January 2026: Q4 San Francisco Apartment Insider

Good morning and Happy New Year.

As we enter the second week of January, I feel very optimistic about the next twelve months. Politically, we seem to be heading on the right path in terms of quality of life issues and a reduction in crime. From a local economic perspective, while AI has been carrying the city, many of the city’s core business sectors (finance, tech, bio/life-science, creative/media, hospitality, etc.) are not yet in full “hire mode” but should hopefully show signs of resurgence this year.

Speaking of politics, there are some new laws that will impact your business as of January. In San Francisco, the Sheriff’s Office has issued new guidance on how it will carry out court-ordered evictions. Removing tenants once a writ of possession is obtained can be dangerous for law enforcement and everyone else involved in assisting in entry (as well as immediate neighbors), but whenever the owner does not have keys that work, the Sheriff’s Office now wants landlord’s consent via a waiver to force entry. A link to the form is here.

Over in Oakland, as of January 1, banking of rent increases will be limited to five years (instead of the current ten-year). Also, transferring banking to new property owners will be prohibited except for transfers through an inheritance between spouses or between parents and siblings, children, or stepchildren, and only if that transferee owns the property for at least one year. Owners will be required to provide a copy of a current Business Tax Certificate with any rent increase notice that includes banked CPIs.

Statewide, we have three laws to be aware of:

-SB 721 – the balcony inspection law - is in effect as of January 1st. This law applies to “Exterior Elevated Elements” (EEE’s) — balconies, decks, stairways, landings, and walkways — in buildings with three or more dwelling units that: (a) Are six feet or more above the ground (b) Have a walking surface designed for human occupancy or use, and (c) Rely in whole or substantial part on wood or wood-based supporting materials

-AB 2493 - Tenant Screening Fees & Credit Report / Application Changes. This regulates how landlords may charge application or screening fees for rental applications under tenancies longer than 30 days. It requires landlords to use a first-come, first-served approach when reviewing applications, and accept the first applicant who meets screening criteria. Screening criteria must be provided in writing.

-AB 2747 - Rent-Payment Reporting Option. Landlords must offer tenants the option to have “on-time rent payments” reported to at least one consumer reporting agency (credit bureau), helping tenants build credit history via rent payment history. Tenants may opt in (or presumably opt out); landlords may pass along a reasonable reporting cost (up to a cap) depending on law’s parameters.

Keep in mind, for San Francisco, that coming in November, there will be a parcel tax item on the ballot. The initiative aims to raise ~$187M annually to (further) fund MUNI. Owners of multifamily residential properties would pay a base annual tax of $249 for parcels smaller than 5,000 square feet. Owners of bigger apartment complexes would pay the introductory $249 plus 19.5 cents for each square foot exceeding 5,000 square feet, with a cap at $50,000. Owners of mixed-use property would pay an introductory rate of $799 for parcels smaller than 5,000 square feet. Also, owners of rent-controlled units can pass-through up to 50% of the tax, capped at $65.

Looking at downtown, the city’s office vacancy rate fell to 33.5% in December from 34.4% in the third quarter. While still high, that’s down 3% from a year ago, and it’s the biggest annual decline since 2011. Although leasing activity is at its highest level in six years, the scary part is that a quarter of space was leased by artificial intelligence companies, and they accounted for over 80% of newly leased space.

Locally, regarding the apartment side of the business, Veritas Investments is back in the news again. The latest update has Canadian RBC Real Estate Capital Corporation selling a $570M loan, backed by 66 apartment buildings owned by Veritas. The buyer, an affiliate of Revere Housing, will take control of the real estate, but retain Veritas as the property manager.

