July 2023: Q2 Sea Cliff - Lake Street Insider

Hello and happy Thursday!

I hope you and your family had a great 4th of July break and found some time to decompress! As we roll into summer, the market continues to show its finicky side. There have been a lot of distractions for buyers and sellers; interest rates, local bank woes and the non-stop news cycle of doom & gloom as it relates to quality of life issues in our City.

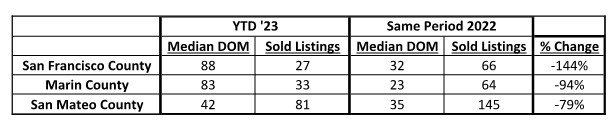

Regardless, the market is moving. Looking at the City as a whole; the single family segment up to $2M is very competitive, the $2M-$5M segment is active with quality homes gaining multiple offers and the $5M+ market has no real ebb or flow. Causes of this segments dysfunction vary, but the bottom line is we have a lot of sellers. Buyers are calling the shots as they have a lot of options in most premium neighborhoods; often times on the same block! On a year over year basis (considering last year at this time interest rates were in the upper fours / low fives), the $5M+ segment activity is largely down. For reference:

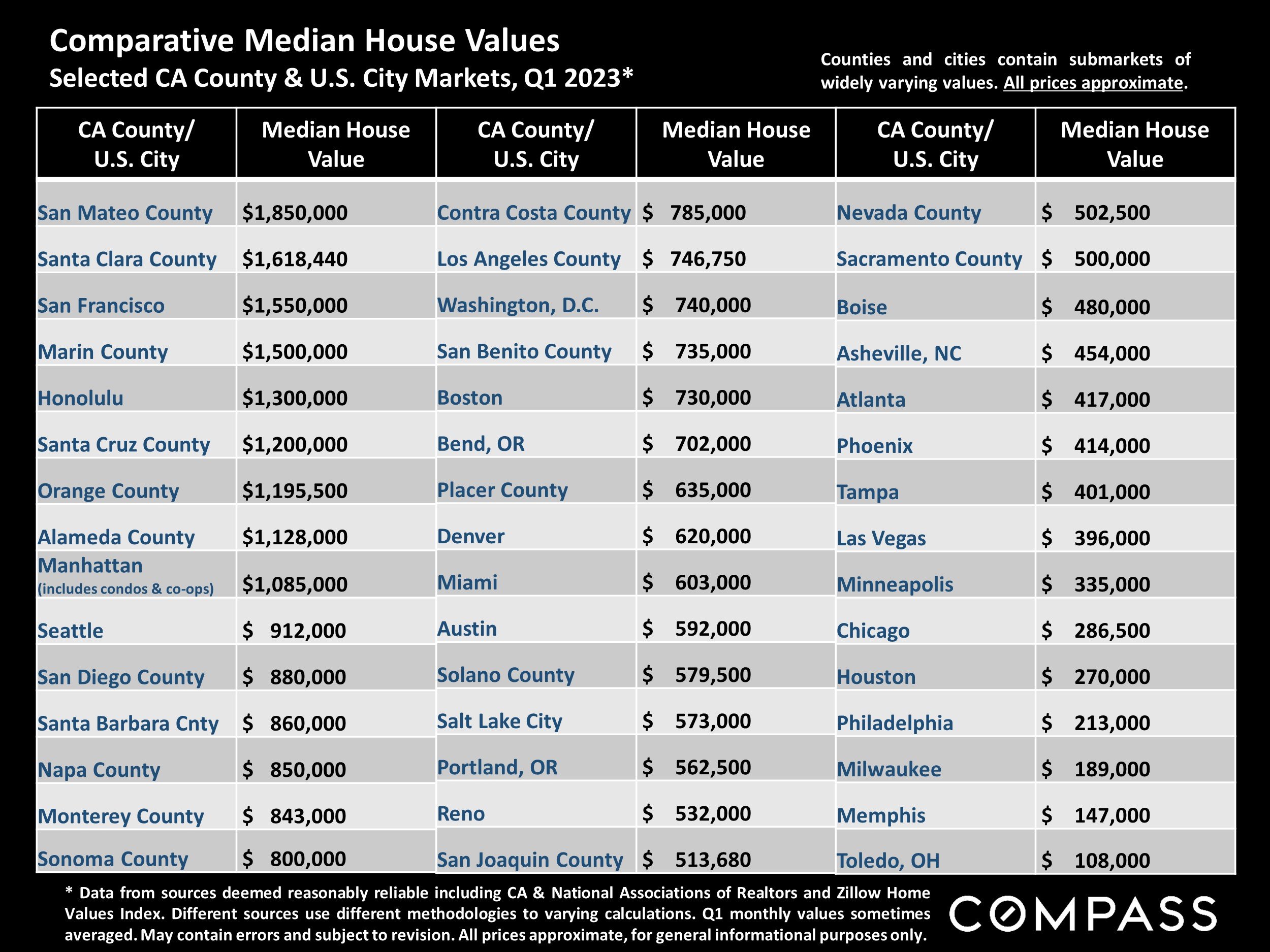

Luxury home sales in San Mateo and Marin County continue to outpace San Francisco. Median prices are still high in San Francisco compared to other metros and that is one of the drivers of the outflow. For reference, here is a sampling of median prices in common destination metros:

When you break down City demand and sales activity into specific neighborhoods, the numbers can vary, a lot. A huge positive for our corner of the City is that demand remains high and inventory is very low. When I see a new house come online in the neighborhood, it usually sells quickly and often for over the asking price; especially in the Lake Street Corridor. Homes in Sea Cliff are also selling quickly – with a huge emphasis on getting those homes priced properly. To demonstrate demand in our corner of the City versus some other north side neighborhoods, this chart should help to show our appeal and performance:

I have an update on the long and arduous 224 Sea Cliff Avenue saga. As I reported last year the home was in contract with a buyer but it was discovered that the steps to the beach had been built beyond the property lines of the lot. The transaction fell apart and permits were filed to remedy the violations. Now, although the permits are not yet finalized, the home has been scheduled for foreclosure auction (which has been in the hands of a bankruptcy trustee) on July 13th (today). The opening bid is scheduled to be $6,525,566. It will be interesting to see if the home finds a buyer. The cost to remedy the lot line issues and the work to remove the entire staircase and decks (to the beach) are likely to cost well north of $12 million. Once that is completed (it was ruled that the work must be done by year end 2023) the house needs to be rebuilt; possibly a five to seven million dollar project (there was a fire in the property a few months back). Considering the lost value of the deck and beach access, I’m not sure this pencils out at or much above the opening bid amount. Comparing to the property at 9 25th Avenue, it sold for $20M and was a better house; pretty much move-in ready and in a much more “private” location.

On to the numbers for the quarter.

Here are the top sales of the quarter. The property at 9 25th Avenue was the top sale in quite some time; several years in fact. This home is just above Baker Beach and had been asking $32 million.

That is it for now. If you are ready to move up, trade down or simply out of the City; let’s put a plan in place to make the most of your asset. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.