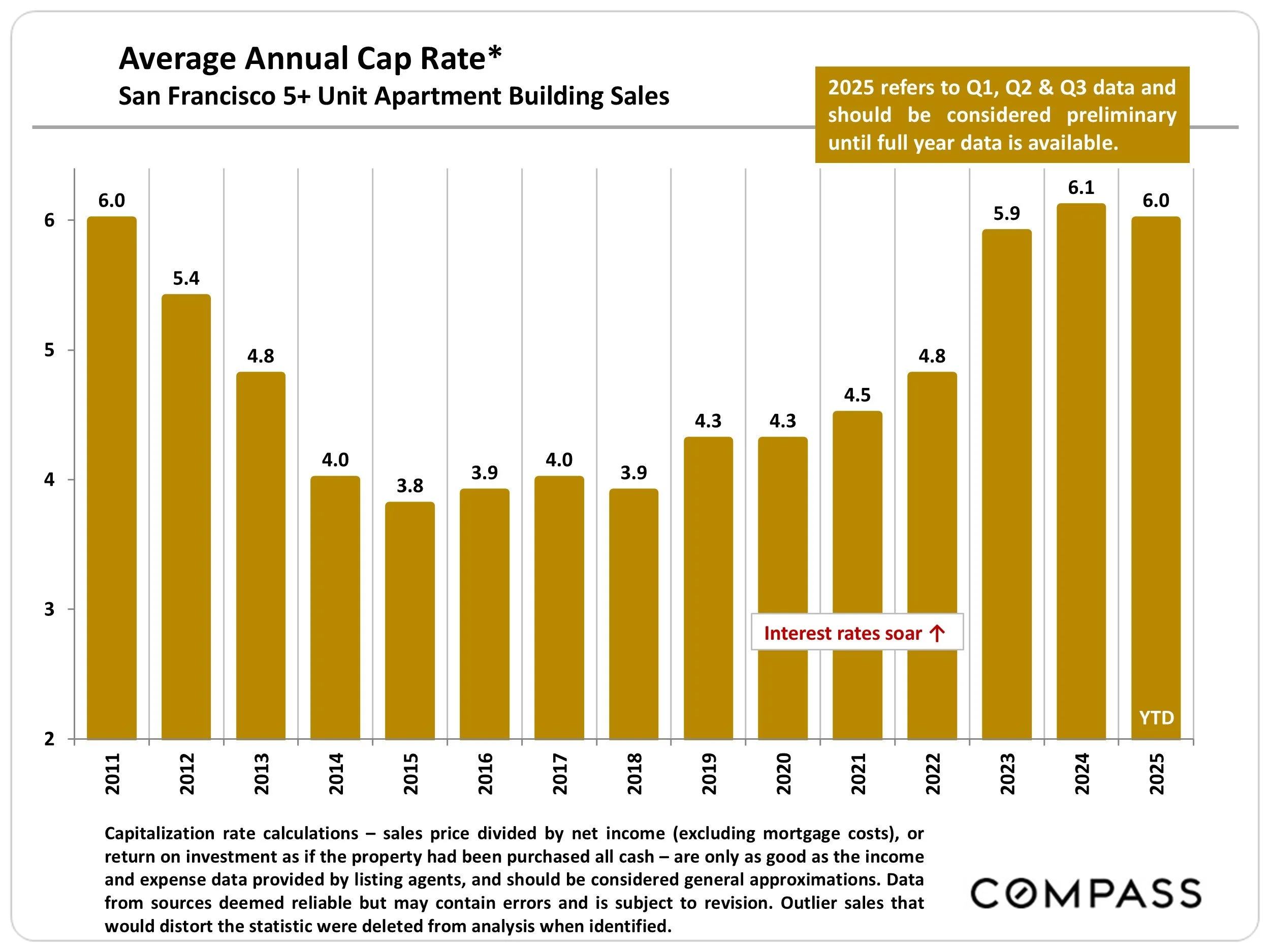