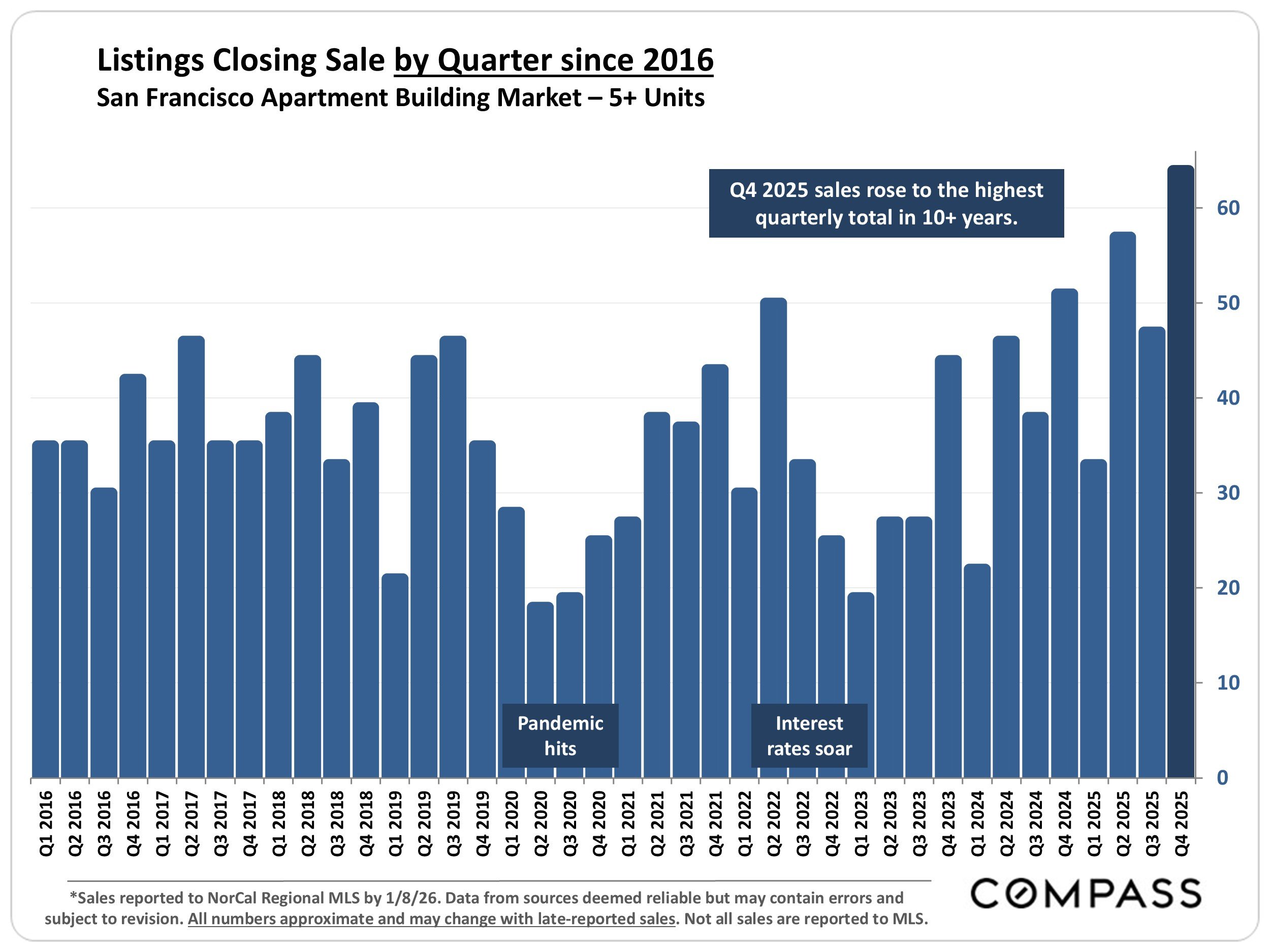

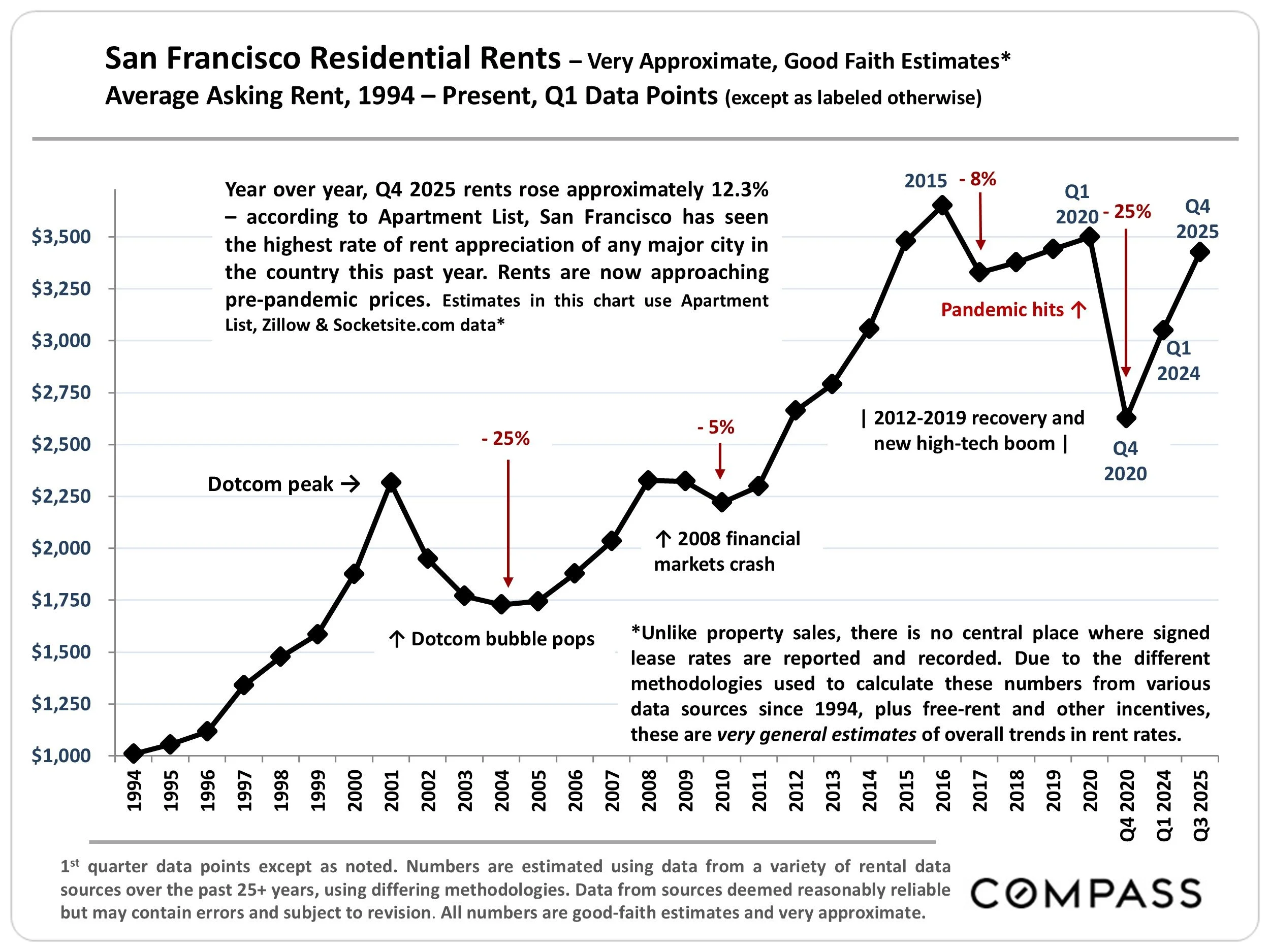

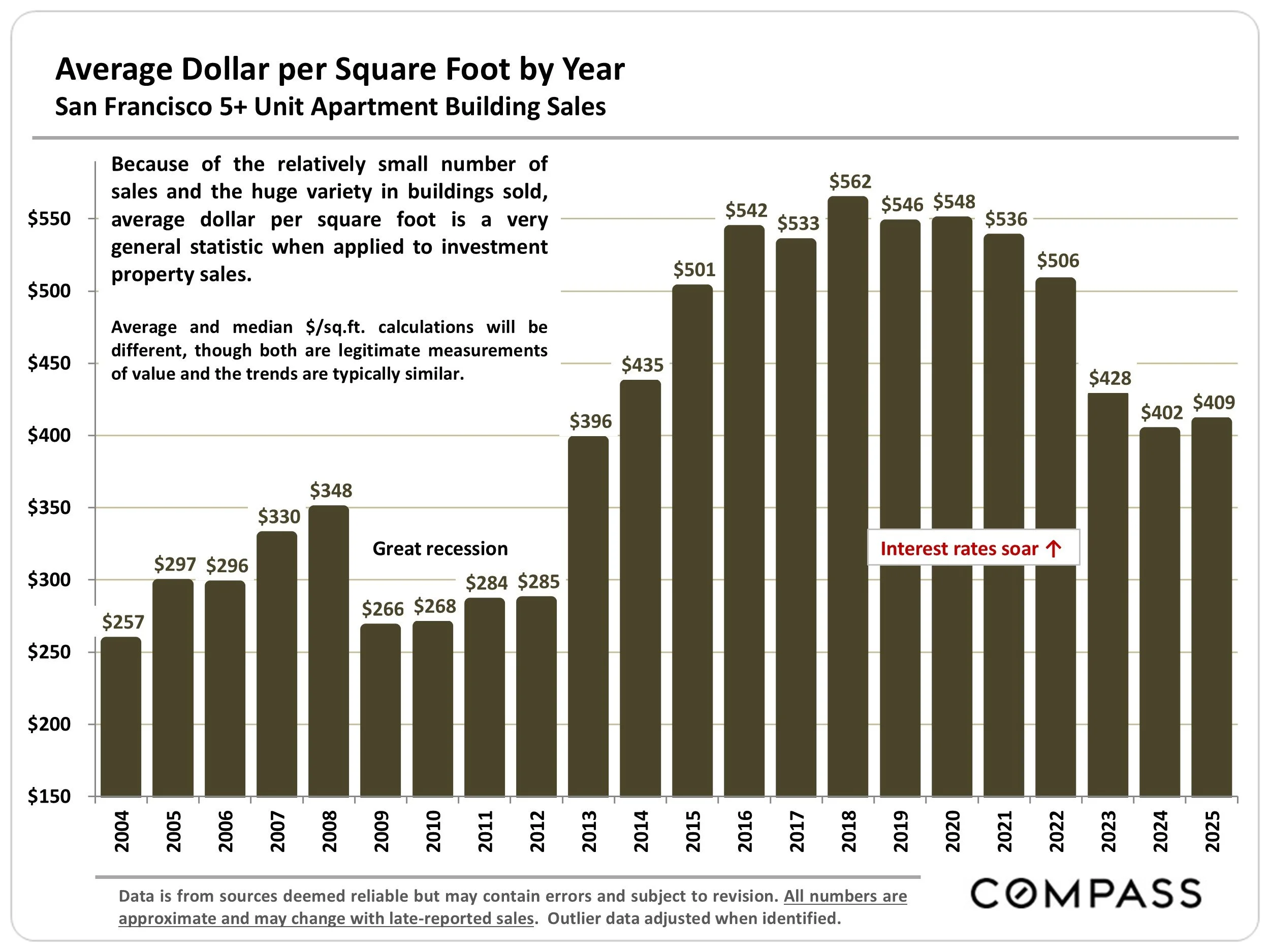

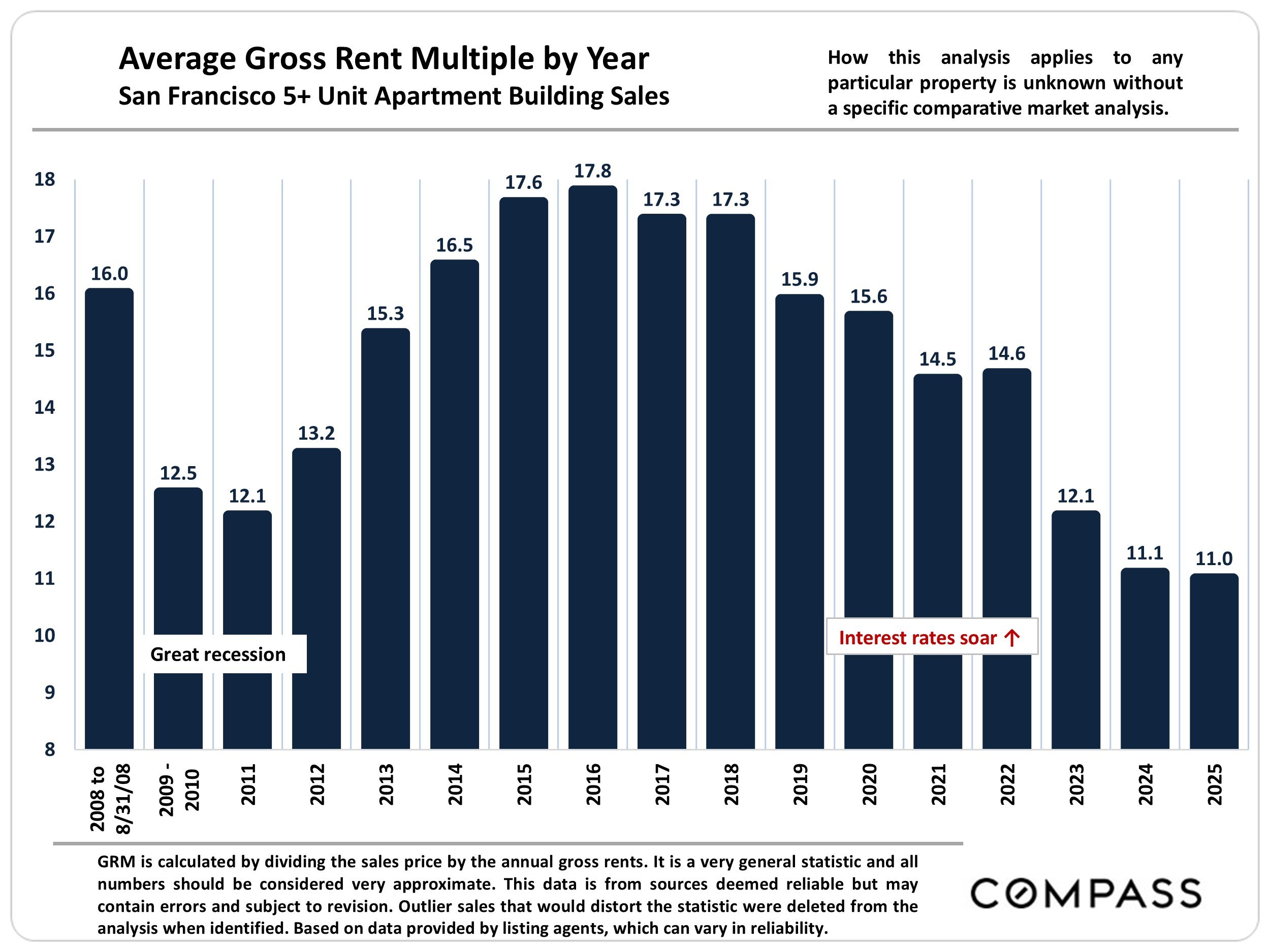

