May 2023: San Francisco Real Estate Insider

With summer around the corner the San Francisco real estate market is usually in full swing as it relates to inventory and transactions. But, although our current market is exhibiting solid demand, transactions are down. The lack of inventory is not just a “San Francisco” issue; it’s a national issue. Why? In short, 30% of the housing stock is locked in with mortgages at 3% or lower and 72% of the housing stock is locked in at 4% or lower. Those owners now have a “financial asset” that they are not willing to give up unless it’s absolutely necessary.

On the buy-side of equation, I am seeing 6% interest rates settling as the “new normal” for buyers. Prior thoughts and hopes of interest rates settling down in the five percent range no longer seem realistic. If you were in the market back in 2007 – early 2008 (pre-market crash), interest rates were in the mid-five to six percent range. We are coming full-circle from a decade-plus of Fed subsidization on interest rates.

Speaking of financing, the loss of First Republic Bank will have an impact on the local jumbo loan market. JP Morgan Chase is not known as jumbo lender and Messrs. Dimon went on record to state he “doesn’t want too many jumbo mortgages on his $3.7 trillion balance sheet.” This leaves the opening for an opportunistic player to cater to these high balance loans. I’d expect it to be a lender; not a non-bank lender. The most common banks in the Bay Area outside of FRB (in the jumbo sector) are Wells Fargo, Bank of America, Citigroup and U.S. Bank.

Also in financing news, Fannie Mae and Freddie Mac are changing how they calculate new loan level price adjustments (LLPA) fees for buyers. What is an LLPA? A loan-level pricing adjustment is a risk-based fee priced into the interest rate on a mortgage. It effectively covers a bank for any losses they may incur on a mortgage. In short, banks are charging more upfront to protect them from any future default. These changes are in effect now (May 1st) and are actually intended to help more first-time buyers from less affluent communities when it comes to home financing.

To explain a bit more, here is an example of what this would cost you as a borrower on a $1,000,000 loan:

740 FICO borrower with 5% down will pay 0.375% more in fee/cost and the interest rate will go up by 0.125%

700 FICO buyer will pay 0.125% with no change in rate

680 FICO buyer will pay 0.125% more with no change in rate

If you have a top credit score, for example those above 720, you will still pay less than those with a lower credit rating. But, buyers with scores from 639-660 receive the biggest benefit.

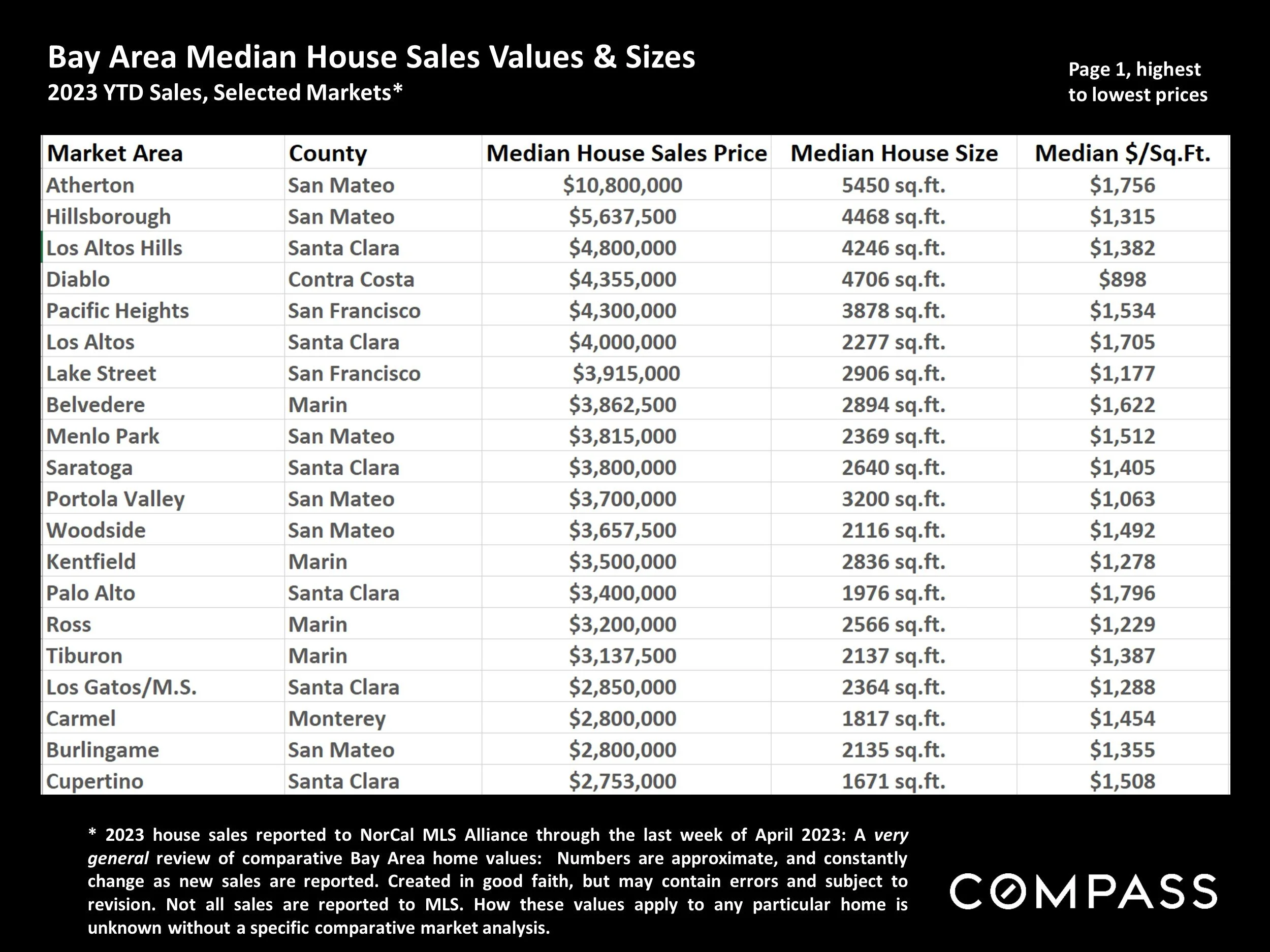

As a bit of a Swan Song to First Republic Bank I want to add the top sales – year to date – in the Bay Area as it relates to city or neighborhood.

Also, the top 20 as it relates to home size and values.