October 2025: ‘Q3 Sea Cliff - Lake Street Insider

Good morning:

Looking at some city news that will impact our corner of the city, Mayor Lurie’s housing plan (aka family zoning) won its first major approval with the Planning Commission. The housing plan, if approved, allows for 36,000 new homes on the city’s west side and northern neighborhoods (The greater Richmond, Sunset, Marina and north waterfront). The family zoning plan provides for more height and density – primarily on transit corridors, but also core neighborhood infill sites (i.e. lots, commercial space, etc.) are targets for potential housing. For reference, under the family zoning plan, St. Anne’s (300 Lake Street) could see a project rise to eight stories.

If the Board of Supervisors can’t come together with the mayor to approve a housing plan to allow the city to meet its (new housing) obligation with the California Department of Housing and Community Development, it risks losing about $100M in annual funding – but more importantly it risks ceding local control over housing approvals through what is known as the “Builder’s Remedy.” If you are not up to speed on Builders Remedy; it allows developers to bypass local zoning and planning requirements to build housing projects if a city or county has failed to meet its housing obligation. The Board of Supervisors has until January 31st to approve the mayor’s plan.

Speaking of St. Anne’s, although the buyer has yet to close escrow (and may not before the end of the year), the word is that there were a few offers with varying density plans for the site. The good news, the buyer has strong familiarity with San Francisco and will develop a product worthy of the address. The bad news, they are not looking to carve up the six acre site into a low density single family site. Once the site closes escrow I would expect to see a high-level site plan put forth within a few months.

Looking at the real estate market, the biggest inventory gap right now is on the luxury and super luxury side of the spectrum. There are a lot of buyer needs in the $5M+ category that are not getting met. I’ve talked to several agents that have highly qualified buyers “ready and willing” to write offers on turnkey homes, but the availability is not there. Due to this demand, two reactions have occurred. First, many of the luxury homes that could not find a buyer in the last 18 months are now in contract or sold. Second, many of these north side (i.e. Pacific Heights / Presidio Heights) buyers are expanding their target geographies, mainly into Lake Street and Sea Cliff. For reference, the sale price of 2144 Lake Street and 1638 Lake Street are solid examples of the shift. Last fall, 2144 Lake Street would not have achieved a $6M sale. Last month it sold for $6.7M. Likewise, 1638 Lake Street was a solid $4.8M-ish home last fall. It’s going to close soon with a ~$5.6M number.

Not only are the high end sales getting blown out of the water, the luxury single family rental market is also “highly heated.” I spoke to several luxury rental agents and they have clients spending $40,000 to $60,000 per month for luxury homes. The AI ecosystem money is here.

To add more fuel to the real estate market, OpenAI employees who’ve held shares for over two years are eligible to participate in a secondary stock sale (at a $500B company valuation!) that was scheduled to close this month. The sale will allow current and former OpenAI employees to cash out some of their equity, providing liquidity while the company remains private. I don’t think it is unreasonable to expect (this event) to add $100M of new capital to the local market in the next six months (when leveraged its really $400M-$500M).

Couple all of this with the recent data that the number of homes for sale continues to shrink. Currently, available inventory in San Francisco is down 28% compared to this time last year. This shortage is creating two very different stories for buyers and sellers. If you’ve recently thought “if I could get $X for my home, I’d move in a heartbeat…” now would be a great time to consider an off market sale. The strategy:

Price is set

The home is quietly marketed offline

No open houses

No signs

Private tours from highly qualified buyers only

Immediate feedback on value and or sale

If this is something that works for your family, let me know and we can have a conversation.

On to our corner of the city. The market in Sea Cliff was non-existent. No listings or sales with the exception of an off market sale where the tenant purchased (the home) from the owner. Aside from the fact that it has been very quiet, I don’t expect to see much Q4 activity in the neighborhood. I know 850 El Camino Del Mar is available in the $19M range and may go to market but it is currently getting shopped offline.

On Lake Street, we had three sales and the numbers are reflective of the prior referenced demand in the luxury category. The sales were all in the $6M category. Although 65 5th Avenue closed at $4.999M, the true market "value" was equivalent to a mid $5M price as the buyer picked up the broker compensation (and avoided the stepped up property tax rate that kicks in at $5M).

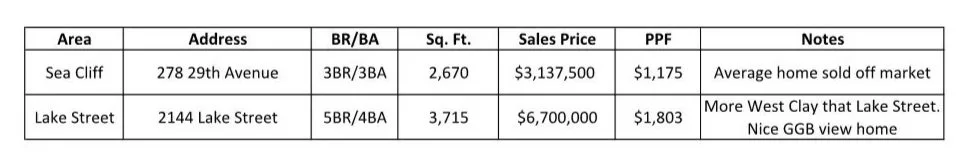

Top sales? One option in Sea Cliff and it’s not truly reflective of the neighborhood (278 29th Ave.). The top sale on Lake Street was prior mentioned 2144 Lake Street. Nice home but no interior access from the garage, the lower level at the front of the home felt disconnected. Regardless, someone loved it…a lot!

That is it for now. If you would like to chat about an off-market sale or simply have me in for a look to give you a valuation, reach out. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.