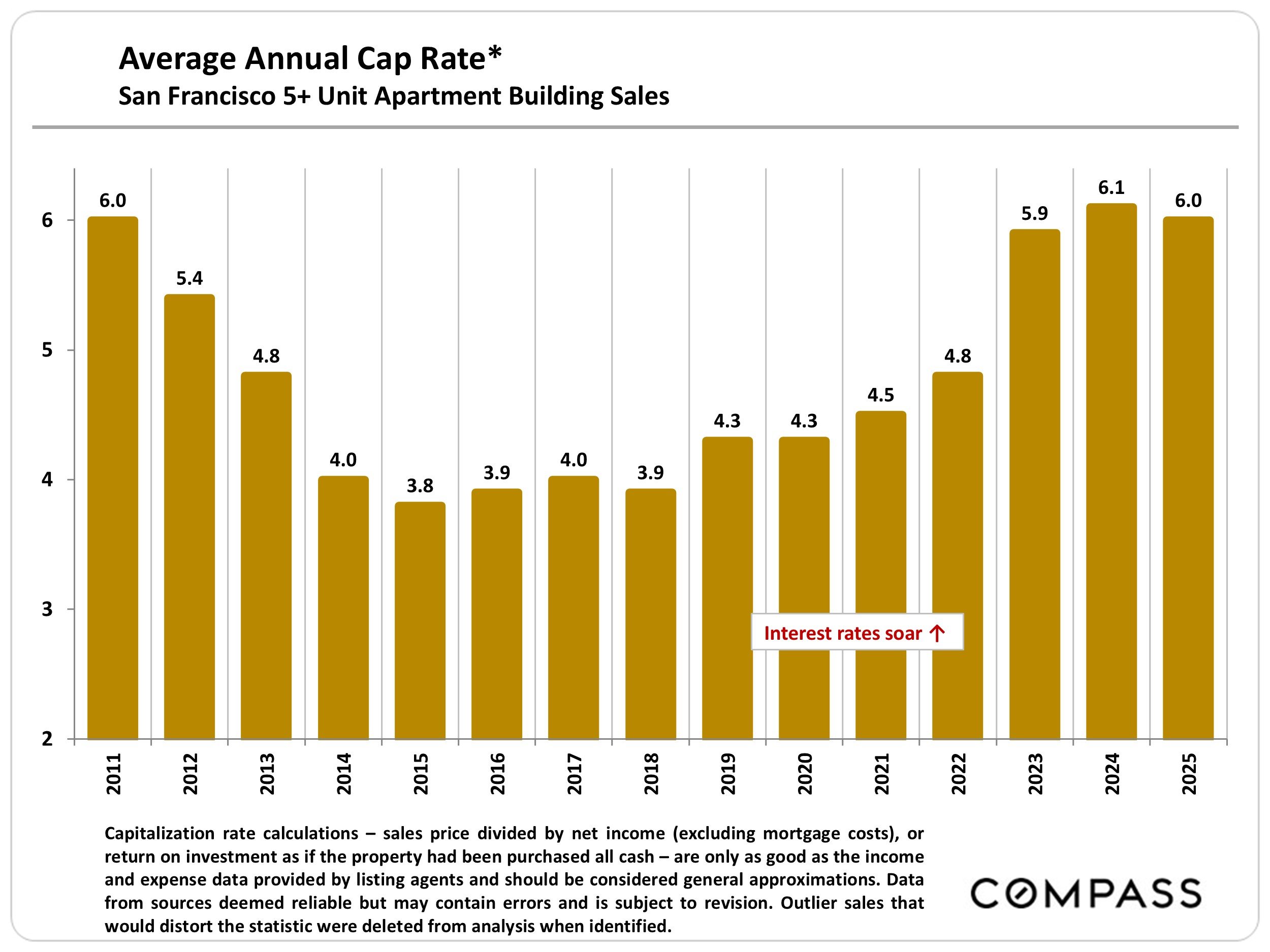

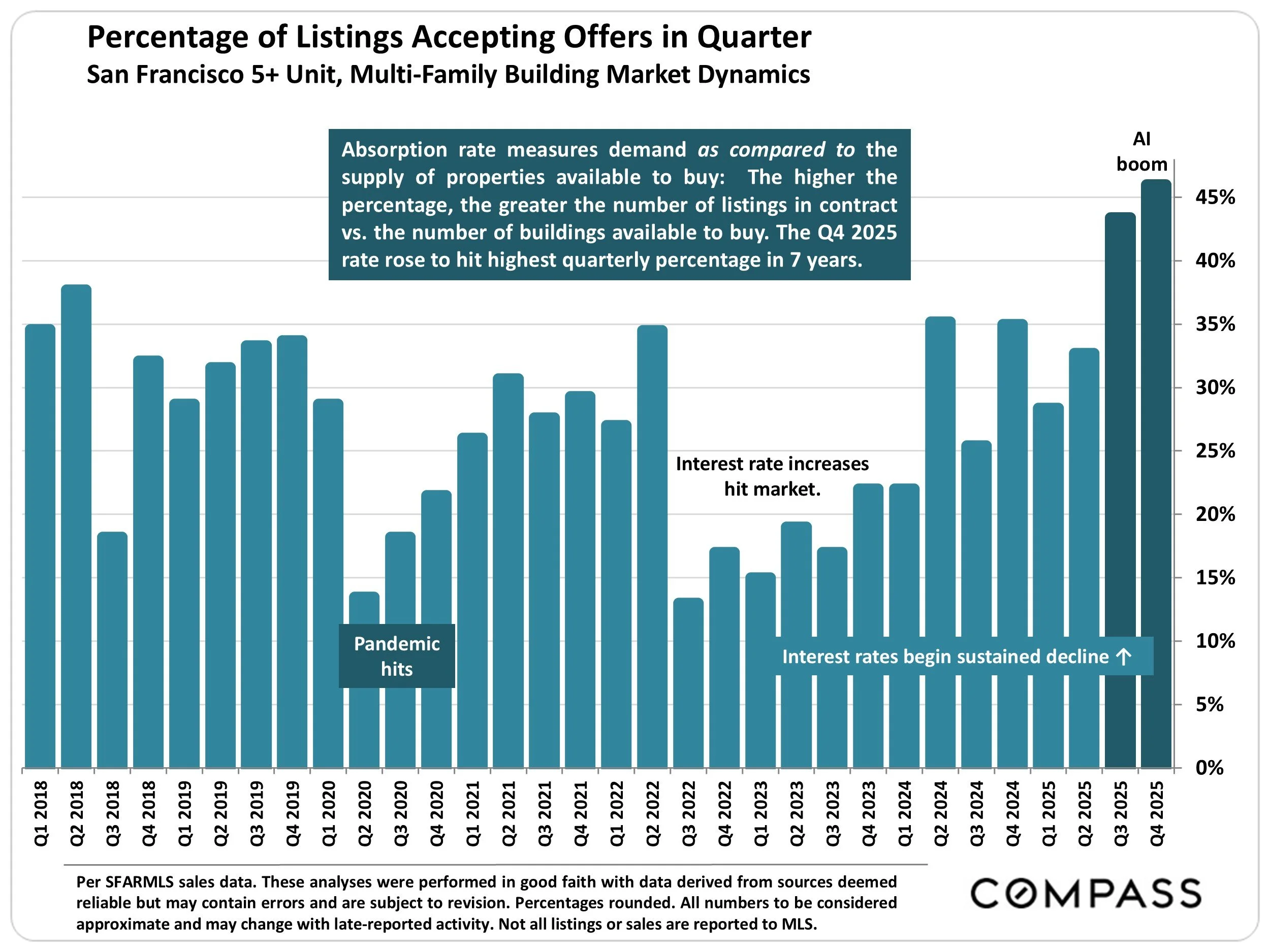

Looking at the city market, the fourth quarter was very active in terms of sales. In fact, Q4 had the highest sales total (of any quarter) in ten years. As far as rents, the year-over-year numbers are up over 12% and San Francisco recorded the highest rent rate of appreciation of any city in the U.S. The San Francisco jump (in rents) is spilling over to the Peninsula and East Bay, with prices in some of those already-expensive regions reaching new heights. For example, San Mateo’s median rent was $3,030 in November; up 7% from a year ago.

