July 2023: Q2 San Francisco Apartment Insider

Hello and happy Thursday!

I hope you and your family had a great 4th of July break and found some time to decompress! Starting off, let’s take a quick look at downtown and office activity. The office vacancy rate is now at a high of 32%, which includes available sub-lease space. To put that number into perspective, the city itself estimates that there are 147,303 fewer office workers downtown compared with March 2020. Some of the buildings that are experiencing serious lack of occupancy are 50 Fremont (90% vacant), 500 Howard (94% vacant), 45 Fremont (60% vacant) and 181 Fremont (100% vacant). This market will continue to be challenged before solutions are found.

Looking at tax dollars and tourism, Park Hotels & Resorts, owner of the Hilton San Francisco Union Square and Parc 55 stopped mortgage payments and plans to give up the two properties. It stopped making payments on a $725 million loan due in November and expects the “ultimate removal of these hotels” from its portfolio. Together, the two hotels account for around 9% of the city’s hotel stock. I’m sensing the lenders do not want to be hotel operators at this current time.

In the same vein – but on the apartment front, Veritas Investments is in default on loans covering a large portion of its overall apartment portfolio. Eastdil Secured (a brokerage firm) has been secured by the lenders to market nonperforming loans which are divided into two portfolios comprising 95 multifamily buildings in San Francisco. The buildings contain 2,452 residential units and 45 commercial units.

The first loan portfolio (which has been in default since November) marketed is secured by a 75-building portfolio consisting of 2,149 rent-controlled apartment units as well as 45 commercial spaces. It is broken down into two pools – the first is for 61 buildings leveraged with a $667.9M balance. The second pool has 14 buildings leveraged with a $132.4M balance. The total unit count is 2,149.

The second portfolio has 20 buildings backed by seven different loans leveraged with $138.8M. The portfolio covers 303 apartments. Six of the loans have been in default since January.

Veritas (ironically), amongst others will be a bidder on the portfolios. Keep in mind Veritas owns about 6,500 rental units in the city.

Over in Alameda County, the eviction moratorium is finally over (April 29, 2023). This end date does not impact specific cities with their own eviction moratoria. Looking at Oakland, the City Council has finally come around and listened to landlords and their advocates. Several transition periods to end the moratorium were initially floated and they Council came up with July 15th as an end date. The key dates to keep in mind for Oakland landlords:

Through July 14, 2023

Eviction moratorium remains in place.

July 15, 2023

Eviction moratorium and late fee moratorium expire. Standard 3-day notices to demand rent can resume.

July 1, 2024

The rent increase moratorium ends.

If you have non-paying tenants in Oakland, I suggest you contact your attorney to discuss your legal avenues to possession.

On the tenant buyout front, in 2022, there were only 389 legally recorded tenant buyout agreements, which is pretty flat compared to 2021 which came in at 391. In 2022, the average reported buyout agreement totaled $53,828, with an average payout of $35,720 per tenant. The 2021 numbers were $46,676 per agreement and $29,270 per tenant. The top neighborhood for buyout agreements; The Mission.

On to the numbers or the quarter. Although the numbers may not reflect it, “street activity” over the past month to two months demonstrates demand for vacant apartments in San Francisco. The demand is on the north side moving south towards Market Street. I’m hearing of lots of calls coming in on advertised vacancies. Is this a new trend or simply a cycle of students moving back to San Francisco after graduation? I am seeing professionals moving up as well as back to San Francisco, so hopefully we are on to a bigger upward trend that spreads southward through the City.