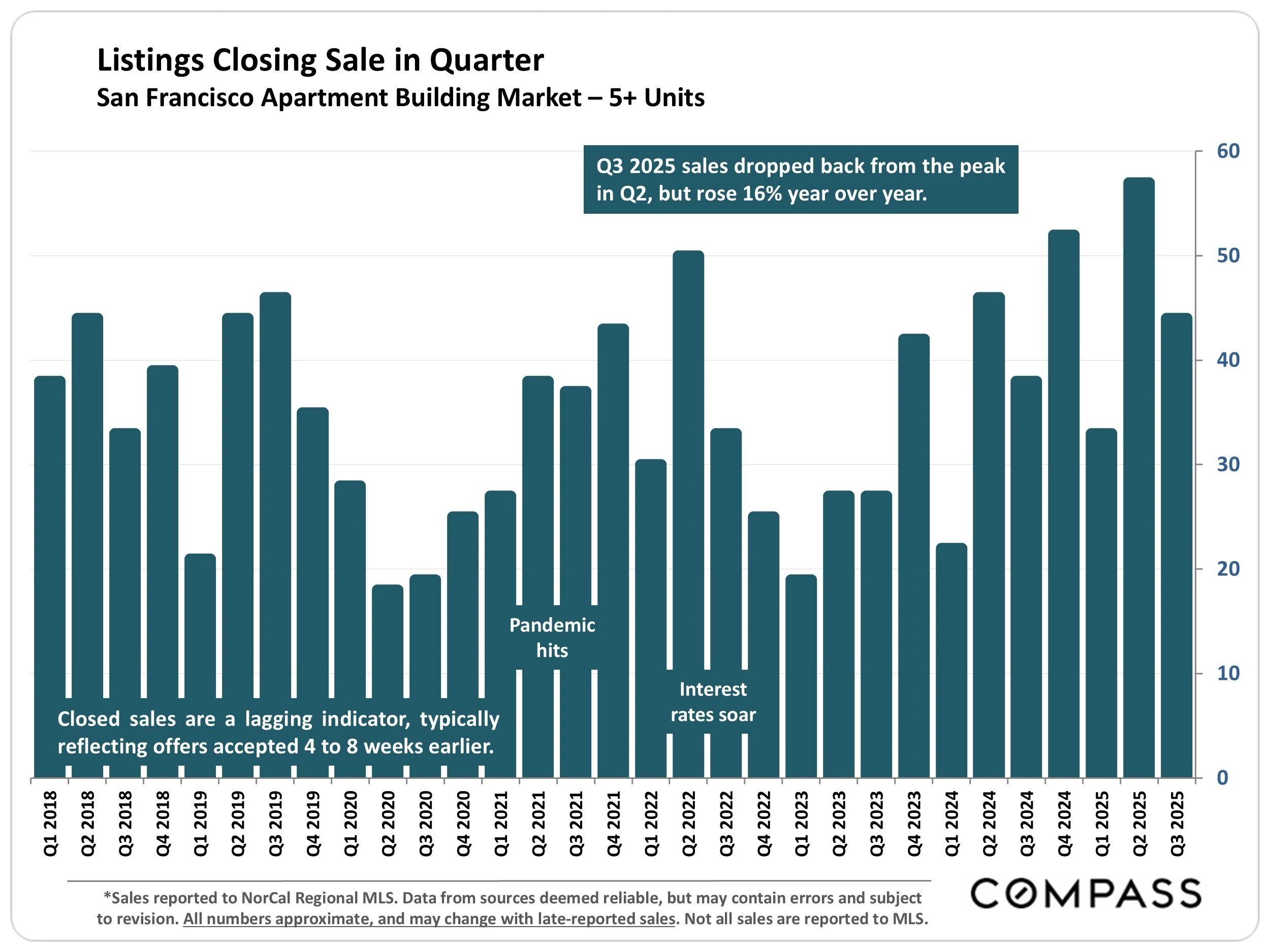

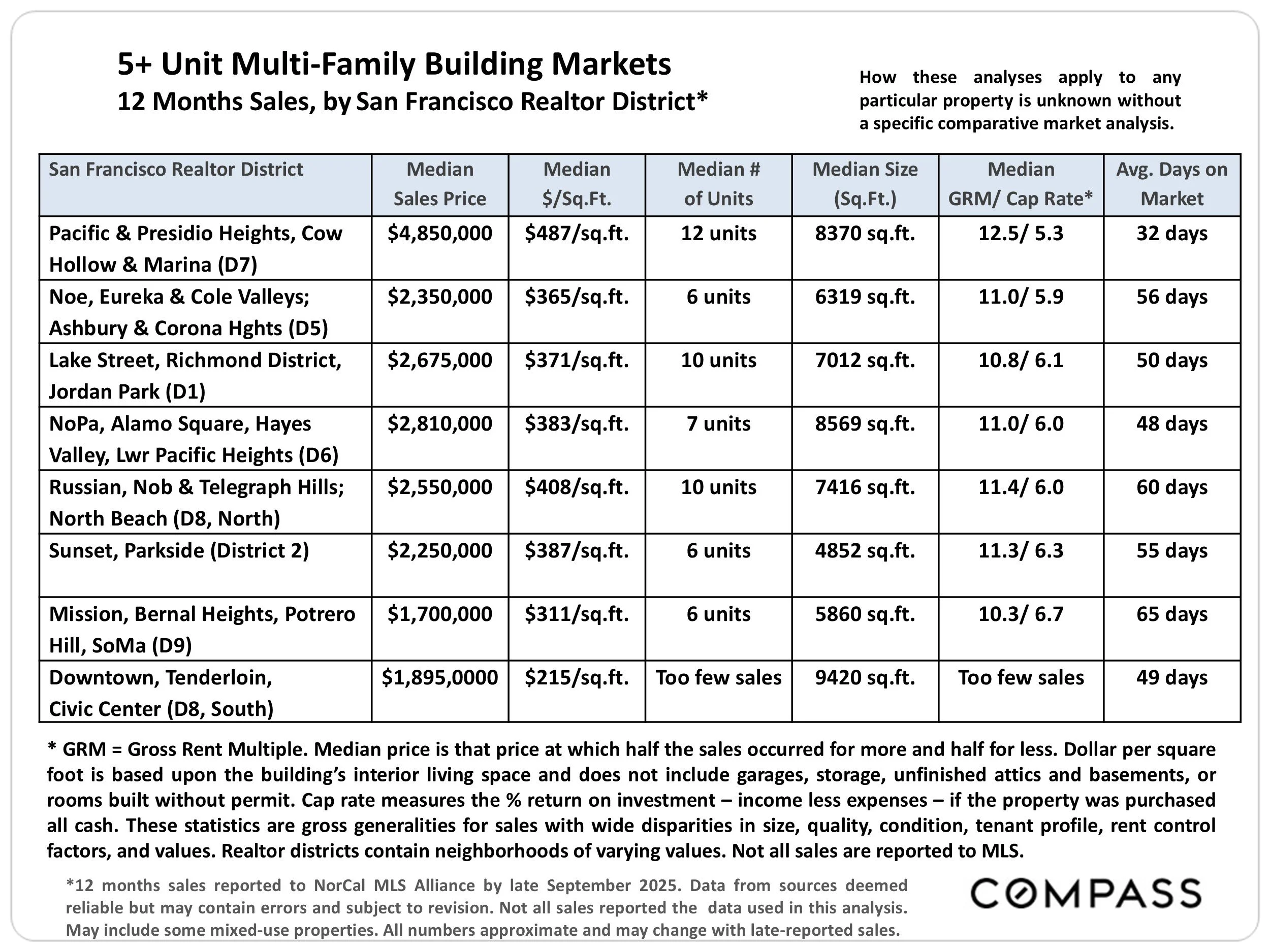

On to the numbers for the quarter.