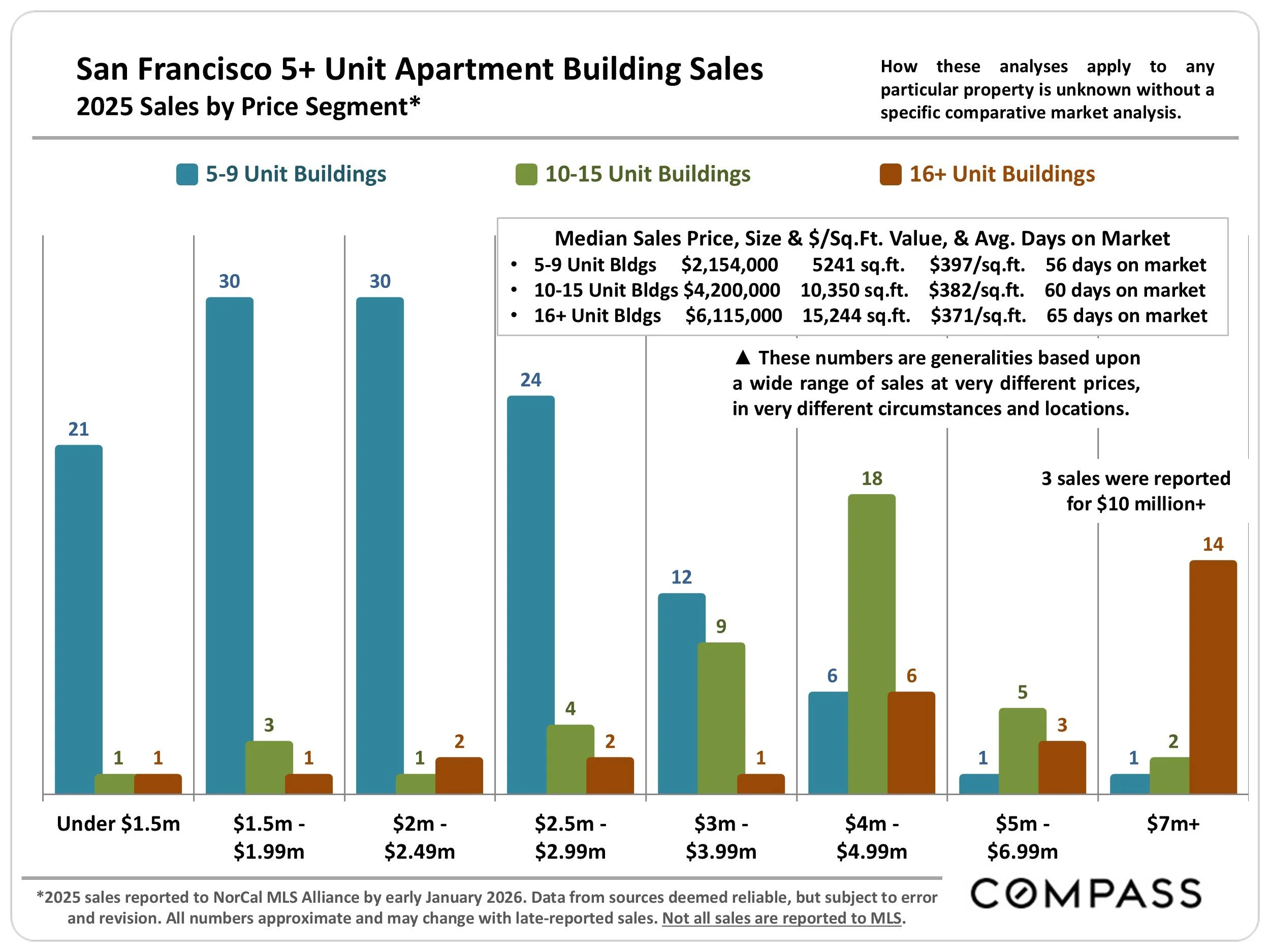

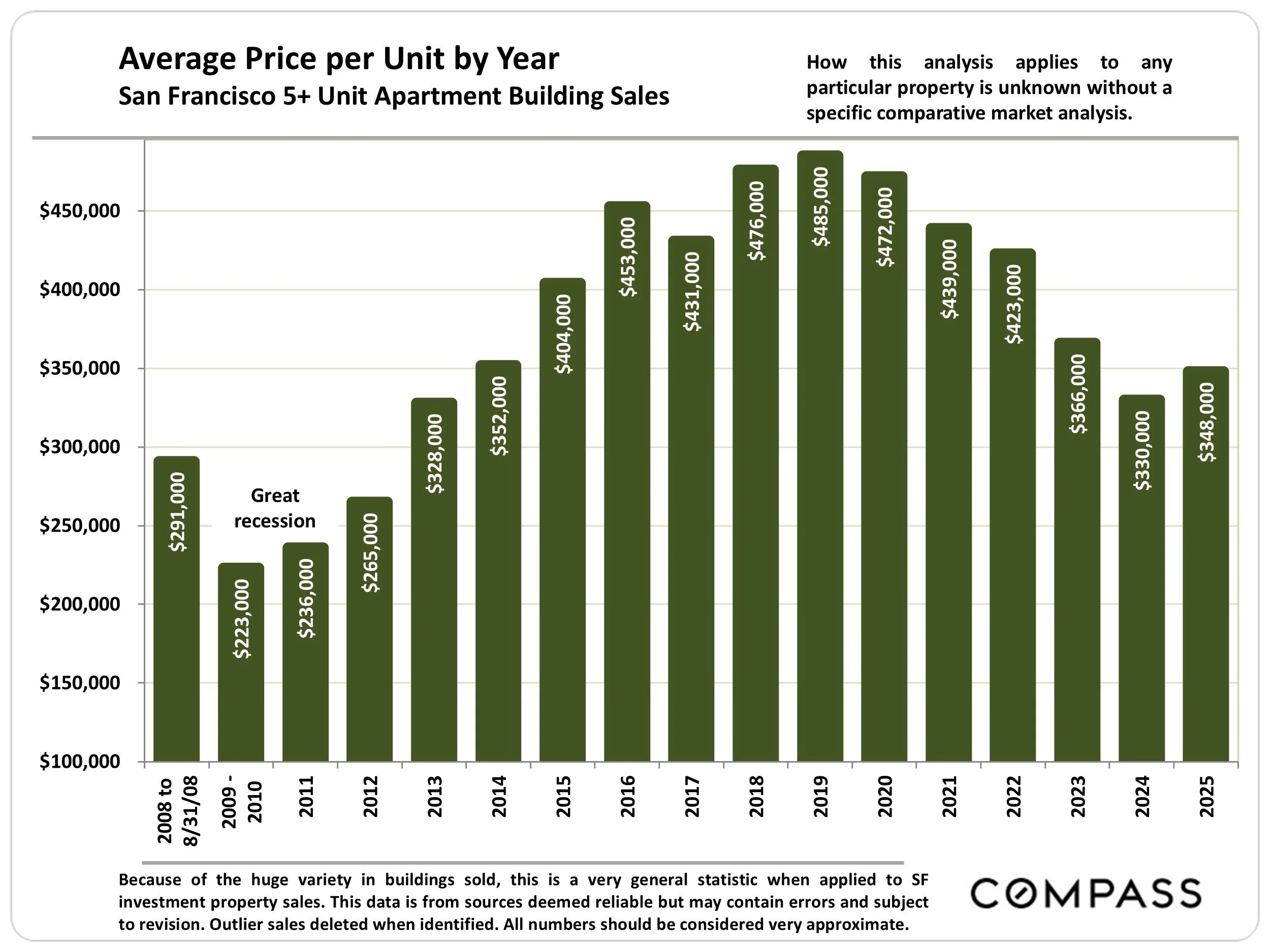