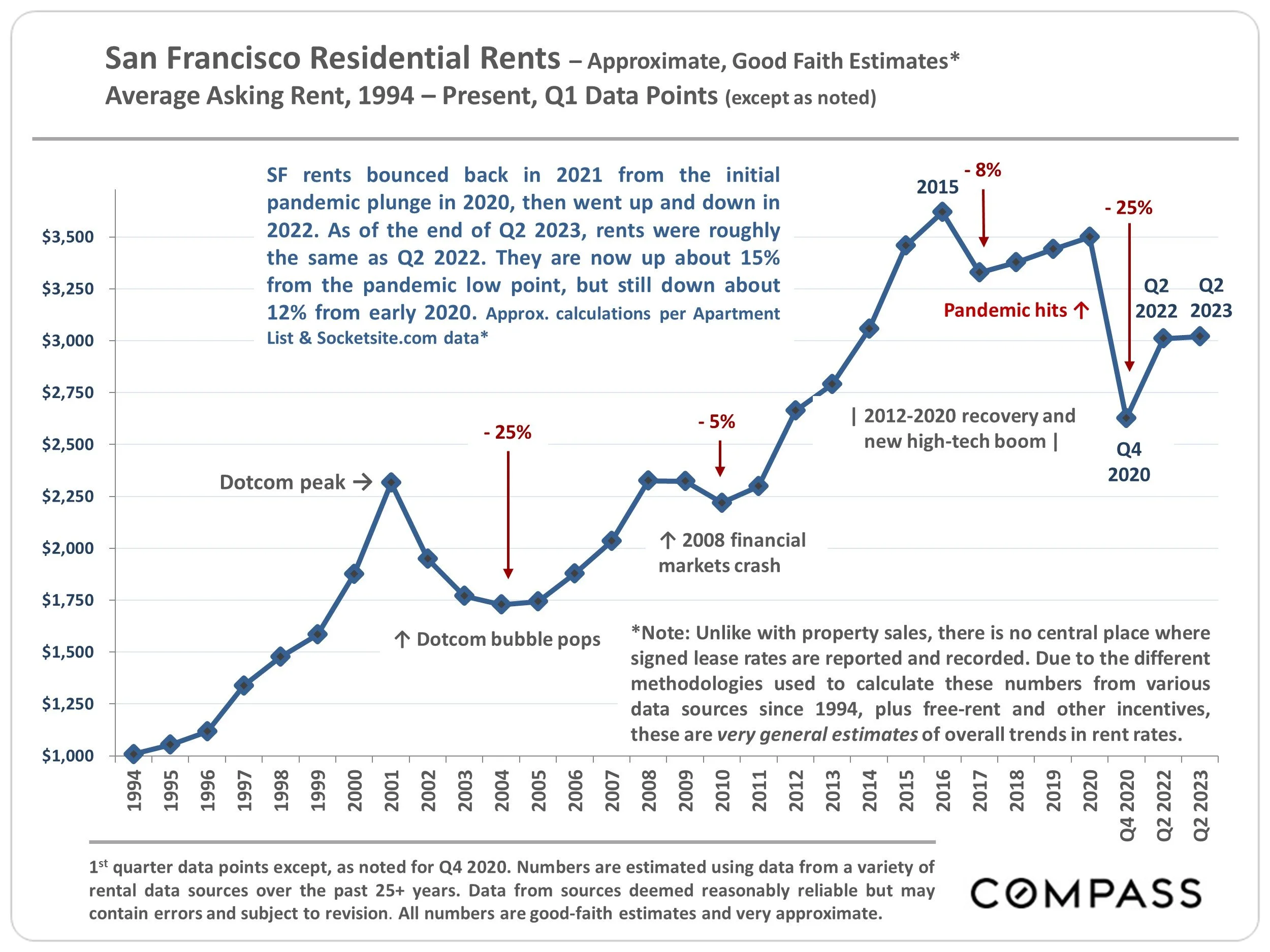

The weighted average asking rent for an apartment in San Francisco has effectively held at around $3,600 over the past quarter, which is:

Fairly flat from the same time last year

12% lower than prior to the pandemic

19% below its 2015-era peak of nearly $4,500 a month

The average asking rent for a one-bedroom in San Francisco is holding at around $3,000 per month, which is:

Fairly flat from the same time last year

15% lower than prior to the pandemic

19% below its 2015-era peak

Over in Oakland, The average asking rent for an apartment has been flat since last quarter at $2,600 per month with the average asking rent for a one-bedroom apartment hovering around $2,200 per month. These numbers are:

Approx. 5% higher than at the same time last year

3% lower than prior to the pandemic

13% below its 2016-era peak

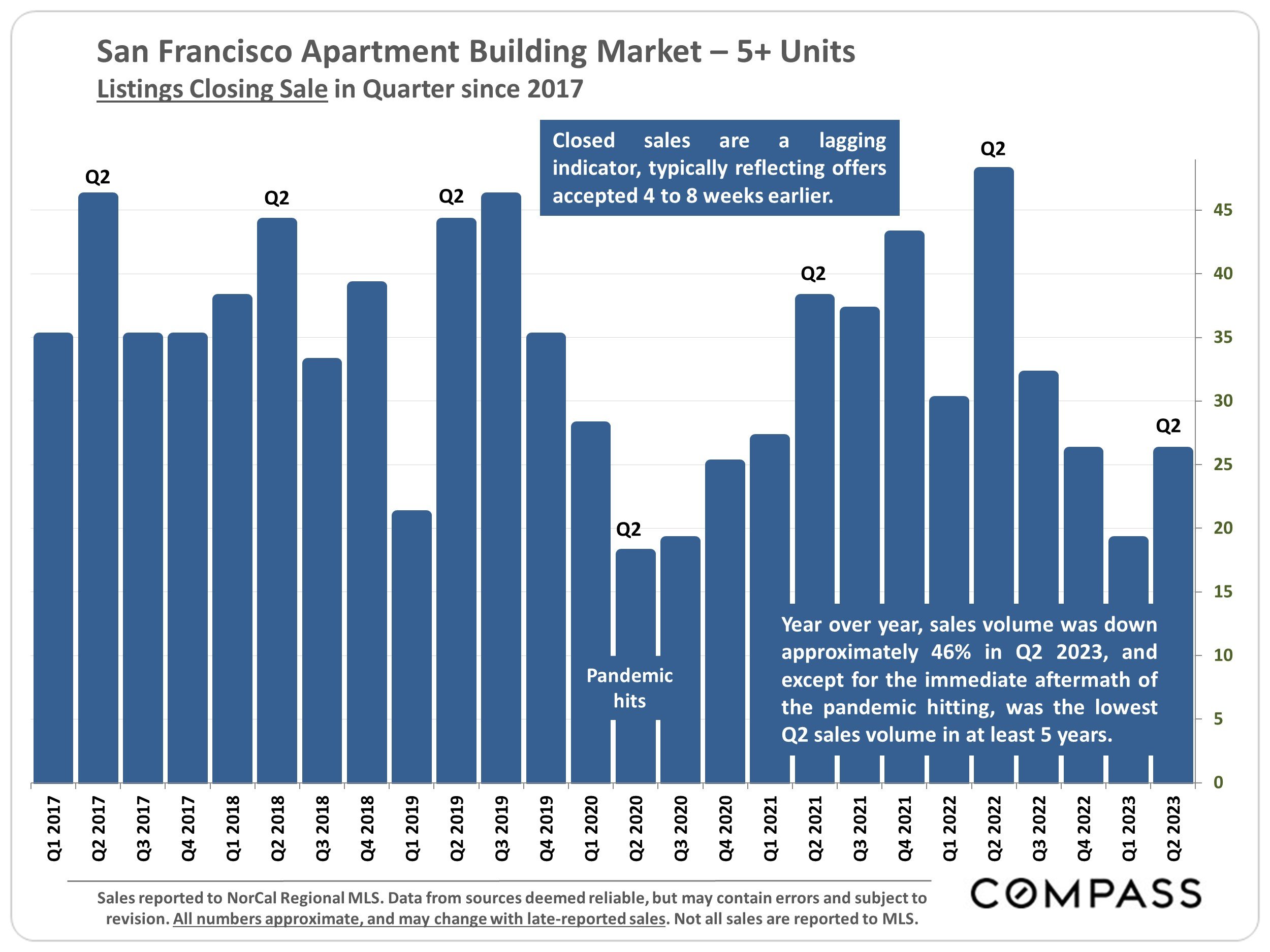

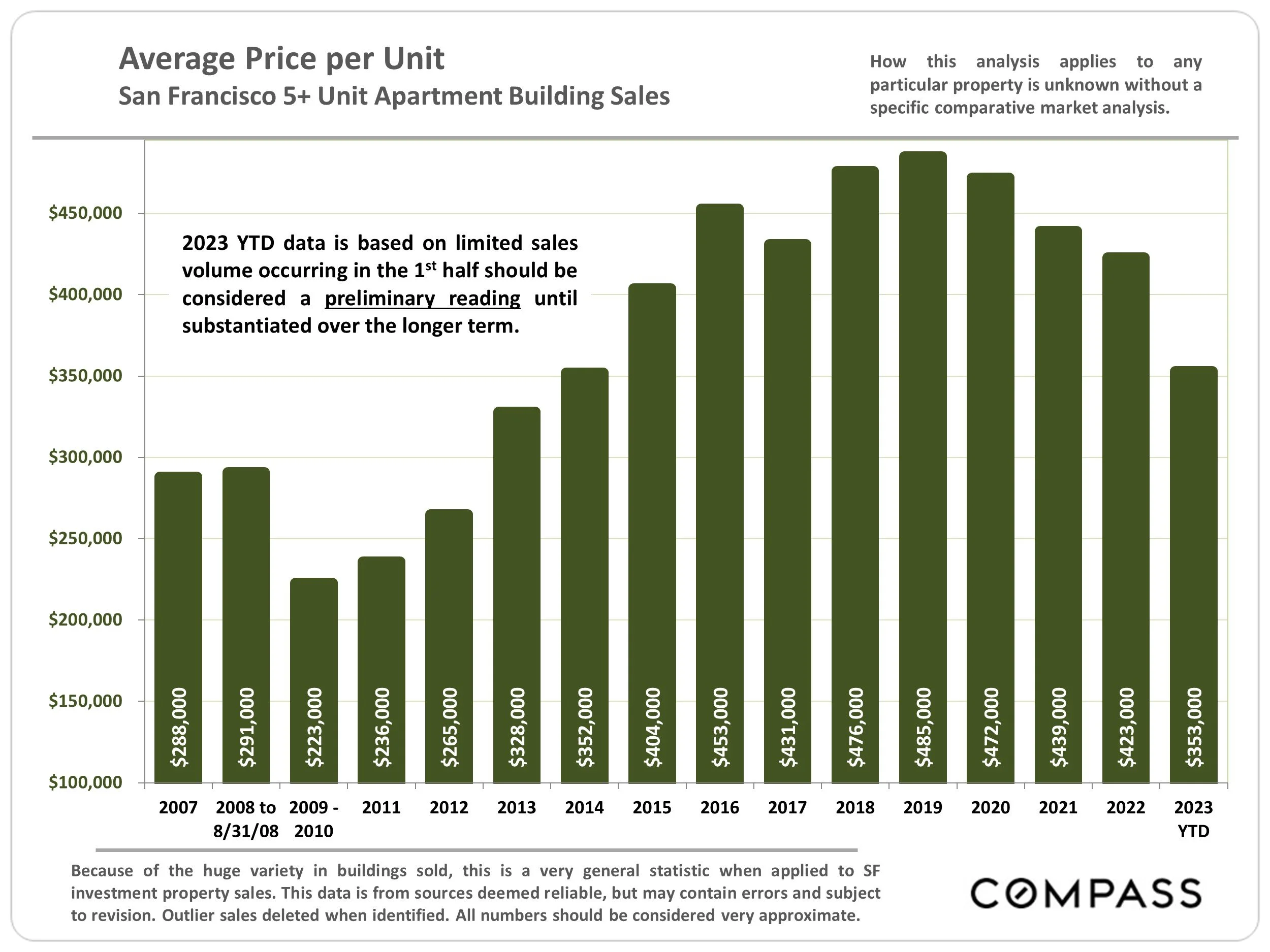

