August 2023: San Francisco Real Estate Insider

As we enter the second week of August, the market is quiet. There was considerable debate over the past six weeks (in the agent community) whether sellers that are planning to sell after Labor Day will expedite their timeline and try to find “their” buyer in August. Well, it looks like that is not happening. I am seeing strong buyer demand now for single family homes up to $3M as well as condos in smaller buildings in most price points. Fall should make for an interesting market.

I think many buyers are still getting a bit too wrapped up in the fluctuation in interest rates and it is hampering their ability to lock in a quality house now. The rates may get another quarter to half a point increase before year end. In fact; it is likely. But it is out of our control. You can control your ability to select the proper financing that affords (a) a competitive rate today and (b) a loan product that provides flexibility to refinance into a lower rate once the dust settles. One thing I can assure the buying population; once rates stabilize, competition for homes will increase significantly. Buyers need to do the math; i.e. $3M home with 25% down and a $2.250M loan. Pay a 1.5% (<$100k) higher in rate for a year or two or, pay $250k to $400k more for a home later (at 1.5% lower in interest rate than today’s offering).

I was reading another doom and gloom article about California regarding the population and job loss since COVID. Sure, jobs and a lot of wealth have exited. But as a “republic,” California is still pretty amazing at economic success. Although we have some of the highest taxes in the US, we have a tremendous business engine that generates jobs and rewards success. This, in short, is why some people stay (opportunity and earnings) AND why some people migrate out (taxes and the cost to operate a business). Some interesting data points about our state:

From the end of 2019 through 2021, California added more than 116,000 millionaire taxpayers, a record for a two year period and more than in the previous decade combined.

The number of residents making more than $50 million surged 158% to 3,182. In total, more than 288,000 Californians, or 0.7% of residents, reported over $1 million in income in 2021.

The top 1% of California earners account for roughly 50% of total personal income tax revenue.

2022 California GDP was $3.59 trillion, close to the size of Germany's GDP, the 4th largest economy in the world!

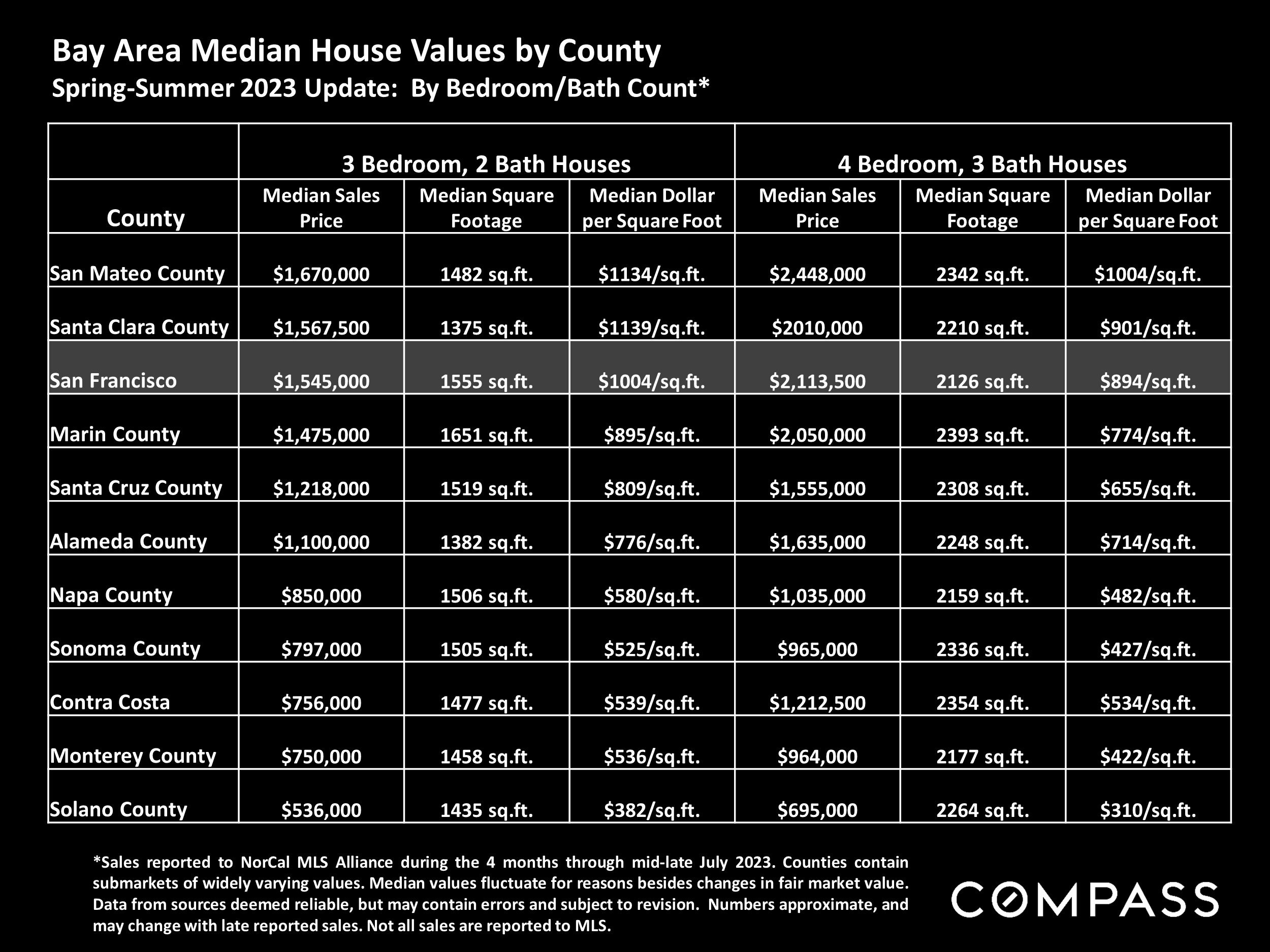

I get a lot of questions from clients about other Bay Area metros and what is available in a certain price points or, “what is it going to cost me to get a nice xBR/xBA home." Below will give you some insight into different costs for BR/BA mix in specific locations.

Locally, I like to look at the recent sales prices as they compare to listing prices to help get a good read on the demand. As usual, the houses are still competitive and condos are showing more flexibility on pricing. This is a citywide average; specific neighborhoods have their own dynamic.

Enjoy the balance of your summer vacation(s)! Kids return to schools later this month.