October 2023: Q3 Sea Cliff - Lake Street Insider

Hello and happy Saturday!

I hope you are well as we enter the final quarter of the year. The market is in full force but we are not seeing the same pace of sales activity as we did last year. Sales of single family homes in San Francisco are down ~20%; 553 sales in ‘Q3 2022 vs. 445 in ‘Q3 2023. Over in our corner of the City, I have several updates before we get into the numbers for the quarter.

A quick update on the home at 224 Sea Cliff Avenue. Last quarter I reported that the property was heading to a foreclosure auction on July 13th. The auction date was pushed back to October 19th. The estimated outstanding debt you ask? $6,144,987.51. How does one bid on this property? Reach out for specifics.

An update on 170 and 178 Sea Cliff Avenue. Last fall I reported on the proposed demolition of the two properties to make way for the construction of two new 11,000 foot structures spanning the lots (living like a family compound). The process is moving forward and the public hearing (for the demolition of the two structures) was on October 5th. If the demolition is approved, the owner will need permits to be issued. Of course, we have a Board of Permit Appeals so there will be another (possible) hurdle to jump for the owner prior to commencing the demolition.

The Alexandria Theater – the multi-decade empty eyesore might soon see some progress in terms of a future use. A new developer bought the site in 2015 and the location was approved for two community pools, offices and a learning center. That never happened. The developer is now looking to get an agreement to convert the eyesore into 76 housing units. Considering the existing height limit at that site is 40 feet, the developer is going to need a variance and utilize AB 2011 and or SB 423 to get 76 units on that corner. Supervisor Chan introduced legislation to designate the theater as a landmark and preserve many of its original features, but she is now going to put that effort on hold to “collaborate” with the developer and various city departments to ensure that the new plan materializes. If all goes accordingly, a development agreement should be reached in a few months and it will have to be approved by the Board of Supervisors before moving to the entitlement phase. In short, this news is all to do with long-standing community outrage over the blithe that attracts to the site as well as our Supervisors need to “check the box” so she can say she worked with a developer to build housing in the Richmond District.

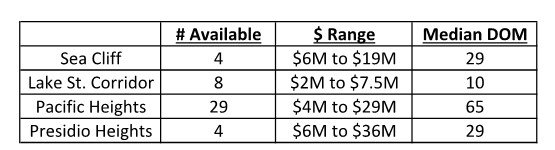

Looking at the inventory in Sea Cliff and the Lake Street Corridor, we are seeing what I would call average fall numbers in Sea Cliff (four homes available) and high availability in Lake Street (eight homes available). When was the last time we had five homes available north of Lake Street at the same time (or three in Presidio Terrace)? Not in the last few decades.

The availability in Sea Cliff is unique as you have all buyer profiles covered for view homes. We have move-in ready view homes, we have full fixer view homes and we have view homes in need of some updating. In the Corridor, we have a huge range of homes as well; from West Clay iconic to fixers. The inventory in the Corridor is all new (less than two weeks on average), but compared to last fall – inventory is up.

For reference, we can compare our corner of the City with the market in Pacific Heights and Presidio Heights in terms of inventory. Thinking about purchasing in Pacific Heights? Sellers are competing! There are values to be had for the long term buyer.

Overall, I am seeing buyer “hesitancy” in the $4M and up category. Why? That is a case-by-case reason but overall, the cost of money is still a big cause as well as buyers sensing that now is the time to be highly discerning on a purchase. The days of low inventory and buyers making trade-offs on their wish list of property features is over (for now). If the home does not meet the full wish list, it’s generally a “pass” and on to the next property.

Does this mean the market in our corner of the City is “dead?” Not even close to the reality. Homes are still selling; they just take longer to find a buyer. Keep in mind we were living in a hyper-active market with low inventory, (access to) cheap money and a lot of local wealth. We got spoiled with the narrative of “my house is worth X and I’ll only sell if I get X.” With the strong economy and cheap money, there were always a few buyers willing to compete. Take away a few of those factors and the market will ebb. I do feel very confident that once Messr. Powell sends the message that inflation is under control and interest rates start to (consistently) drop, the buyers will be back ‘en masse.

For comparison sake, although we don’t have many sub $2M homes in our neighborhoods, this market is very hot. Buyers are competing in most all neighborhoods and we see many sales with offer dates and multiple offers.

The numbers for the quarter reflect a very quiet summer. We had a single sale in each neighborhood. The summer inventory was super low; sellers deferred from jumping the (fall) competition to list in the summer. As previously referenced, we now have inventory! The ‘Q4 report will be quite telling.

Here are the top sales of the quarter. The property at 91 25th Avenue was sold off market and the home on 11th Avenue sold very quickly.

That is it for now. Its a great time to be a buyer. Likewise, if you are ready to move up, trade down or simply out of the City; let’s put a plan in place to make the most of your asset. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.