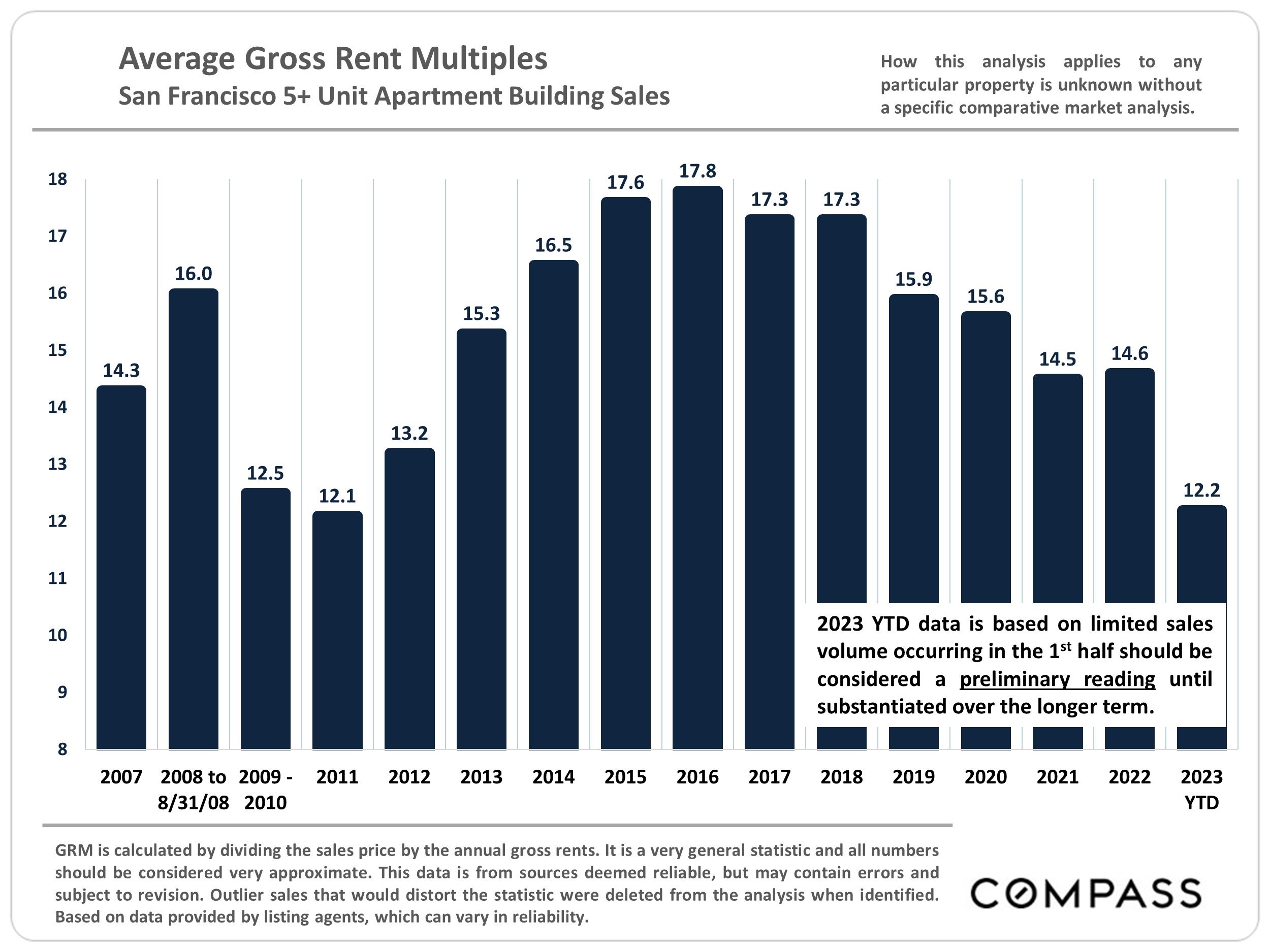

The data points for the quarter: