April 2025: ‘Q1 Sea Cliff - Lake Street Insider

Good morning:

I hope this report find’s you well. The market in the first quarter in San Francisco (and our corner of the city) was quite active and I have a lot to cover.

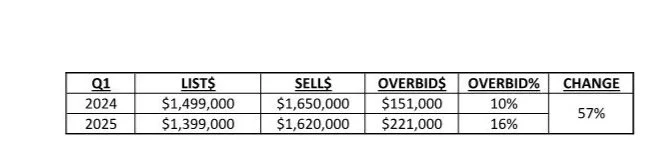

First, buyer activity was off the charts for the city in the first quarter, albeit quite similar to 'Q1 2024 in terms of volume or closed sales. This year, a combination of unusually dry, warm weather with enthusiasm to own put most single family homes into multiple offer scenarios. Comparing single family sales between Q1 in 2024 vs. 2025, the big change for 2025 was the jump in the median overbid amount.

Also, in the luxury market ($5m+), the median overbid had a very strong jump. Closed sales in 'Q1 2024 were coming in under asking and in 2025 buyers were aggressive – coming in at a median of $750,000 over asking.

I also see buyers in the ultra-luxury ($10m+) category making large, significant purchases and this segment is now fluid again after a few years of stagnation. Although the sales volume numbers are much smaller, we are talking about a 3x jump in activity. I will dedicate more insight to this category next quarter when I have a full data set from the first half of the year.

Over in our corner of the city, I have several updates. First, over at China Beach, the “stalled” $20m renovation that was approved and started back in 2022 is set to resume work. When done, the beach area will include bathrooms with indoor plumbing and rinse-off stations, a new sun deck, and a restored bathhouse structure. Also, the bathhouse structure will once again resume its role as the GGNRA Ocean Rescue Patrol's headquarters (they were relocated to Fort Funston once the bathhouse infrastructure failed).

At the long-dormant and blighted Alexandria Theater, the owner recently filed applications with the Planning Department to establish the “Alexandria Theater Special Use District.” It’s well established the owner wants housing at the site; but likely wants more latitude than the current planning code provides. The SUD would be created to allow “exceptions to existing zoning controls for a residential project in the SUD, subject to specified conditions.” My recollection was that this project was endorsed by the local supervisor and she was “working” with the developer to fast track new housing for the neighborhood. I don’t see this playing out any time soon.

In a rare Sea Cliff neighborhood home demolition, the property at 496 Sea Cliff Avenue has cleared the Planning Department and has permits to build a new 7,500 foot three level home. The new property (at the far west end of Sea Cliff Avenue) will also feature a 900 foot ADU, which I’m sure will have spectacular views. Interestingly, the project permits noted the demo and build with a $5m cost/expense. Wow! If you are pondering a home expansion I’d run down to the site and get the name of the contractor as he is quoting less than $600 per foot for the project. I don’t know any builders that could do that site proper justice for less than $1,000 per foot.

In a notable off market sale and a tale of old money and new money, 260 Sea Cliff Avenue sold for $30m. The sale of the 8,306 foot home comes in at a whopping $3,612 per foot. The seller’s family (Shorenstein) purchased the home in 1988 for $3m. The new steward is a local investor and was one of the Nest co-founders (for reference Nest was acquired by Google in 2014 for $3.2b).

Staying in Sea Cliff, and a “feel good” tale of days past when San Francisco was a city not negatively equated with an extreme cost of living, I sold a home for a family on lower 26th Avenue in March. The trustee of the home had the actual classified ad for the home when the family acquired it in 1969. The asking price was $68,500…and the shrewd father negotiated the price to $65,000. That $13,000 down payment paid forward a nice return!

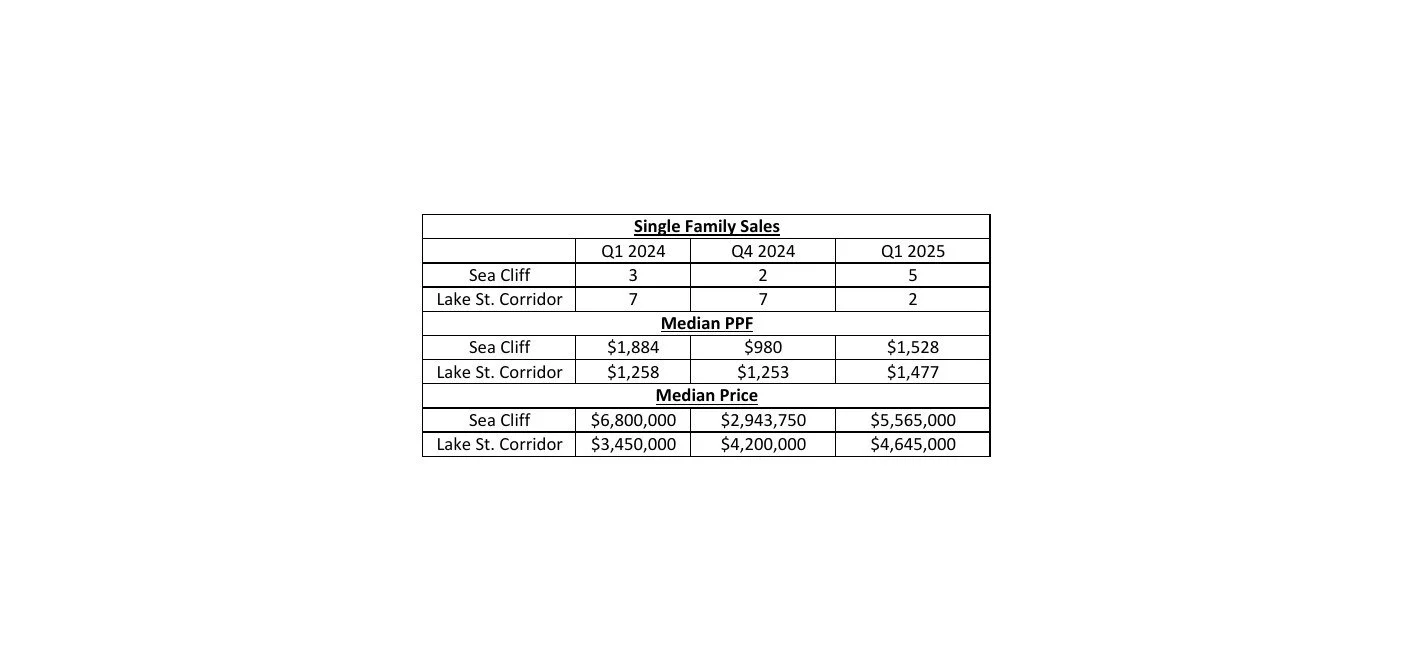

Looking at our corner of the city, Sea Cliff was very active in terms of inventory. Five sales and the "Robin Williams" home finally closed ($18,100,000). The Lake Street corridor was unusually low; only two sales. I can personally say there are a lot of buyers writing offers and or waiting for inventory to appear. Noting the aforementioned 26th Avenue listing, we received seven offers; six highly qualified buyers are still looking. The inventory is simply not available. This is somewhat counter to the ‘Q1 inventory levels of the Bay Area. The number of new listings in early in the quarter rose 27.5% year-over-year. This was the highest count since the end of the pandemic. The "mortgage lock-in effect" appears to be weakening and sellers are starting to “let go.” But, this has not yet caught on in the northwest corner of San Francisco.

The numbers for the quarter;

The top sales of the quarter;The top sales of the quarter;

That is it for now. If you are ready to move up, trade down or simply out; please reach out. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.