December 2023: San Francisco Real Estate Insider

Hello and I hope you had a relaxing Thanksgiving holiday with your loved ones. I will keep it brief this month but will be back in January with a full market recap including some choice data points and notable sales.

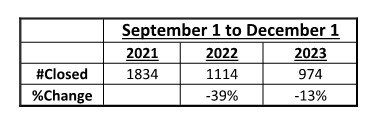

As we enter the home stretch for 2023, we have another three weeks of solid market activity until the (buyers & sellers) shut it down until 2024. Looking at the quarter, the first half of ‘Q4 was somewhat of an under performer compared to typical fall markets. For reference, looking at the chart below, deal flow (single family & condo) in San Francisco was down about 13% from the same period last year. Shockingly, deal flow is down over 50% from the same period in 2021. Keep in mind that money was cheap in 2021; about half the cost of today’s rates.

But, in the past couple weeks, and ideally, continuing through the end of the year, I’ve seen an uptick in buyer activity in terms of open house traffic, requests for disclosure packages and offers. This uptick covers all price-points and it’s been a common agent sentiment in many different offices. Hopefully the December numbers will make a solid contribution to the overall quarter (numbers). I am optimistic on a strong close to the year! Hopefully, 2024 starts equally as strong.

One of the driving factors in the uptick in recent activity is definitely the softening of interest rates. We’ve seen a few continuous weeks where rates have dropped. Some buyers see this as the end of upward movement in rates and they want to jump in before the competition returns. Others are happy saving an eighth to a quarter percent in rate.

Let’s hope the Fed is done with increases and we continue the trend (of lower rates) in 2024. Nobody has a crystal ball to see where rates are going with any certainty, but if you look at other markets that are tied to the Fed (and its policy) you can draw your own conclusions. A good example is looking at currency investors. Investors are selling dollars at the fastest rate in a year as they raise their bets that the Fed has finished its aggressive campaign of interest rate increases and will deliver multiple cuts next year.

Also, buyer confidence is also assisted by performing financial markets. The S&P 500 (Index) and the NASDAQ (Index) are both up on a year-over-year basis; ~19% and ~36% respectively.

Speaking of rates and financing, the 2024 conforming loan limits have been set. The base amount is $766,550. San Francisco County gets the high balance limit of $1,149,825. For reference, the conforming loan limit is the maximum amount that can be guaranteed by Fannie Mae and Freddie Mac (the government-sponsored enterprises or GSEs). That guarantee has advantages in terms of the loan approval process and interest rates (for borrowers).

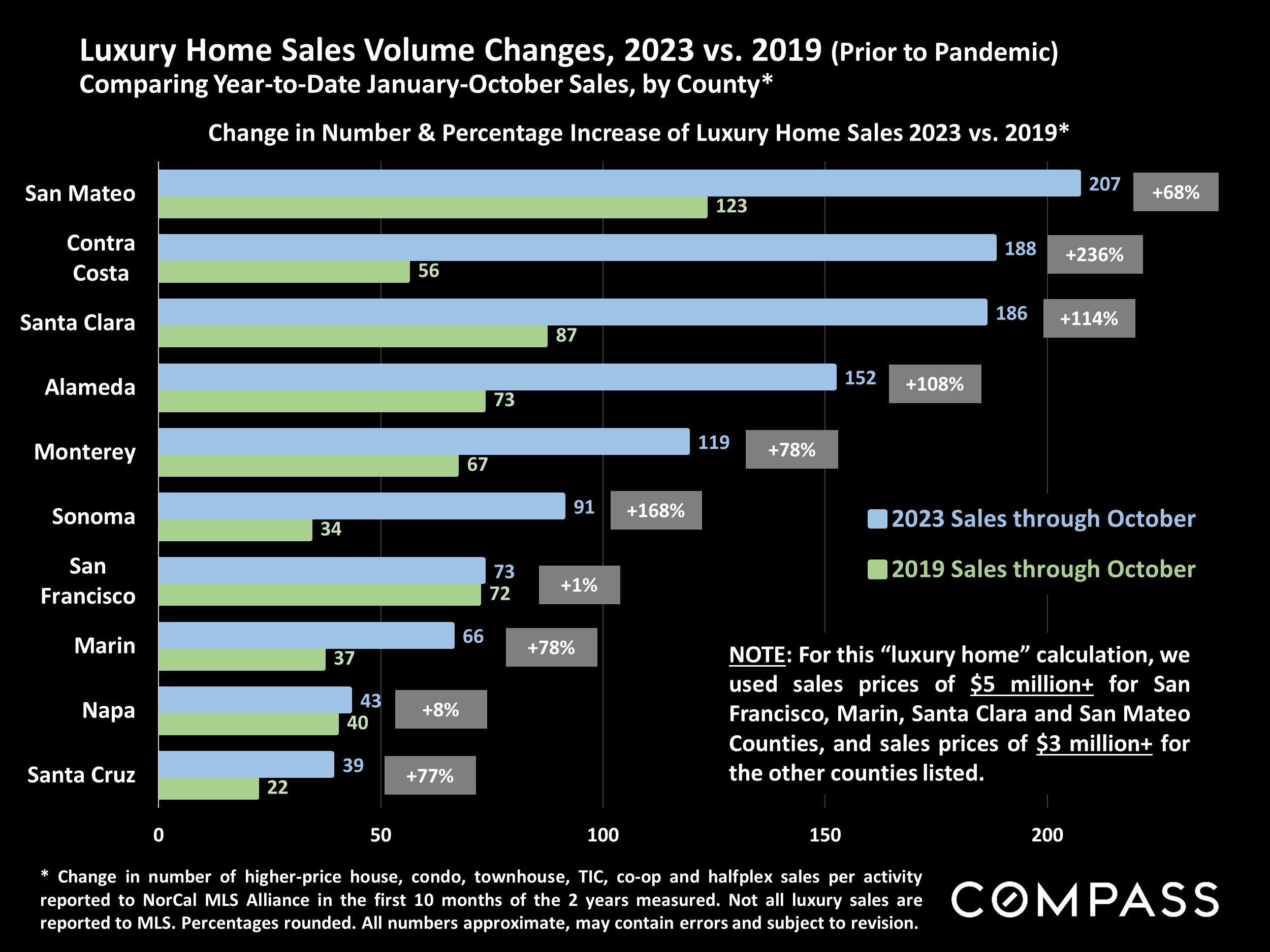

One of the biggest laggards in the San Francisco market over the last 18 months or so is the luxury category. But, that has also started to move in a positive direction. The sales numbers in the chart below make the segment look great. But, what the chart does not capture is the inventory. For reference, the "luxury home" category is defined as $5 million+ in the four most expensive counties (SF, Marin, Santa Clara and San Mateo), and as $3 million+ in the other counties.

In case you are curious, there are currently 48 available luxury homes available in San Francisco (priced from $5M to $35M).

That is it for now. I wish you and your family happy holidays! Be thankful and I will be back in 2024!