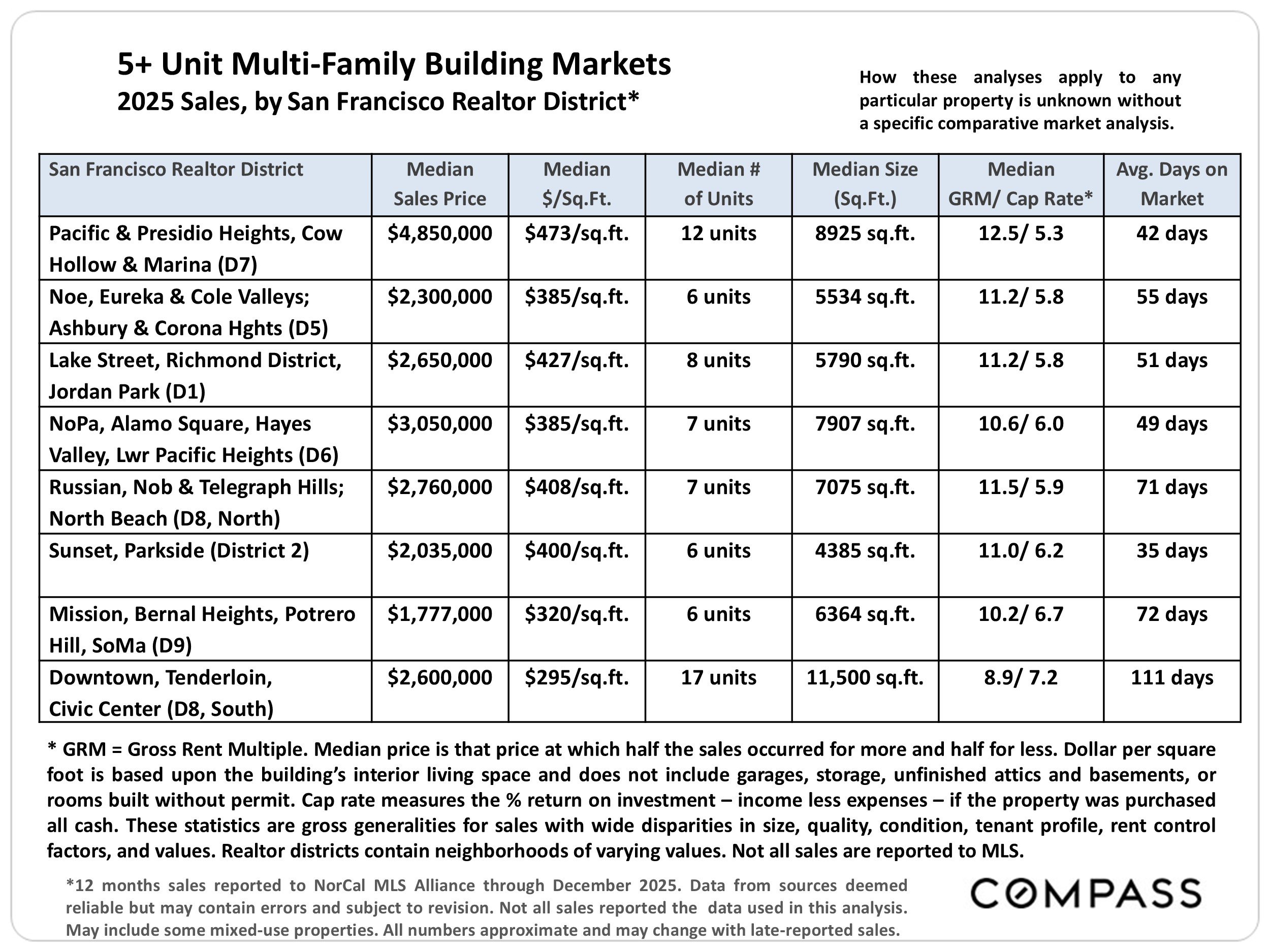

On to the numbers.