April 2024: Q1 Sea Cliff - Lake Street Insider

Hello & Happy Saturday:

Hopefully you and your family are back or about to return from a well-deserved break. Over the past quarter the market has been incredibly active; both in our corner of the city as well as in the overall city market. How quickly the market can change. We are currently experiencing a lack of single family homes to purchase. Sound familiar? This lack of supply will likely continue to starve demand and I expect to see it manifest into a political prop as we head into the fall election cycle.

Looking back at ‘Q4, the market was very quiet until we got to Thanksgiving and then the buyers showed up en masse. The correlation was that interest rates were declining and the message to the market was that rate hikes were over. Once we got to January, the market continued to be very active. I encouraged my clients that were planning on selling in the spring, to list their home as soon as possible (if they could) as there were aggressive buyers in the market. Why wait for competition? Although interest rates have remained fairly flat since January, anticipation of rate declines in the second half of the year coupled with a red hot stock market and surging crypto market have kept buyer enthusiasm up.

On to our corner of the city.

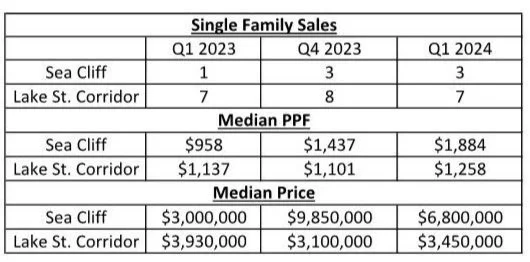

Homes are in demand. Reference point; in Q1, single family homes in Sea Cliff & the Lake Street Corridor that come to market and go into contract are doing so in eight days! Sure, there are a few outliers – primarily the $10M+ market as that takes longer to find a buyer. But, the demand is incredibly high. In Pacific Heights, its takes almost three times as many days for a home to find a buyer (21 days). Also, there are currently six homes available in Sea Cliff and the Lake Street Corridor for a median of 22 days on the market. In Pacific Heights, 18 homes available with a median of 62 days on the market.

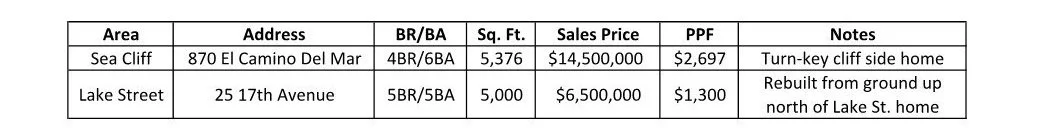

Last quarter I reported that we experienced a surge of North of Lake Street homes that came to market (four homes). They all sold and this quarter the trend continued; four more North of Lake Street properties were listed and all sold quickly with the exception of the top sale in the Corridor.

This will likely be the last update I have to report on the saga of 224 Sea Cliff. The hammer finally came down and the property sold! The overbid amount was $7M and the sale was confirmed just below at $6.5M. Don’t expect this to be the site of a multi-year expansion project. Word is the new owners are a family and they intend to keep the footprint of the home pretty much intact. The steps and decks to the beach will be removed (per the BCDC enforcement action) and it looks like the owners will develop a lower level to the home at the same time - quite efficient.

Good news on grocery options for us in the neighborhood. Although not exactly in the area –Whole Foods will open in the City Center Plaza at Geary & Masonic. After almost six-and-a-half years since Whole Foods filed its application with the city to occupy the vacated Best Buy space, the Planning Commission has finally provided authorization. The 50,000 foot space has been empty since 2017 and Whole Foods faced political obstacles. The biggest objector was our Board of Supervisors, which in a majority vote sided with an appeal filed by the local grocery workers’ union. The union filed an appeal over the mitigating concerns of the “air quality impacts” over their refrigeration equipment, cooling towers and HVAC units. The appeal forced Whole Foods to prepare a new Environmental Impact Report, which was recently approved by the BOS (7-0 vote). Do you think the citywide mass of empty store fronts combined with an election year motived their vote to approve the application?

Closer to home, the long dormant Alexandria Theater (on the corner of Geary and 18th Avenue) is back in the news. The Historic Preservation Commission has approved the site for 76 units of housing and the developer and City recently signed an MOU, allowing the process to continue without landmark status, which would make the project financially impossible. In short, the MOU is not worth the paper it’s written on. Even with no MOU, the City and the developer could continue to work on details to develop the site. This project seems to have become more of a political prop for the local supervisor as she tries to build an 11th hour resume to show she supports housing development in D1.

The numbers for the quarter.

Here are the top sales of the quarter.

That is it for now. If you are ready to take advantage of the lack of inventory and sell, reach out. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.